Get the free Premiere Select SEP-IRA Plan

Show details

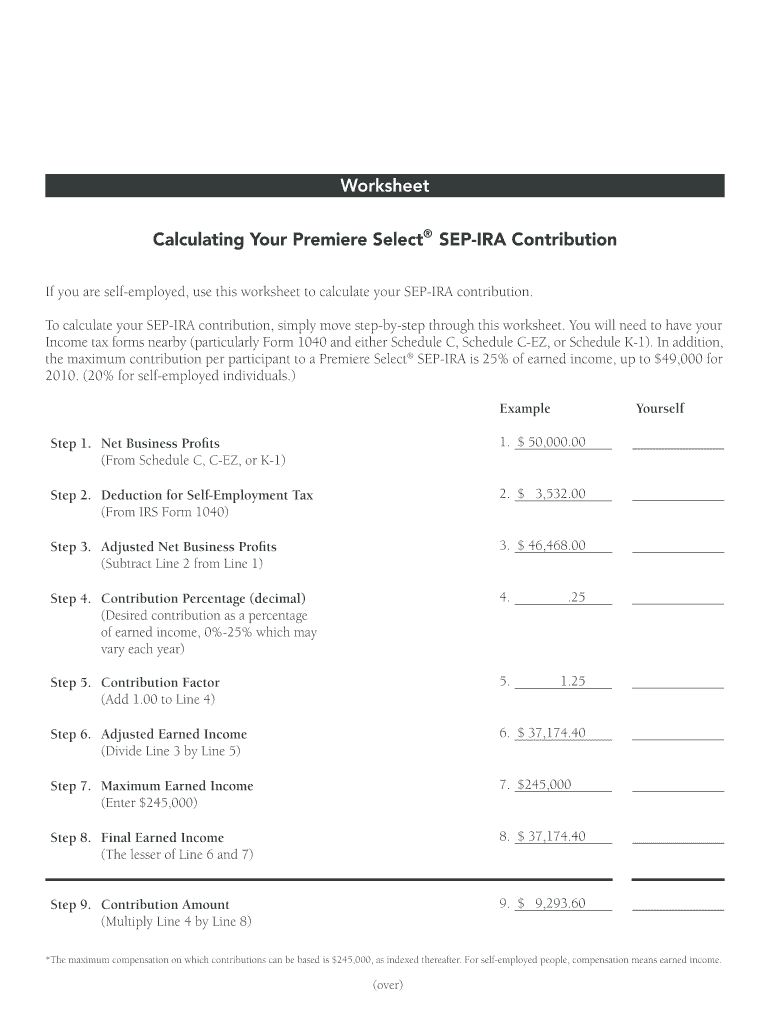

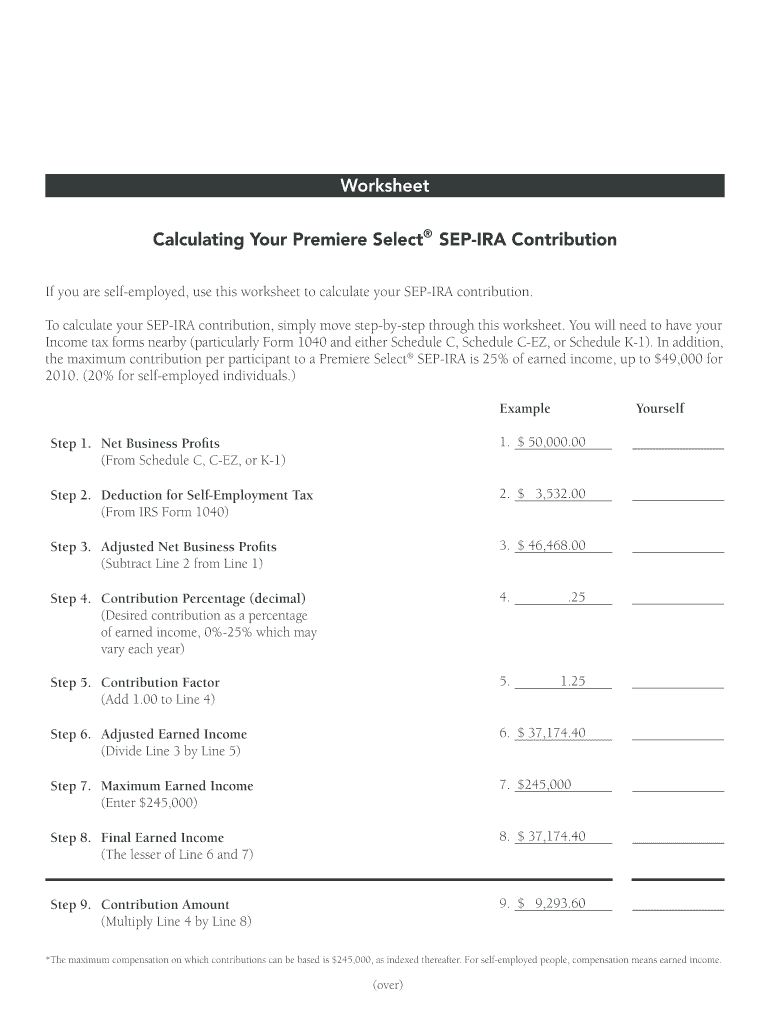

This document provides information about the Simplified Employee Pension Plan (SEP-IRA) designed for small-business owners and self-employed individuals. It outlines the benefits, including tax advantages,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign premiere select sep-ira plan

Edit your premiere select sep-ira plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your premiere select sep-ira plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit premiere select sep-ira plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit premiere select sep-ira plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out premiere select sep-ira plan

How to fill out Premiere Select SEP-IRA Plan

01

Gather necessary paperwork including your business information and employee details.

02

Determine the contribution rates for each eligible employee according to the SEP-IRA guidelines.

03

Fill out the SEP-IRA plan document, ensuring to include all required information like business details and employee names.

04

Establish a SEP-IRA account with a financial institution that supports SEP-IRA plans.

05

Contribute to each eligible employee's SEP-IRA account by the tax deadline for appropriate tax year.

06

Ensure to keep accurate records of contributions and employee eligibility for future reference.

Who needs Premiere Select SEP-IRA Plan?

01

Small business owners who want to offer retirement benefits to themselves and their employees.

02

Self-employed individuals looking for a retirement savings option with tax benefits.

03

Employers with few employees who want a simple, low-cost retirement plan.

04

Businesses looking to attract and retain talent through competitive retirement benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is premiere select IRA?

The Premiere Select® SIMPLE IRA Plan allows businesses with fewer than 100 employees to offer a retirement plan that features certain tax benefits that are similar to large corporate retirement plans — with a lot less cost and administration.

How to select an IRA?

As you compare IRA providers, think carefully about how hands-on you'd like to be. Be sure to pay close attention to account minimums and fees. Next, you'll need to choose between a traditional or Roth IRA . Each option offers unique tax benefits and has different IRS rules regarding eligibility.

What is Premier Select IRA?

A Premiere Select Rollover IRA offers a convenient. vehicle in which to invest your retirement plan. savings to pursue your retirement goals. This self- directed brokerage account enables you to work.

What is the best IRA to put your money in?

Best IRA Accounts Charles Schwab IRA: Best Overall IRA. Fidelity IRA: Best IRA for Tools and Features. Betterment Investing: Best IRA Robo-Advisor. SoFi IRA: Best IRA for Low-Fees. Vanguard IRA: Best for Experienced Investors. Goldco: Best Gold IRA.

What is a premier IRA?

Premier IRA Money Market A variable IRA that allows you to make contributions in any amount up to the yearly maximum. The account requires a higher minimum balance and comes with higher interest rates. Traditional or Roth IRA options are available.

What is an IRA select account?

IRASelect is an easy-to-use IRA Solution to help customers prepare for a financially secure retirement. BPAS partners with financial professionals to offer individuals a low-cost IRA solution, with a simplified account opening process.

What is the downfall of SEP IRA?

Cons of SEP IRA If you contribute 10% of your own wages, you must also contribute 10% on behalf of all your employees. Minimum distributions and age requirement: SEP IRAs are subject to required minimum distributions (RMDs), which means you must begin taking withdrawals (and paying taxes on them) at age 73.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Premiere Select SEP-IRA Plan?

The Premiere Select SEP-IRA Plan is a Simplified Employee Pension Individual Retirement Account designed for small business owners and self-employed individuals to provide retirement benefits to their employees.

Who is required to file Premiere Select SEP-IRA Plan?

Employers who establish a SEP-IRA for their employees are required to file the plan, specifically those who have employees and want to contribute to their retirement savings.

How to fill out Premiere Select SEP-IRA Plan?

To fill out the Premiere Select SEP-IRA Plan, employers need to provide necessary information such as their business details, eligible employee information, and contribution amounts. This typically involves filling out a form provided by the financial institution managing the SEP-IRA.

What is the purpose of Premiere Select SEP-IRA Plan?

The purpose of the Premiere Select SEP-IRA Plan is to allow small business owners to facilitate retirement savings for themselves and their employees while providing tax advantages and flexibility in contributions.

What information must be reported on Premiere Select SEP-IRA Plan?

Information that must be reported on the Premiere Select SEP-IRA Plan includes the business name, employer identification number (EIN), plan details, employee eligibility criteria, and the contributions made to employee accounts.

Fill out your premiere select sep-ira plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Premiere Select Sep-Ira Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.