Get the free CREDIT HANDOUT

Show details

Este documento ofrece información sobre los informes de crédito, cómo obtenerlos, cómo disputarlos, y cómo mejorar su puntaje de crédito a través de tarjetas de crédito aseguradas y el proceso

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit handout

Edit your credit handout form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit handout form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit handout online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit handout. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit handout

How to fill out CREDIT HANDOUT

01

Begin by gathering all necessary personal information, including your name, address, and Social Security number.

02

Provide details about your employment status, including your current job title and employer information.

03

List all sources of monthly income, including salary, bonuses, and any other income streams.

04

Input your monthly expenses, such as rent/mortgage, utilities, groceries, and loans.

05

Specify the amount of credit you are requesting and the purpose of the credit.

06

Review all entered information for accuracy before submission.

07

Sign and date the application, and submit it as instructed.

Who needs CREDIT HANDOUT?

01

Individuals seeking financial assistance or credit to manage personal or business expenses.

02

People looking to consolidate debt or make significant purchases that require a credit evaluation.

03

Borrowers applying for loans or credit cards needing a formal record for lenders.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 C's of credit?

Meaning of credit transfer in English the process of moving money from one bank account to another electronically: automated/automatic credit transfer The move to automatic credit transfer will virtually eliminate fraud in benefit payments. Several million cheques and credit transfers are handled every day.

What are the 5 P's of credit?

Meaning of give someone credit for something/doing something in English. to say that someone deserves praise, approval, or honour for something they have done: He gave the board credit for supporting him as he made major changes. You have to give credit to the other team for never giving up.

What are the 5 Cs of credit and what do they mean?

The 5 C's Unpacked They include Character, Capacity, Capital, Collateral, and Conditions. All solid factors that tend to be reprioritized over time based on the economic cycle.

What are the 5 principles of credit?

Character, capacity, capital, collateral and conditions are the 5 C's of credit. Lenders may look at the 5 C's when considering credit applications. Understanding the 5 C's could help you boost your creditworthiness, making it easier to qualify for the credit you apply for.

What are the 7Cs of credit?

These key factors are known as the Five Cs of Credit: Capital, Condition, Capacity, Collateral, and Character. Each of these factors is evaluated by your lender and ultimately will determine whether you're on the way to receiving your loan.

What are the 5 P's of credit management?

Different models such as the 5C's of credit (Character, Capacity, Capital, Collateral and Conditions); the 5P's (Person, Payment, Principal, Purpose and Protection), the LAPP (Liquidity, Activity, Profitability and Potential), the CAMPARI (Character, Ability, Margin, Purpose, Amount, Repayment and Insurance) model and

What are the 5C's of credit analysis?

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral. There is no regulatory standard that requires the use of the five Cs of credit, but the majority of lenders review most of this information prior to allowing a borrower to take on debt.

What are the 5 keys of credit?

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

What are the 5 Cs explained?

Examines five key areas: Company, Customers, Competitors, Collaborators, and Climate. It serves as a roadmap that illuminates the critical factors impacting an organization, offering insights that can be harnessed to drive growth and profitability.

What are the 5 P's of banking?

Since the birth of formal banking, banks have relied on the “five p's” – people, physical cash, premises, processes and paper. Customers could not bank without being exposed to the five p's.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

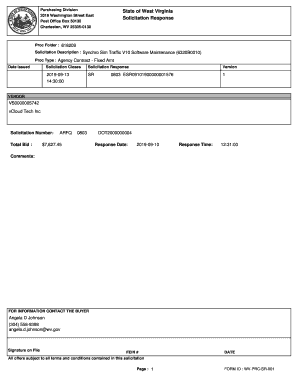

What is CREDIT HANDOUT?

A CREDIT HANDOUT is a document or form that provides detailed information about credit transactions, including loans and credit extended by lenders to borrowers.

Who is required to file CREDIT HANDOUT?

Entities such as lending institutions, banks, and creditors who extend credit to consumers or businesses are typically required to file a CREDIT HANDOUT.

How to fill out CREDIT HANDOUT?

To fill out a CREDIT HANDOUT, one must provide detailed information about the credit transaction, including borrower's information, loan amount, interest rates, repayment terms, and any disclosures as required by law.

What is the purpose of CREDIT HANDOUT?

The purpose of a CREDIT HANDOUT is to ensure transparency in credit transactions, inform borrowers about the terms of credit, and assist regulatory bodies in monitoring lending practices.

What information must be reported on CREDIT HANDOUT?

The information that must be reported on a CREDIT HANDOUT typically includes the borrower's name, the amount of credit granted, interest rates, repayment schedule, and any fees or penalties associated with the credit.

Fill out your credit handout online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Handout is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.