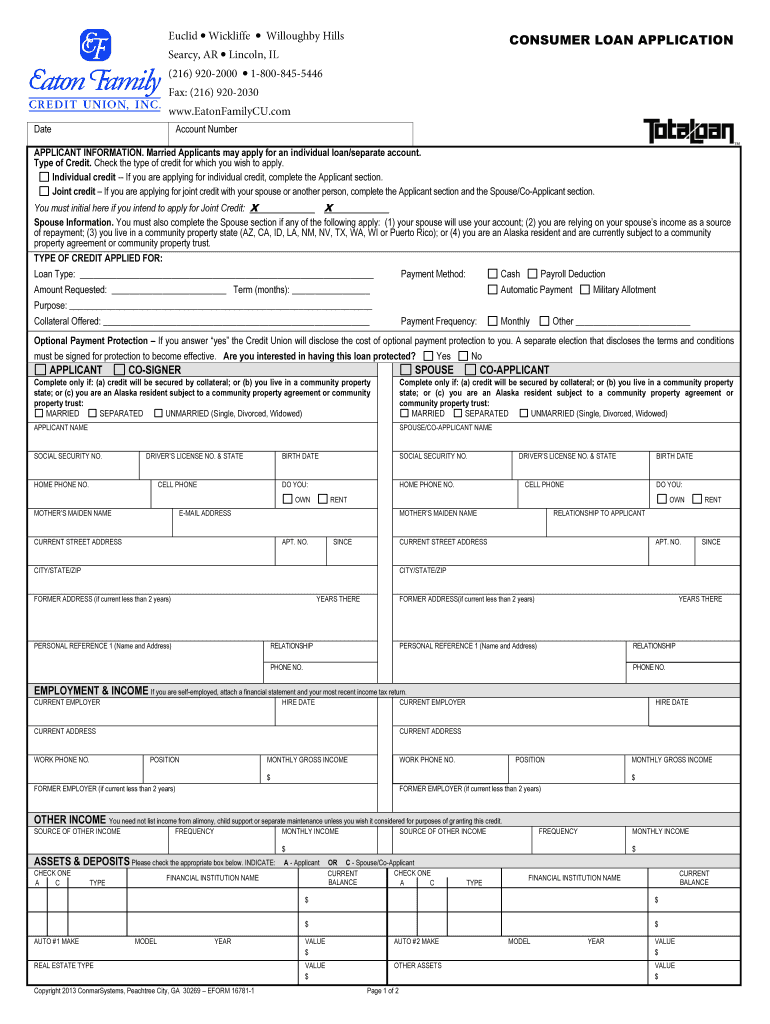

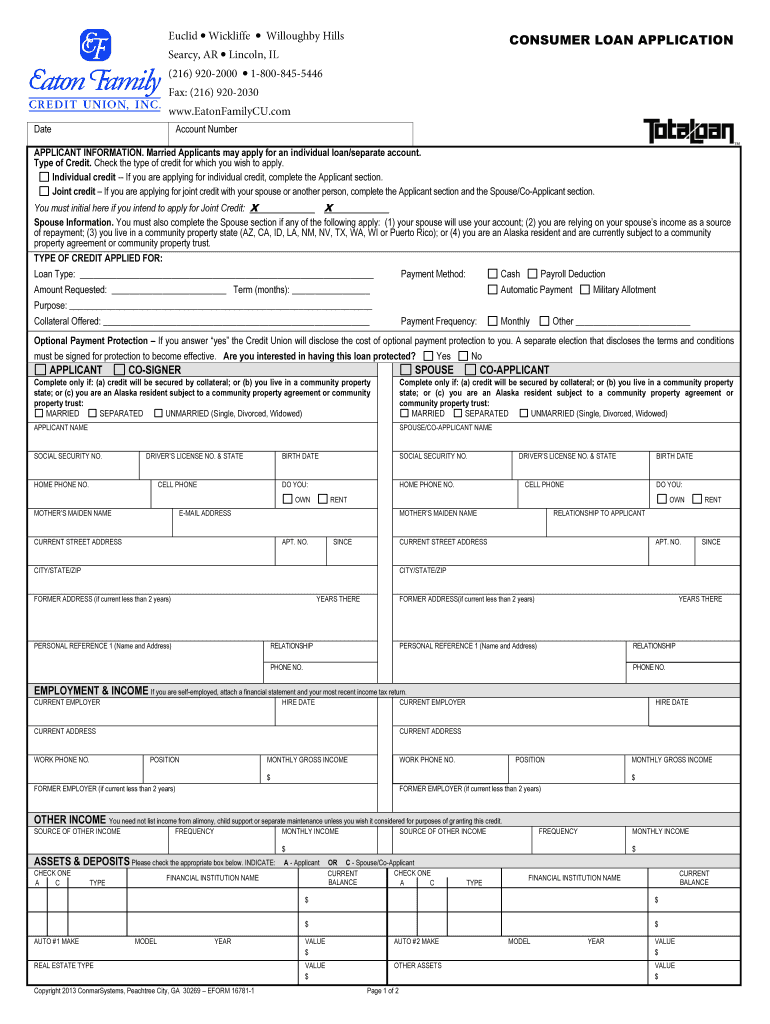

Get the free Consumer Loan Application

Show details

Este formulario es una solicitud para un préstamo al consumidor que incluye información sobre el solicitante, el co-firmante y el cónyuge. Permite a los solicitantes elegir el tipo de crédito,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan application

Edit your consumer loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer loan application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer loan application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan application

How to fill out Consumer Loan Application

01

Gather necessary personal information such as name, address, and Social Security number.

02

Collect financial details including employment information, income, and expenses.

03

List any existing debts and monthly payment obligations.

04

Specify the loan amount required and the intended purpose of the loan.

05

Review the application for accuracy and completeness.

06

Sign and date the application form before submission.

Who needs Consumer Loan Application?

01

Individuals seeking to finance a large purchase such as a car or home.

02

Consumers needing funds for unexpected expenses or emergencies.

03

People looking to consolidate existing debts into a single loan.

04

Applicants requiring funds for personal projects or education.

Fill

form

: Try Risk Free

People Also Ask about

What is the process of a consumer loan?

Documents that are required to seek a consumer durable loan vary from lender to lender. Generally the list of documents includes: Identity proof (PAN Card, Voter's ID, Aadhar Card etc.), Address proof (Passport, Driver's License, Electricity Bill etc.) and Income proof (latest salary slip).

What are the requirements for a consumer loan?

Information You Will Need Full name and address of the applicants. Valid Social Security Numbers for the applicants. Current employer information, including years of service and the employer address and phone number, for the applicants. Monthly income data for the applicants.

What credit score is needed for a consumer loan?

Still, there are personal loans you can get if you have a fair or bad credit score. Some lenders cater to applicants with lower credit scores in the poor range (below 580) to help them borrow money for emergency expenses, medical bills, debt consolidation and other financing needs.

How does a consumer loan work?

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

How to convince customer to take loan in english?

Encourage them to take loan from your bank & pay later in instalments with slight higher interest rates from your fixed deposit interest rates. Advise them that due to inflation everything may be more costlier next year so purchase now from bank loan . Always make a co-operative & gentle behaviour with your customers.

What happens if a consumer loan is not paid?

Missing loan repayments or defaulting on a loan can severely damage your credit score, making it difficult for you to secure credit in the future. Increased interest rates: Lenders may increase the interest rate on your personal loan in case of repeated missed payments or defaults.

What are the requirements for a consumer loan?

Information You Will Need Full name and address of the applicants. Valid Social Security Numbers for the applicants. Current employer information, including years of service and the employer address and phone number, for the applicants. Monthly income data for the applicants.

How to write loan application in English?

A Step-By-Step Guide To Writing A Personal Loan Application Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Highlight Your Creditworthiness. Include Any Collateral (If Applicable) Maintain a Professional and Courteous Tone.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Loan Application?

A Consumer Loan Application is a formal request submitted by an individual to borrow money from a financial institution for personal use, which may include purchasing a vehicle, home improvements, or other personal expenses.

Who is required to file Consumer Loan Application?

Any individual or consumer seeking to obtain a loan from a bank, credit union, or other financial service provider must file a Consumer Loan Application.

How to fill out Consumer Loan Application?

To fill out a Consumer Loan Application, carefully read the form instructions, provide personal details such as name and contact information, disclose financial information including income and employment history, and detail the purpose and amount of the loan requested.

What is the purpose of Consumer Loan Application?

The purpose of a Consumer Loan Application is to assess the borrower's financial health and creditworthiness, determine the ability to repay the loan, and facilitate the lender's decision-making process regarding loan approval.

What information must be reported on Consumer Loan Application?

Information that must be reported on a Consumer Loan Application typically includes personal identification details, employment and income history, financial obligations, loan amount requested, and the purpose of the loan.

Fill out your consumer loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.