Get the free IT-272 - tax ny

Show details

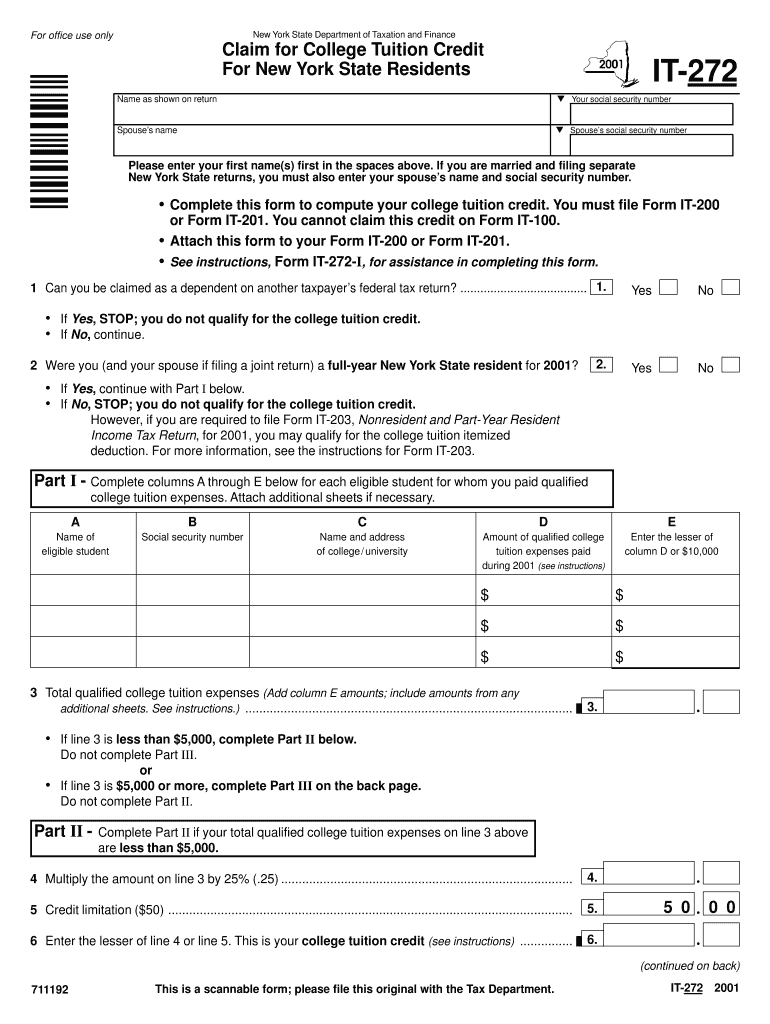

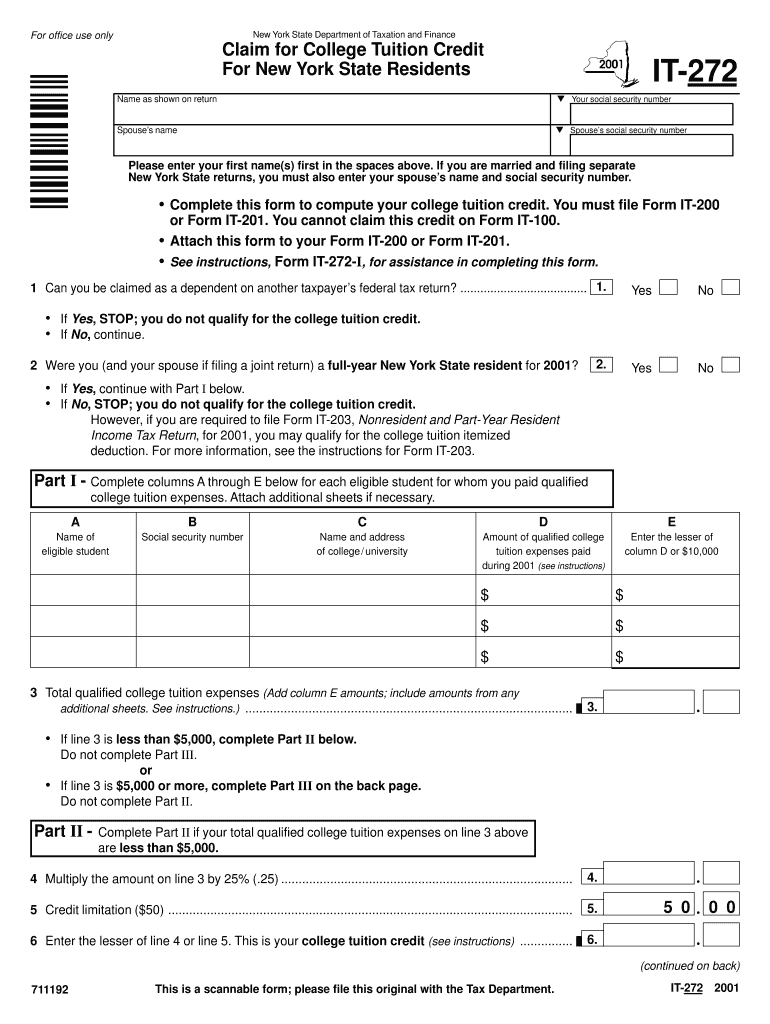

Ce formulaire doit être complété pour calculer votre crédit d'impôt pour les frais de scolarité universitaire. Vous devez joindre ce formulaire à votre Formulaire IT-200 ou Formulaire IT-201.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-272 - tax ny

Edit your it-272 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-272 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-272 - tax ny online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit it-272 - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-272 - tax ny

How to fill out IT-272

01

Obtain a copy of Form IT-272 from the New York State Department of Taxation and Finance website.

02

Enter your personal information at the top of the form, including your name, address, and Social Security Number.

03

Indicate your filing status (single, married, etc.) in the designated section.

04

Follow the instructions to calculate your modification amounts based on the guidelines provided in the form.

05

Fill in the appropriate lines for your credits, deductions, and additional information as required.

06

Review all entries for accuracy and completeness before signing the form.

07

Submit the completed IT-272 form along with your tax return by the specified deadline.

Who needs IT-272?

01

Individuals who reside in New York State and need to report modifications to their income.

02

Taxpayers claiming certain adjustments or credits for their New York State tax return.

03

Anyone required to file a personal income tax return in New York and making relevant modifications.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for NY college tuition credit?

You are entitled to this credit or deduction if: you were a full-year New York State resident; you, your spouse, or dependent (for whom you have taken an exemption) were an undergraduate student who was enrolled at or attended an institution of higher education and paid qualified college tuition expenses; and.

Is college tuition an itemized deduction?

Qualified tuition and fees are no longer tax deductible after 2020. The Tuition and Fees deduction was an adjustment to income if you incurred qualified education expenses for you, your spouse, or your dependent.

Who is eligible for the college tuition credit in NY?

You are entitled to this credit or deduction if: you were a full-year New York State resident; you, your spouse, or dependent (for whom you have taken an exemption) were an undergraduate student who was enrolled at or attended an institution of higher education and paid qualified college tuition expenses; and.

Who can claim college tuition credit?

You, your dependent or a third party pays qualified education expenses for higher education. An eligible student must be enrolled at an eligible educational institution. The eligible student is yourself, your spouse or a dependent you list on your tax return.

Who is eligible for free tuition in New York?

Earn $125,000 or less (household federal adjusted gross income) Complete the Free Application for Federal Student Aid (FAFSA) and the Tuition Assistance Program (TAP) application.

What is the maximum income for tuition credit?

For the American Opportunity Credit the education credit income limit is as follows: Single, head of household, or qualifying widow(er) — $80,000-$90,000. Married filing jointly — $160,000-$180,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-272?

IT-272 is a form used for reporting specific tax information related to income tax in certain jurisdictions.

Who is required to file IT-272?

Individuals or entities that meet specific income thresholds or requirements set by tax authorities must file IT-272.

How to fill out IT-272?

To fill out IT-272, taxpayers must provide their personal information, income details, and any deductions or credits they are claiming, as outlined in the form instructions.

What is the purpose of IT-272?

The purpose of IT-272 is to ensure that taxpayers accurately report their income and calculate their tax liability as required by law.

What information must be reported on IT-272?

IT-272 requires reporting various types of income, deductions, and credits, as well as personal identification information.

Fill out your it-272 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-272 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.