Get the free Investment Firms Prudential Regime (IFPR) FCA

Show details

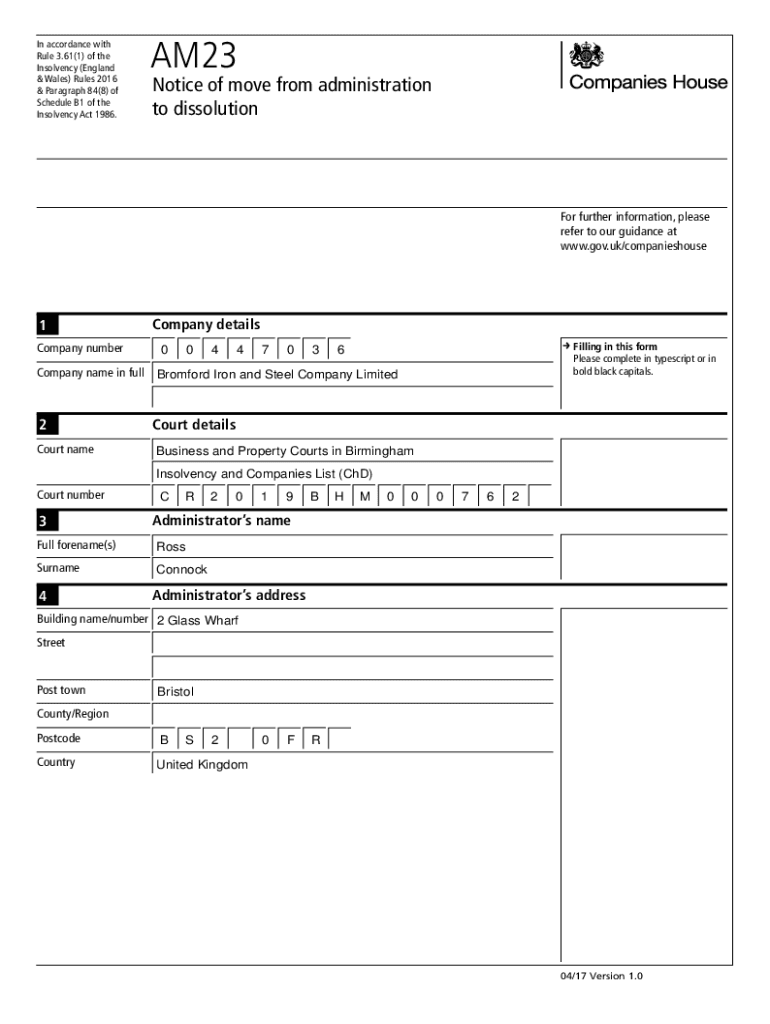

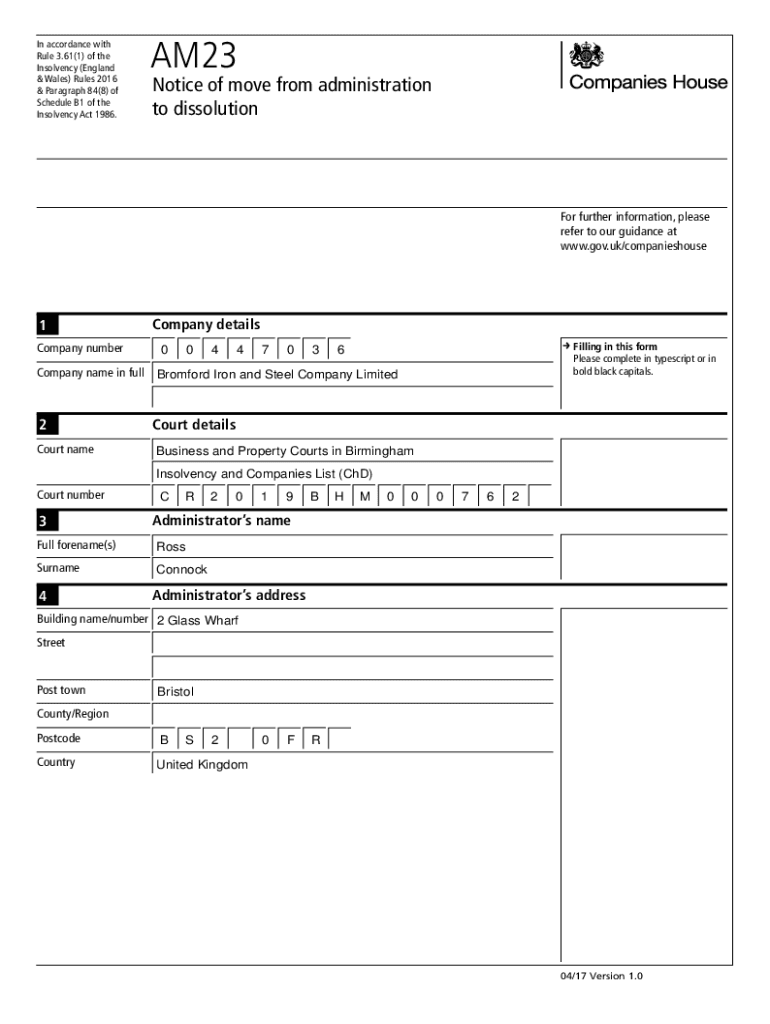

In accordance with Rule 3.61(1) of the Insolvency (England & Wales) Rules 2016 & Paragraph 84(8) of Schedule B1 of the Insolvency Act 1986.AM23Notice of move from administration to dissolution further

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment firms prudential regime

Edit your investment firms prudential regime form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment firms prudential regime form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment firms prudential regime online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit investment firms prudential regime. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment firms prudential regime

How to fill out investment firms prudential regime

01

Identify the specific investment firm prudential regime that applies to your organization. This can vary depending on factors such as the size and type of firm, as well as its activities.

02

Familiarize yourself with the regulatory requirements and standards set forth in the relevant prudential regime. This may include capital adequacy rules, risk management practices, liquidity requirements, and reporting obligations.

03

Review your firm's existing operations and assess any gaps or areas of non-compliance with the prudential regime. This may involve conducting a comprehensive internal audit and risk assessment.

04

Develop and implement a plan to address any identified gaps or deficiencies. This may include adjusting capital levels, enhancing risk management systems, and implementing new reporting processes.

05

Monitor and regularly assess your firm's adherence to the prudential regime. This involves ongoing monitoring of capital ratios, risk exposures, and compliance with reporting deadlines.

06

Stay updated on any changes or updates to the prudential regime. Regulatory requirements may evolve over time, and it is important to stay informed and adjust your firm's practices accordingly.

Who needs investment firms prudential regime?

01

Investment firms, including banks, brokers, asset managers, and other financial institutions, typically need to comply with the investment firm prudential regime.

02

The prudential regime sets out regulatory requirements that aim to ensure the financial stability and soundness of investment firms, as well as protect investors and clients.

03

Compliance with the prudential regime is essential for investment firms to maintain their license to operate, meet regulatory obligations, and mitigate risks associated with their activities.

04

Investors and clients of investment firms also benefit from the prudential regime, as it helps to enhance the overall stability and integrity of the financial system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my investment firms prudential regime directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your investment firms prudential regime along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find investment firms prudential regime?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific investment firms prudential regime and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my investment firms prudential regime in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your investment firms prudential regime and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is investment firms prudential regime?

Investment firms prudential regime is a set of rules and regulations that govern the financial stability and risk management practices of investment firms.

Who is required to file investment firms prudential regime?

Investment firms that fall under the regulatory authority are required to file investment firms prudential regime.

How to fill out investment firms prudential regime?

To fill out investment firms prudential regime, firms need to provide detailed information about their financial position, risk exposure, and compliance with regulatory requirements.

What is the purpose of investment firms prudential regime?

The purpose of investment firms prudential regime is to ensure the stability and soundness of investment firms and protect investors from financial risks.

What information must be reported on investment firms prudential regime?

Information such as financial statements, risk management practices, capital adequacy, and regulatory compliance must be reported on investment firms prudential regime.

Fill out your investment firms prudential regime online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Firms Prudential Regime is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.