NM TRD PIT-1 2021 free printable template

Show details

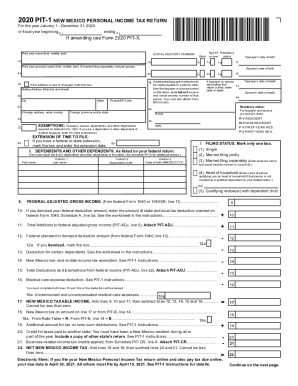

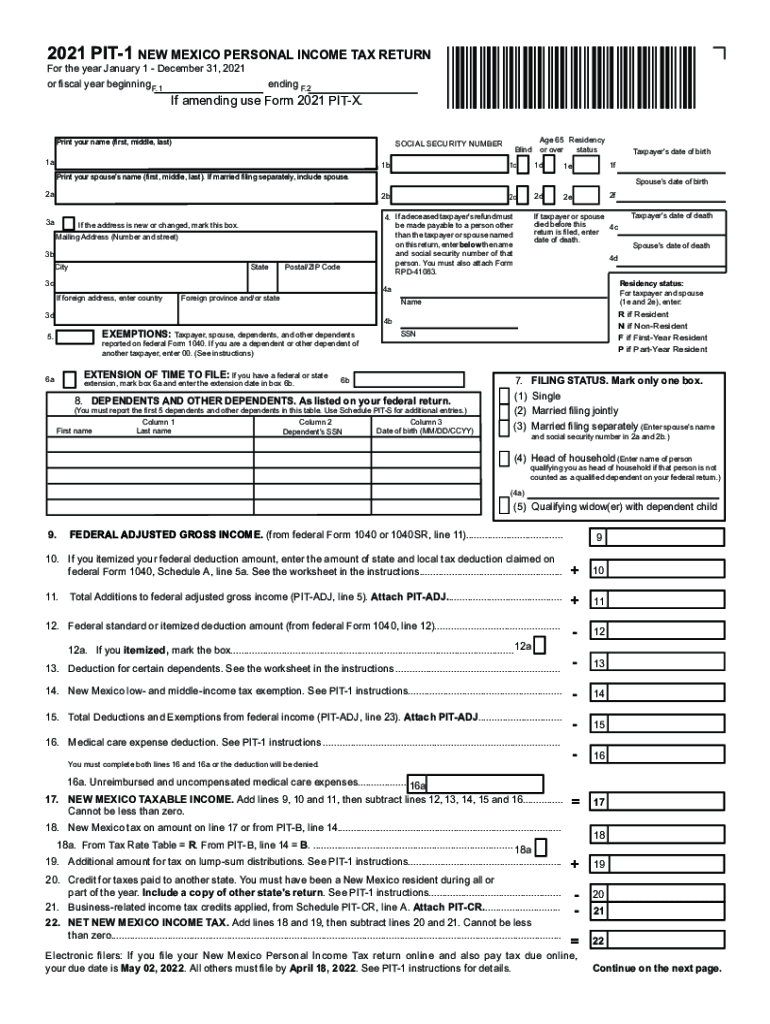

2021 PIT1 NEW MEXICO PERSONAL INCOME TAX RETURN For the year January 1 December 31, 2021, or fiscal year beginning F.1ending F.2If amending use Form 2021 PIT. Print your name (first, middle, last)*210180200×SOCIAL

pdfFiller is not affiliated with any government organization

Instructions and Help about NM TRD PIT-1

How to edit NM TRD PIT-1

How to fill out NM TRD PIT-1

Instructions and Help about NM TRD PIT-1

How to edit NM TRD PIT-1

To edit the NM TRD PIT-1 form, you can use pdfFiller's online editor. Upload your completed form to the platform, and utilize the editing tools to make necessary changes. You can adjust text, add signatures, or make notes directly on the form.

How to fill out NM TRD PIT-1

Filling out the NM TRD PIT-1 involves several straightforward steps. Begin by gathering necessary tax information including personal identification and income documentation. Follow these steps:

01

Download the NM TRD PIT-1 form from the New Mexico State Taxation and Revenue Department website.

02

Provide your name, address, and Social Security Number at the top of the form.

03

Fill in income details in the specified sections, ensuring all figures are accurate and match corresponding documents.

04

Review your entries for errors before submission.

About NM TRD PIT-1 2021 previous version

What is NM TRD PIT-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NM TRD PIT-1 2021 previous version

What is NM TRD PIT-1?

NM TRD PIT-1 is the New Mexico Personal Income Tax return form used by residents to report personal income and calculate tax liability. This form collects information regarding income received from various sources throughout the tax year.

What is the purpose of this form?

The purpose of the NM TRD PIT-1 is to ensure that New Mexico residents accurately report their income and pay the appropriate amount of state income taxes. This form is critical for compliance with New Mexico's tax laws and provides the state with necessary revenue for public services.

Who needs the form?

Residents of New Mexico who earn income must file the NM TRD PIT-1 form. It applies to individuals who receive wages, salaries, business income, or other types of taxable income. Additionally, even if you have no tax liability, filing may be beneficial for receiving potential refunds.

When am I exempt from filling out this form?

You may be exempt from filing NM TRD PIT-1 if your total income falls below the state’s minimum threshold for taxation or if you are a non-resident who does not earn income in New Mexico. Consult the New Mexico Taxation and Revenue Department for specifics on income criteria.

Components of the form

The NM TRD PIT-1 includes several key components, including personal identification information, income reporting sections, and tax calculation fields. Each section specifically corresponds to different types of income and deductions allowable under New Mexico law.

What payments and purchases are reported?

The NM TRD PIT-1 requires reporting various types of income such as wages, self-employment income, and investment earnings. Additionally, any taxable purchases made during the year must be included to ensure accurate tax assessment.

What are the penalties for not issuing the form?

Failing to file the NM TRD PIT-1 can result in penalties imposed by the New Mexico Taxation and Revenue Department. These may include fines based on the amount of tax owed and interest accrued on unpaid taxes. Timely and accurate filing is essential to avoid these repercussions.

What information do you need when you file the form?

When filing the NM TRD PIT-1 form, you need to gather personal identification information, income details from all sources, and documentation of any qualifying deductions or credits. Accurate record-keeping will help reduce errors and ensure a smooth filing process.

Is the form accompanied by other forms?

Typically, the NM TRD PIT-1 may be accompanied by supporting documents such as W-2 forms, 1099 forms, or any schedules for itemized deductions. Ensure you include all necessary attachments to support your tax claims for a complete filing.

Where do I send the form?

The completed NM TRD PIT-1 form should be mailed to the address provided on the form itself. Ensure that the envelope is properly addressed and includes sufficient postage. Alternatively, check if electronic filing options are available through the New Mexico state tax portal.

See what our users say