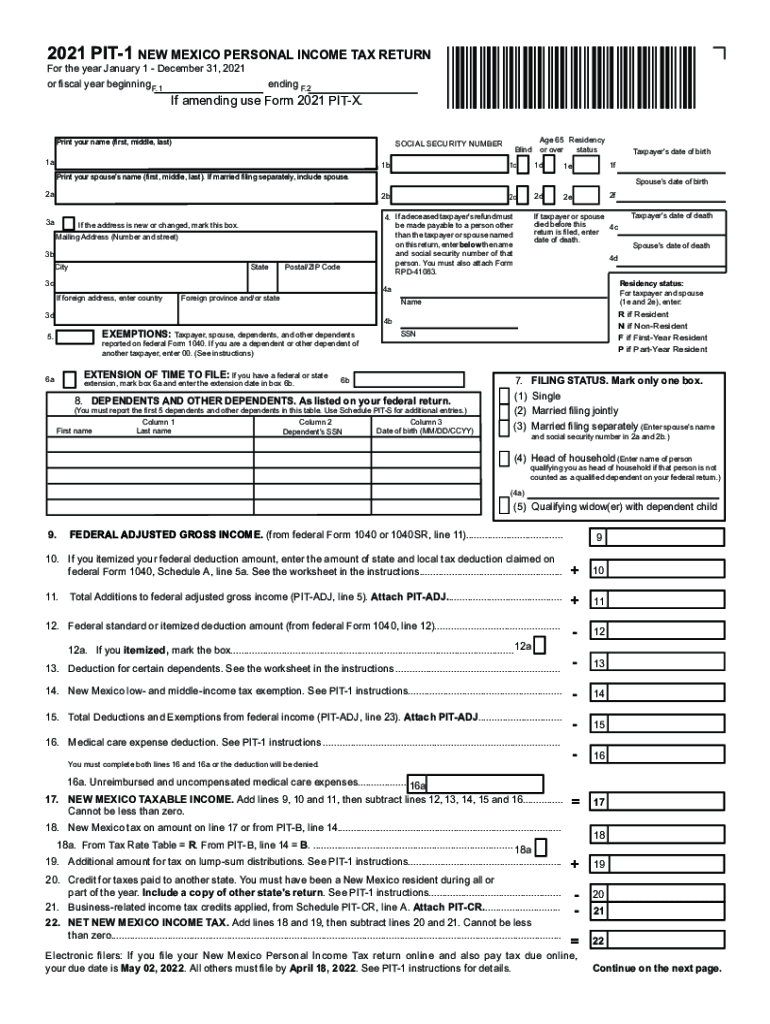

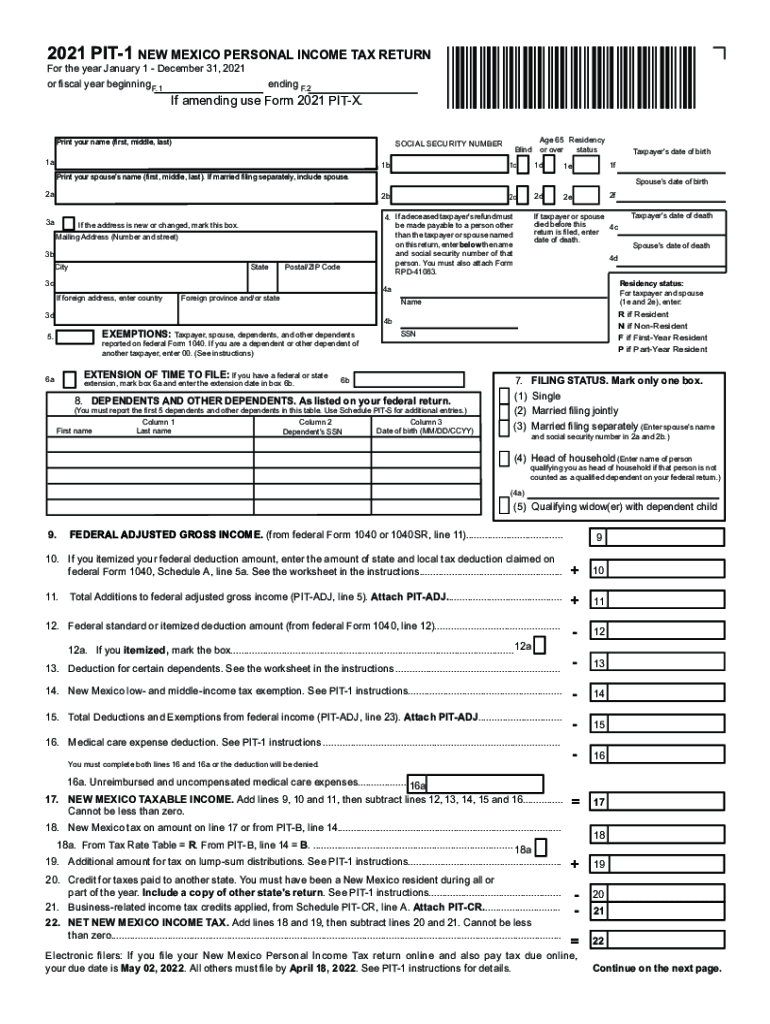

NM TRD PIT-1 2021 free printable template

Get, Create, Make and Sign NM TRD PIT-1

How to edit NM TRD PIT-1 online

Uncompromising security for your PDF editing and eSignature needs

NM TRD PIT-1 Form Versions

How to fill out NM TRD PIT-1

How to fill out NM TRD PIT-1

Who needs NM TRD PIT-1?

Instructions and Help about NM TRD PIT-1

Welcome to the tax and rev video series in this edition we will demonstrate how to file a personal income tax return using the new taxpayer access point or tap for short currently we are logged into the taxpayer David Jones account you can see on the summary page a 2020 personal income tax return has not yet been fired you can file the 2020 personal income tax return by clicking this link here file now if you would like to file view or amend a current year or previous year return you can click this link file view or amend all returns we are going to click file here you will see the purpose eligibility and information needed we will click next and on this page we will review the client information if you need to update your name you can select yes and make changes to your name here your social security number or ITIN is already pre-populated when you registered your tap account you provided that information you will indicate if you are blind, and you will select your residency status there are four residency statuses first year resident non-resident part your resident or resident we are...

People Also Ask about

What is PIT declaration?

Do I have to file New Mexico state taxes?

Where can I get NM state tax forms?

Can I file my taxes by mail and pay online?

What is Pit tax in Vietnam?

When can I file my New Mexico state taxes?

Where can I pick up local tax forms?

Can you buy tax forms?

Is there a state tax form for New Mexico?

What is a pit 1 tax form?

What is Pit allowance?

What is pit in income tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NM TRD PIT-1 to be eSigned by others?

Where do I find NM TRD PIT-1?

How do I make edits in NM TRD PIT-1 without leaving Chrome?

What is NM TRD PIT-1?

Who is required to file NM TRD PIT-1?

How to fill out NM TRD PIT-1?

What is the purpose of NM TRD PIT-1?

What information must be reported on NM TRD PIT-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.