Get the free Student/Parent Non-Tax Filer’s Statement - vaughn

Show details

Este formulario debe completarse si no se requiere presentar declaraciones de impuestos federales de EE. UU. para el año 2009. Se debe adjuntar copias de cualquier formulario W-2 y/o formularios

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign studentparent non-tax filers statement

Edit your studentparent non-tax filers statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your studentparent non-tax filers statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

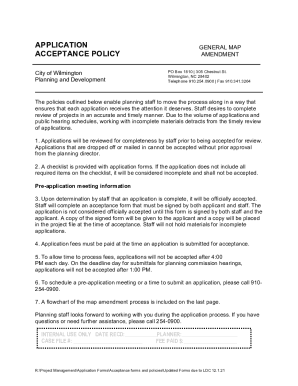

Editing studentparent non-tax filers statement online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit studentparent non-tax filers statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

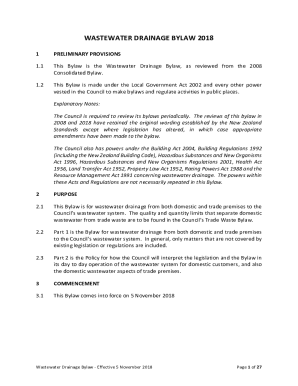

How to fill out studentparent non-tax filers statement

How to fill out Student/Parent Non-Tax Filer’s Statement

01

Obtain the Student/Parent Non-Tax Filer's Statement form from the financial aid office or website.

02

Fill in the student's name, Social Security number, and date of birth.

03

Provide the parent's name and Social Security number.

04

Indicate that the parent did not file a federal tax return for the specified year.

05

List any income sources the parent received, such as unemployment benefits or welfare.

06

Sign and date the form, confirming that the information provided is accurate.

07

Submit the completed form to the appropriate financial aid office or institution.

Who needs Student/Parent Non-Tax Filer’s Statement?

01

Students who are applying for financial aid and whose parents did not file a federal tax return.

02

Parents who need to document their non-filing status for financial aid purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the 3 types of tax return forms?

But choose carefully. There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

What documents does a college student need to file taxes?

What Do You Need to File Taxes as a College Student? Social Security number or Individual Taxpayer Identification Number. Driver's license or ID card. Identity Protection PIN (IP PIN). If you were assigned one by the IRS. Last year's tax return (if you filed). Bank account and routing numbers.

What does student's non tax filer's statement mean?

An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040 for the year you requested. Non Tax filers can request an IRS Verification of Non-filing Letter, free of charge, from the IRS in one of three ways: Online. By Telephone. By Paper.

What are 3 tax preparation options to file your taxes?

Options for filing taxes include getting free help from the IRS, paying for tax software, or hiring a pro. Whether you go solo or with a tax pro, the IRS says you'll get a refund faster (if you're owed one) by filing electronically and including your direct deposit information.

What happens if my school doesn't give 1098-T forms?

If you, your spouse, or your dependent had education expenses and did not receive Form 1098-T, you may need to still report the amounts on the return. If your expenses are more than your scholarships, fellowships, and grants, you may qualify for an education credit.

What are the three forms needed for a student to file their tax return?

What Tax Forms Do Students Need? 1040: This is the basic income-reporting form that nearly everyone uses. State tax return forms: States have their own rules for who must pay state taxes. 1098-T: This form tells the IRS how much you paid in tuition and fees. 1098-E: Did you pay any interest on student loans last year?

What is a parent tax Nonfiling statement Yale?

Description: U.S. citizens and permanent residents who did not file a federal tax return for the year requested by FAFSA must submit a Tax Nonfiling Statement with the financial aid application. You can either complete the form on IDOC or use Yale's nonfiling form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

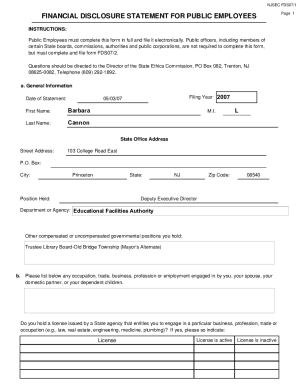

What is Student/Parent Non-Tax Filer’s Statement?

The Student/Parent Non-Tax Filer’s Statement is a form used to declare that a student or parent has not filed a tax return for a particular year, usually required for financial aid applications.

Who is required to file Student/Parent Non-Tax Filer’s Statement?

Individuals who have not earned enough income to require filing a tax return are required to file the Student/Parent Non-Tax Filer’s Statement when applying for financial aid.

How to fill out Student/Parent Non-Tax Filer’s Statement?

To fill out the statement, you need to provide personal information such as name and Social Security Number, indicate your non-filer status, and state the reason for not filing a tax return.

What is the purpose of Student/Parent Non-Tax Filer’s Statement?

The purpose of the statement is to provide verification to financial aid offices that the student or parent did not file a federal tax return, helping to assess eligibility for financial aid.

What information must be reported on Student/Parent Non-Tax Filer’s Statement?

The statement must report personal identification information, income information, and the reason for not filing a tax return, along with any other relevant details as required by the financial aid office.

Fill out your studentparent non-tax filers statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Studentparent Non-Tax Filers Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.