VT CVO-007 2021-2025 free printable template

Show details

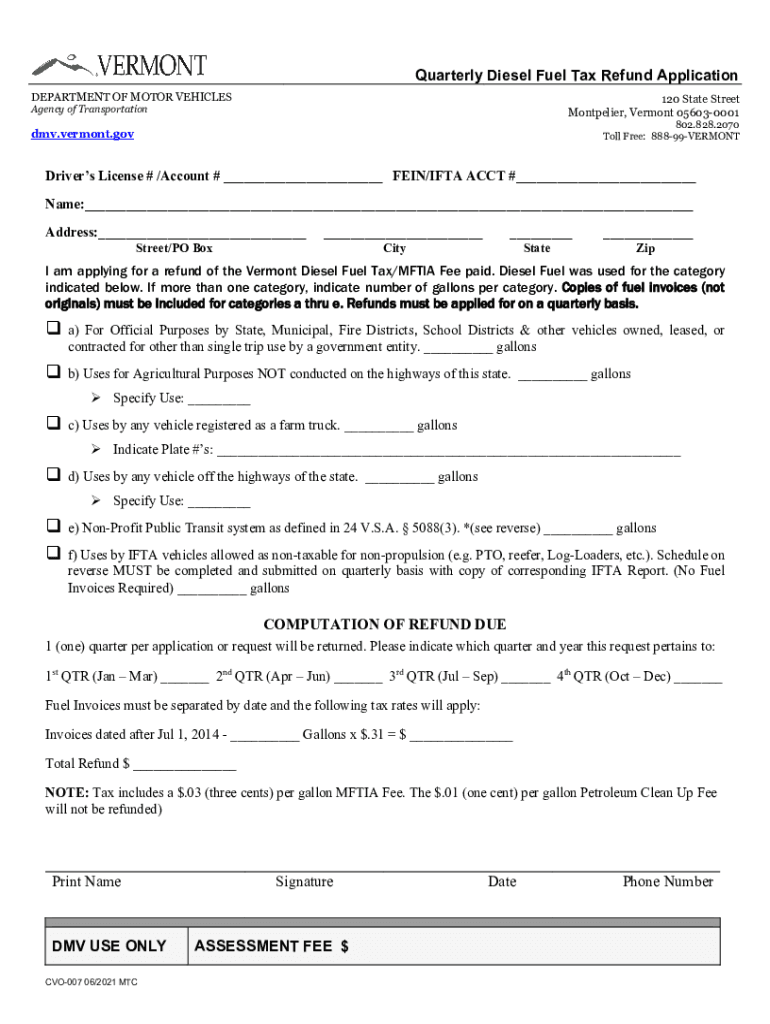

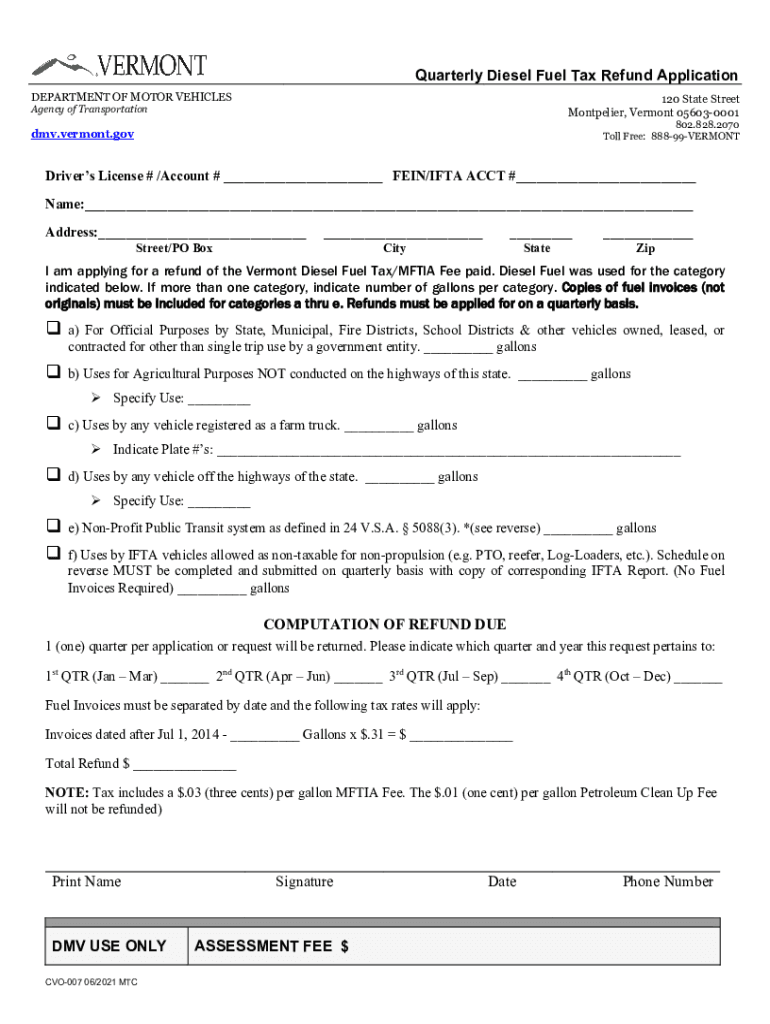

01 one cent per gallon Petroleum Clean Up Fee will not be refunded Preparer s Signature DMV USE ONLY TA-VP-35 5M 07/2014 REB Title ASSESSMENT FEE Date Phone Number Exempt Vermont Fuel Allowance Worksheet IFTA CARRIERS The following information must to be extracted from the Quarterly IFTA Report in which the allowance is being taken. 1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign filliofuels-tax-refund-applicationfill - fuels tax

Edit your filliofuels-tax-refund-applicationfill - fuels tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filliofuels-tax-refund-applicationfill - fuels tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit filliofuels-tax-refund-applicationfill - fuels tax online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit filliofuels-tax-refund-applicationfill - fuels tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT CVO-007 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out filliofuels-tax-refund-applicationfill - fuels tax

How to fill out VT CVO-007

01

Obtain the VT CVO-007 form from the relevant state department or website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide accurate vehicle information, such as make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the form, such as registration, title transfer, or ownership verification.

05

Complete any required sections related to liens, loans, or previous ownership.

06

Review the filled form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the form along with any required documents and payment to the appropriate authority.

Who needs VT CVO-007?

01

Individuals who are registering a vehicle in Vermont.

02

People transferring vehicle ownership in Vermont.

03

Owners of vehicles seeking to establish or verify ownership.

04

Anyone needing to update their vehicle's information with the state.

Fill

form

: Try Risk Free

People Also Ask about

How much federal tax is in a gallon of gasoline?

How much tax do we pay on a gallon of gasoline and on a gallon of diesel fuel? Federal taxes include excises taxes of 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel, and a Leaking Underground Storage Tank fee of 0.1 cents per gallon on both fuels.

Who is the commissioner of motor vehicles in vermont?

Wanda brings a unique blend of leadership skills to her position with 37 years of State service which has provided her the relevant understanding to lead the department as Commissioner for the Vermont Department of Motor Vehicles.

How do I speak to someone at the Vermont DMV?

Phone Numbers 802.828.2000. 888 99-VERMONT (888.998.3766)

Am I eligible for VA tax rebate?

To be eligible for the rebate, people have to file by Nov. 1, 2022, and have a 2021 tax liability. Some individuals may not be eligible for the rebate based on how much disability, social security or unemployment pay they may have received, because those streams of income are not taxed in the first place.

What is vermont fuel tax?

A person buying at retail will pay 6% sales and use tax for natural gas to fuel a motor vehicle, propane in a free-standing container, and dyed diesel for limited specific uses. Heating oil, gas, and other fuels used for commercial purposes are also subject to 6% sales and use tax, but not when used in the home.

Which state has the highest fuel tax?

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

How to apply for VA fuels tax refund?

- click "Online Services" - scroll to "Payments and Refunds" - scroll to "Fuels Tax Refund" and, . - click "Logon" to access your account and submit your refund application or, - click "Register for MyFuels Tax Refund Account" to establish "Customer Registration" (a new account) and submit your refund application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute filliofuels-tax-refund-applicationfill - fuels tax online?

pdfFiller has made it easy to fill out and sign filliofuels-tax-refund-applicationfill - fuels tax. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit filliofuels-tax-refund-applicationfill - fuels tax straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing filliofuels-tax-refund-applicationfill - fuels tax, you can start right away.

How do I edit filliofuels-tax-refund-applicationfill - fuels tax on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as filliofuels-tax-refund-applicationfill - fuels tax. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is VT CVO-007?

VT CVO-007 is a specific form used in Vermont for reporting the sale or purchase of a motor vehicle.

Who is required to file VT CVO-007?

Individuals or entities that register or title a motor vehicle in Vermont are required to file VT CVO-007.

How to fill out VT CVO-007?

To fill out VT CVO-007, provide accurate information regarding the vehicle, seller, buyer, and transaction details according to the instructions on the form.

What is the purpose of VT CVO-007?

The purpose of VT CVO-007 is to document and report vehicle transactions to ensure proper registration and taxation.

What information must be reported on VT CVO-007?

VT CVO-007 requires reporting of the vehicle details such as VIN, make, model, seller and buyer information, transaction date, and sale price.

Fill out your filliofuels-tax-refund-applicationfill - fuels tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Filliofuels-Tax-Refund-Applicationfill - Fuels Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.