Get the free Military Non-taxed Income Letter - sfccmo

Show details

This document is used to report military non-taxed income and allowances for completing a financial aid application for State Fair Community College.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign military non-taxed income letter

Edit your military non-taxed income letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your military non-taxed income letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit military non-taxed income letter online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit military non-taxed income letter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out military non-taxed income letter

How to fill out Military Non-taxed Income Letter

01

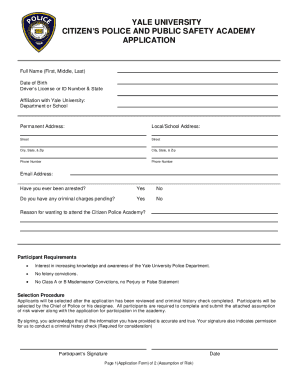

Obtain a blank Military Non-taxed Income Letter template.

02

Fill in your personal information including full name, rank, and service number.

03

Indicate the periods of active duty or any relevant dates.

04

List the specific sources of non-taxed income, such as housing allowances or basic allowances for subsistence.

05

Calculate the total amount of non-taxed income for the specified period.

06

Include any supporting documentation or verification as needed.

07

Sign and date the letter to certify its accuracy.

08

Submit the completed letter to the appropriate authority or organization requiring it.

Who needs Military Non-taxed Income Letter?

01

Active duty military personnel seeking to provide proof of non-taxed income for loans or financial applications.

02

Veterans applying for financial assistance or benefits that require documentation of income.

03

Military families needing to document income for tax exemptions or benefits eligibility.

04

Service members applying for housing or educational benefits that consider non-taxed income.

Fill

form

: Try Risk Free

People Also Ask about

Can the military get taxes done for free?

Eligible service members and spouses have access to MilTax free tax filing and prep services, tax consideration info and more. Start with Military OneSource MilTax for information on free tax filing in the military.

Who qualifies for the free file program?

Taxpayers with an AGI of $84,000 or less in 2024 can find an IRS Free File product; some providers include free state tax return preparation and filing. All partners offer active-duty military personnel with an AGI of $84,000 or less in 2024, free tax preparation and filing using IRS Free File.

How do I get free taxes from the military?

MilTax e-filing software is free for service members, eligible family members, survivors and recent veterans up to 365 days from their separation or retirement date. To access this benefit, we'll need to verify your eligibility. Note: You do not need to log in to your Military OneSource account to access the software.

Do military get TurboTax for free?

In proud support of your service and sacrifice, enlisted active military and reservists can file both their federal and state taxes for FREE using any of our TurboTax Online products, which include Free, Deluxe, and Premium. Not valid for TurboTax Live or TurboTax Desktop products. Offer not valid for officers.

Is bah and bas non-taxable income?

While all pays are taxable, most allowances are tax-exempt. The primary allowances for most individuals are BAS and BAH, which are tax-exempt.

What VA income is non-taxable?

Tax benefits as a Veteran: Disability benefits received from VA should not be counted as part of a Veteran's gross income. Payments from compensation, pension, Veteran Readiness & Employment (VR&E), and education—including the G.I. Bill—are exempt from taxation.

What is non taxable income for the military?

A servicemember who serves, or has served, in a combat zone can exclude up to 100% of combat pay from income. Visit IRS's Tax Exclusion for Combat Service for more information. You have 180 days plus the number of days you served in a combat zone or qualified hazardous duty area (QHDA) to file your return.

Do military members get tax breaks?

Being in the military entitles you to certain tax advantages, but you need to stay on top of them as they sometimes change. Some benefits could include deductible moving expenses, not owing taxes on combat pay and avoiding the capital gains tax on the sale of your home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

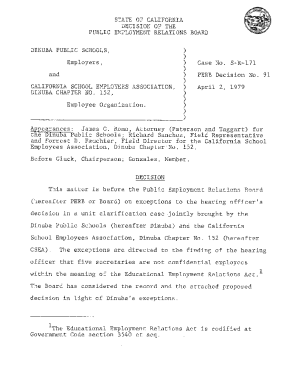

What is Military Non-taxed Income Letter?

The Military Non-taxed Income Letter is a document provided by the military that outlines specific types of income received by service members that are exempt from federal taxes.

Who is required to file Military Non-taxed Income Letter?

Service members who receive non-taxed income, such as certain allowances and benefits, may be required to file the Military Non-taxed Income Letter for financial verification purposes.

How to fill out Military Non-taxed Income Letter?

To fill out the Military Non-taxed Income Letter, service members need to provide their personal information, details of non-taxed income received, and any relevant service branch details as required in the form's sections.

What is the purpose of Military Non-taxed Income Letter?

The purpose of the Military Non-taxed Income Letter is to verify the income status of military personnel for loans, benefits, or other financial assessments, ensuring accurate representation of their financial situation.

What information must be reported on Military Non-taxed Income Letter?

The Military Non-taxed Income Letter must report information such as the service member's rank, branch of service, types and amounts of non-taxed income, and the period for which the income is applicable.

Fill out your military non-taxed income letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Military Non-Taxed Income Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.