OK Resident Fiduciary Income Tax Forms and Instructions 2021 free printable template

Show details

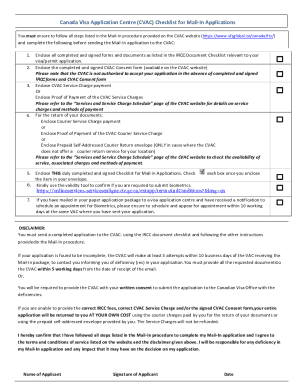

2021 Oklahoma Resident Fiduciary Income Tax Forms and Instructions This packet contains: Instructions for Completing Form 513 513 Fiduciary Income Tax Form 2021 Fiduciary Income Tax Table Filing date:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Resident Fiduciary Income Tax Forms

Edit your OK Resident Fiduciary Income Tax Forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Resident Fiduciary Income Tax Forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Resident Fiduciary Income Tax Forms online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK Resident Fiduciary Income Tax Forms. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Resident Fiduciary Income Tax Forms and Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Resident Fiduciary Income Tax Forms

How to fill out OK Resident Fiduciary Income Tax Forms and

01

Gather all necessary financial information for the fiduciary entity, including income and expenses.

02

Obtain the OK Resident Fiduciary Income Tax Forms from the Oklahoma Tax Commission website or office.

03

Fill out Part 1 of the form with the fiduciary's identification information, including name, address, and tax identification number.

04

Complete Part 2, detailing the income received by the fiduciary, such as interest, dividends, and distributions.

05

In Part 3, itemize any deductions that the fiduciary is entitled to, such as administrative expenses.

06

Ensure all calculations are accurate and supported by documentation.

07

Sign and date the form, confirming the information provided is true and accurate.

08

Submit the completed forms and any necessary attachments either electronically or by mail to the Oklahoma Tax Commission.

Who needs OK Resident Fiduciary Income Tax Forms and?

01

Trusts that generate income and are subject to Oklahoma state taxation.

02

Estate executors managing the income generation of estates after an individual has passed away.

03

Fiduciaries of irrevocable trusts that are required to file income tax returns for the trust.

04

Individuals who are appointed as fiduciaries to manage the financial affairs of another party.

Fill

form

: Try Risk Free

People Also Ask about

What documents do I send with federal tax return?

File a Federal Income Tax Return A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations and medical and business expenses if you are itemizing your return.

Do I need to include a copy of my federal return with my Oklahoma state return?

If I e-file the OK-511, do I have to send a copy of the Federal return to the state? State DOR requests that you include a copy of your Federal return. If you paper-file the OK-511, you should include a copy of the Federal return and if applicable, the federal child care credit schedule.

Where can I pick up local tax forms?

In Your Community. Many libraries and post offices offer free tax forms during the tax filing season. Some libraries also have copies of commonly requested IRS publications.

Where can I find tax forms in my area?

Convenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Where can I pick up paper IRS forms?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

Do I need to send a copy of my federal return with my Oklahoma state return?

If I e-file the OK-511, do I have to send a copy of the Federal return to the state? State DOR requests that you include a copy of your Federal return. If you paper-file the OK-511, you should include a copy of the Federal return and if applicable, the federal child care credit schedule.

Do I mail a copy of my federal and state taxes together?

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2's or any 1099's.

Where can I get IRS forms 2022?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

When can I mail my tax return 2022?

24; IRS outlines refund timing and what to expect in advance of April 18 tax deadline.

Do you need to report federal refund on taxes?

If you took an itemized deduction in an earlier year for taxes paid that were later refunded, you may have to include all or part of the refund as income on your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my OK Resident Fiduciary Income Tax Forms directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your OK Resident Fiduciary Income Tax Forms as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send OK Resident Fiduciary Income Tax Forms to be eSigned by others?

To distribute your OK Resident Fiduciary Income Tax Forms, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete OK Resident Fiduciary Income Tax Forms online?

pdfFiller makes it easy to finish and sign OK Resident Fiduciary Income Tax Forms online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is OK Resident Fiduciary Income Tax Forms?

The OK Resident Fiduciary Income Tax Forms are documents used to report income earned by trusts and estates that are residents of Oklahoma.

Who is required to file OK Resident Fiduciary Income Tax Forms?

Trusts and estates that generate taxable income in Oklahoma must file the OK Resident Fiduciary Income Tax Forms.

How to fill out OK Resident Fiduciary Income Tax Forms?

To fill out the forms, provide information about the trust or estate, including income sources, deductions, and credits, and ensure calculations are accurate before submitting.

What is the purpose of OK Resident Fiduciary Income Tax Forms?

The purpose of these forms is to report the taxable income of a fiduciary entity, ensuring compliance with Oklahoma tax laws.

What information must be reported on OK Resident Fiduciary Income Tax Forms?

The forms require reporting of total income, allowable deductions, distributions to beneficiaries, and other relevant financial information pertaining to the trust or estate.

Fill out your OK Resident Fiduciary Income Tax Forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Resident Fiduciary Income Tax Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.