Get the free Minimum wages - Fair Work Ombudsman

Show details

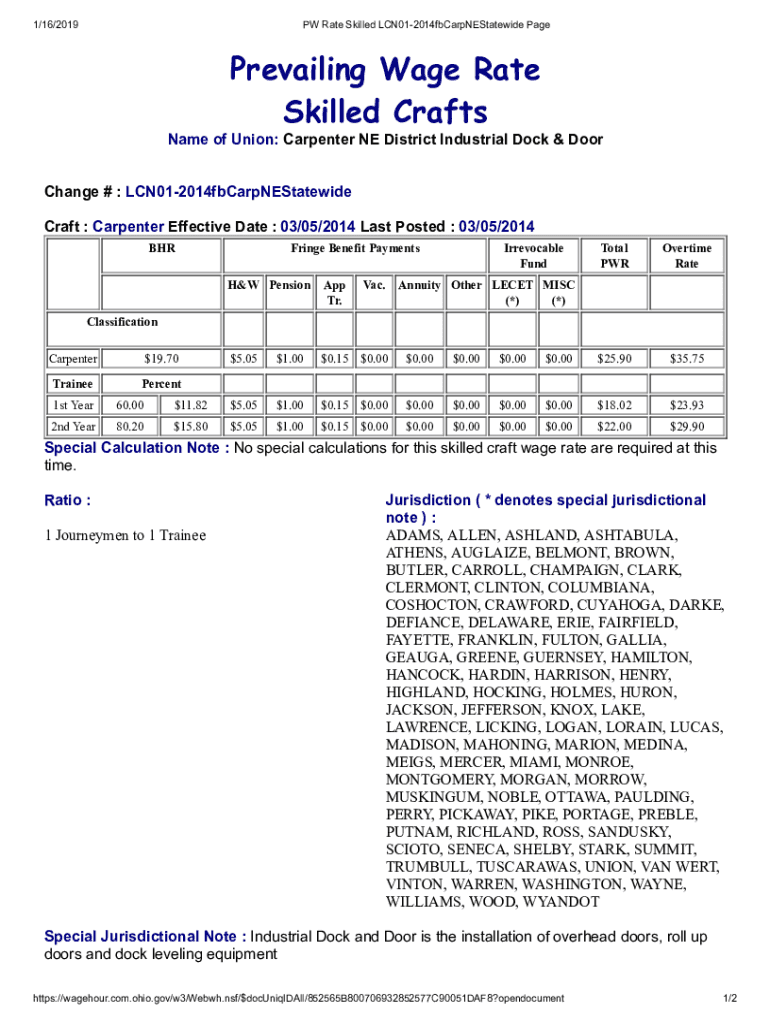

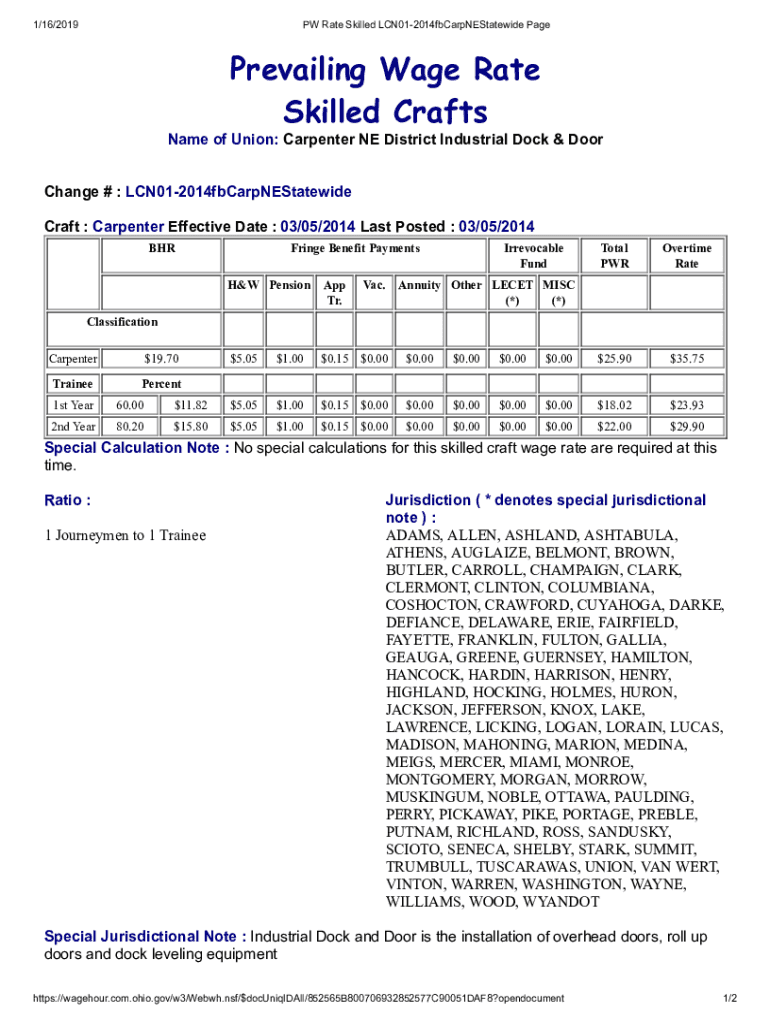

1/16/2019PW Rate Skilled LCN012014fbCarpNEStatewide PagePrevailing Wage Rate Skilled Craftsmen of Union: Carpenter NE District Industrial Dock & Door Change # : LCN012014fbCarpNEStatewide Craft :

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign minimum wages - fair

Edit your minimum wages - fair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minimum wages - fair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit minimum wages - fair online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit minimum wages - fair. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minimum wages - fair

How to fill out minimum wages - fair

01

To fill out minimum wages - fair, follow these steps:

02

Research the current minimum wage laws in your jurisdiction. Each country, state, or region may have different minimum wage regulations.

03

Determine whether your business falls under the minimum wage laws. Some small businesses or specific industries may be exempt from minimum wage requirements.

04

Calculate the minimum amount that needs to be paid to employees per hour or per day based on the established regulations.

05

Keep track of the working hours and wages for each employee. Maintain accurate records to ensure compliance and fair payment.

06

Communicate the minimum wage policies to your employees. Make sure they understand their rights and entitlements.

07

Regularly review and update the minimum wage rates according to any changes in the law.

08

Consult with a legal expert or local labor authorities if you have any doubts or questions regarding the minimum wage laws in your jurisdiction.

Who needs minimum wages - fair?

01

Minimum wages - fair are needed by various stakeholders including:

02

- Employees: Minimum wages ensure that workers receive a fair and decent income for their labor.

03

- Labor Unions: Unions advocate for minimum wage laws as part of their effort to protect workers' rights and improve working conditions.

04

- Government: The government implements minimum wage laws to prevent exploitation of workers and address income inequality.

05

- Employers: Minimum wages help establish a level playing field and prevent unfair competition. It also contributes to a motivated and productive workforce.

06

- Society: Minimum wages promote social welfare by reducing poverty, improving living standards, and reducing income disparities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find minimum wages - fair?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the minimum wages - fair in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute minimum wages - fair online?

pdfFiller has made it easy to fill out and sign minimum wages - fair. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit minimum wages - fair on an Android device?

You can make any changes to PDF files, like minimum wages - fair, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is minimum wages - fair?

Minimum wages - fair are the legally established minimum amount of compensation that employers are required to pay to their employees.

Who is required to file minimum wages - fair?

Employers are required to file minimum wages - fair for their employees.

How to fill out minimum wages - fair?

Minimum wages - fair can be filled out by providing accurate information about employee compensation and hours worked.

What is the purpose of minimum wages - fair?

The purpose of minimum wages - fair is to ensure that employees are paid a fair wage for their work.

What information must be reported on minimum wages - fair?

Information such as employee names, hours worked, compensation, and any deductions must be reported on minimum wages - fair.

Fill out your minimum wages - fair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minimum Wages - Fair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.