Get the free FAIR LENDING COMPLIANCE - WebContentor

Show details

Este documento aborda la necesidad de regulaciones en el sector hipotecario para garantizar un trato equitativo a todos los solicitantes de hipotecas. Se discuten diversas leyes como la Ley de Igualdad

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair lending compliance

Edit your fair lending compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair lending compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fair lending compliance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fair lending compliance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair lending compliance

How to fill out fair lending compliance:

01

Understand the requirements: Familiarize yourself with the fair lending laws and regulations in your jurisdiction. This includes laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA).

02

Design a comprehensive policy: Develop a fair lending policy that outlines your commitment to nondiscriminatory lending practices. This policy should include procedures for evaluating loan applications, handling customer complaints, and training employees on fair lending practices.

03

Collect and analyze data: Gather data on loan applications, approvals, and denials. Analyze this information to identify any disparities or potential signs of discrimination. Use statistical analysis techniques to detect any systemic bias or disparate impact on protected classes.

04

Implement corrective actions: If any disparities or discriminatory practices are identified, take prompt corrective action. This may involve modifying underwriting criteria, providing additional training to employees, or adopting new strategies to reach underserved communities.

05

Monitor and assess: Continually monitor your lending practices to ensure ongoing compliance. Regularly review data, conduct internal audits, and implement measures to address any identified issues.

06

Document compliance efforts: Keep detailed records of all fair lending activities, including policies, training materials, data analysis, and corrections made. These records may be required in case of audits, investigations, or legal actions.

07

Engage legal counsel if needed: If you have concerns or uncertainties about fair lending compliance, it is advisable to consult with legal counsel experienced in this area to ensure that your practices are in line with the law.

Who needs fair lending compliance?

01

Financial institutions: Banks, credit unions, and other lending institutions are required to comply with fair lending laws and regulations to ensure that all applicants are treated fairly and without discrimination.

02

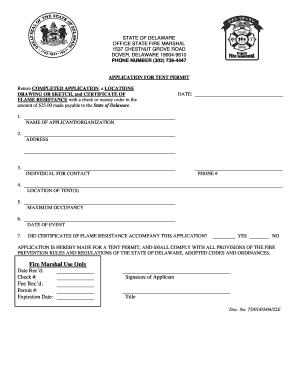

Mortgage lenders: Companies that provide mortgage loans must comply with fair lending requirements to ensure that potential homebuyers are not subject to discriminatory practices.

03

Consumer finance companies: Institutions that offer consumer loans, including personal loans or credit cards, need to adhere to fair lending regulations to protect consumers from unfair treatment.

04

Government agencies: Regulatory bodies and agencies responsible for overseeing lending practices must promote and enforce fair lending compliance to protect the rights of borrowers.

05

Businesses with in-house financing: Companies that offer financing options to their customers, such as automobile dealerships or retail stores, should follow fair lending practices to avoid accusations of discrimination.

06

Any organization involved in lending or loan-related activities: Any entity engaged in lending or loan-related activities should have fair lending compliance measures in place to uphold ethical standards and prevent discrimination in the lending process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fair lending compliance to be eSigned by others?

fair lending compliance is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find fair lending compliance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fair lending compliance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my fair lending compliance in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fair lending compliance directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is fair lending compliance?

Fair lending compliance refers to the adherence of laws and regulations that promote fair and equal access to credit and financial services for all individuals, regardless of their race, color, religion, national origin, sex, marital status, or age.

Who is required to file fair lending compliance?

Financial institutions such as banks, credit unions, mortgage lenders, and other lenders are required to file fair lending compliance to ensure they are not engaging in discriminatory lending practices.

How to fill out fair lending compliance?

Filling out fair lending compliance involves gathering relevant data, analyzing loan portfolios, assessing lending policies and procedures, and documenting efforts to ensure fair treatment and equal access to credit. It may also require the completion of specific reporting forms or templates provided by regulatory agencies.

What is the purpose of fair lending compliance?

The purpose of fair lending compliance is to eliminate discriminatory practices in lending and ensure that individuals have equal access to credit and financial opportunities. It aims to prevent unfair treatment based on protected characteristics and uphold the principles of equal opportunity and non-discrimination.

What information must be reported on fair lending compliance?

The information reported on fair lending compliance may include loan applicant demographics, loan approval and denial rates by protected classes, loan pricing data, lending policies and procedures, and any actions taken to address identified disparities or issues related to fair lending.

Fill out your fair lending compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Lending Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.