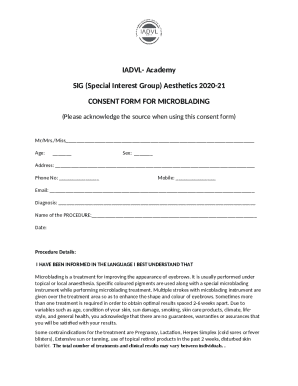

Get the free Mortgage Application – Individuals - homeloanadvicecentre com

Show details

Este formulario sirve como guía para los requisitos de documentación para solicitudes de préstamos enviadas a HomeSide Lending para su aprobación. Se requiere que toda la documentación esté

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage application individuals

Edit your mortgage application individuals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application individuals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage application individuals online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage application individuals. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage application individuals

How to fill out Mortgage Application – Individuals

01

Begin by gathering personal information, including your full name, address, and contact details.

02

Provide details about your employment history, including your current employer, position, and income.

03

List your monthly debt obligations, such as credit card payments, car loans, and student loans.

04

Enter information about any assets you have, including bank accounts, investments, and real estate.

05

Indicate the loan amount you are seeking and the purpose of the mortgage.

06

Review and confirm your credit history and score, as these will be checked by the lender.

07

Certify and sign the application to authorize the lender to proceed with the process.

Who needs Mortgage Application – Individuals?

01

Individuals looking to purchase a home and need financing.

02

First-time homebuyers seeking to enter the real estate market.

03

Individuals looking to refinance an existing mortgage for better terms.

04

Borrowers wanting to access home equity for renovations or other expenses.

Fill

form

: Try Risk Free

People Also Ask about

Why would you get denied for a mortgage?

The key reasons underwriters reject mortgages often involve credit score issues, income shortfalls, high LTV ratios, property type or recent changes in your financial situation.

What will prevent me from getting a mortgage?

A common reason a home loan might be denied is when a negative item on your credit sinks your score below a required benchmark. That's important because a lower credit score can affect the interest rate you're offered, which in turn can affect how affordable your monthly mortgage payment will be.

Can an individual write a mortgage?

A private mortgage provides the financing for purchasing a home and comes from an individual or company that isn't a bank or traditional mortgage lender. Private mortgages are often provided by a family member, friend or other person with a personal relationship to the borrower.

What can make you not get a mortgage?

Mortgage applications are declined for financial reasons too. Poor credit history. You'll need to have a good credit history. High level of debt. Low deposit. The lender may have changed their criteria or something new may have been identified following the hard credit check. Affordability. Using payday loans.

What would stop me from getting a mortgage?

Things that can prevent you from getting a mortgage include bad credit, high debt and low income. Tackle any of the relevant issues below to improve your odds of mortgage approval and favorable terms.

What would make you not qualify for a mortgage?

High debt-to-income (DTI) Before approving you for a mortgage, lenders review your monthly income in relation to your monthly debt, or your debt-to-income (DTI). A good rule of thumb: your mortgage payment should not be more than 28% of your monthly gross income. Similarly, your DTI should not be more than 36%.

What is the English translation of mortgage?

mortgage | Business English a legal agreement to borrow money from a bank or other financial organization, especially to buy a house or other property, or the amount of money borrowed: apply for/take out/get a mortgage You take out a mortgage on your home at a fixed rate of interest.

How do English mortgages work?

There are two main types of repayment mortgage: Fixed rate mortgage – your interest rate is guaranteed to stay the same for a set period. Tracker mortgage – your interest rate tracks the Bank of England Base Rate, plus a bit more. This means your monthly repayments and interest rates can go up or down during your term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Application – Individuals?

A Mortgage Application – Individuals is a formal request made by a person to a lender for financing to purchase or refinance real estate. The application includes personal, financial, and property information.

Who is required to file Mortgage Application – Individuals?

Individuals seeking to obtain a mortgage for purchasing or refinancing a property are required to file a Mortgage Application. This typically includes homebuyers, owners refinancing their existing mortgage, and borrowers seeking home equity loans.

How to fill out Mortgage Application – Individuals?

To fill out a Mortgage Application – Individuals, one should gather personal identification, employment history, income details, credit history, asset information, and the details of the property involved. The application form can then be completed online or in person with the lender, providing all required information accurately.

What is the purpose of Mortgage Application – Individuals?

The purpose of a Mortgage Application – Individuals is to provide lenders with comprehensive information to assess the borrower's creditworthiness and ability to repay the loan. It is used to determine the terms and conditions of the mortgage offered.

What information must be reported on Mortgage Application – Individuals?

A Mortgage Application – Individuals must report personal details (name, address, Social Security number), employment and income information, financial assets and liabilities, credit history, and details about the property being financed or refinanced.

Fill out your mortgage application individuals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Application Individuals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.