Get the free Market-Based Monetary Policy Uncertainty - Oxford Academic

Show details

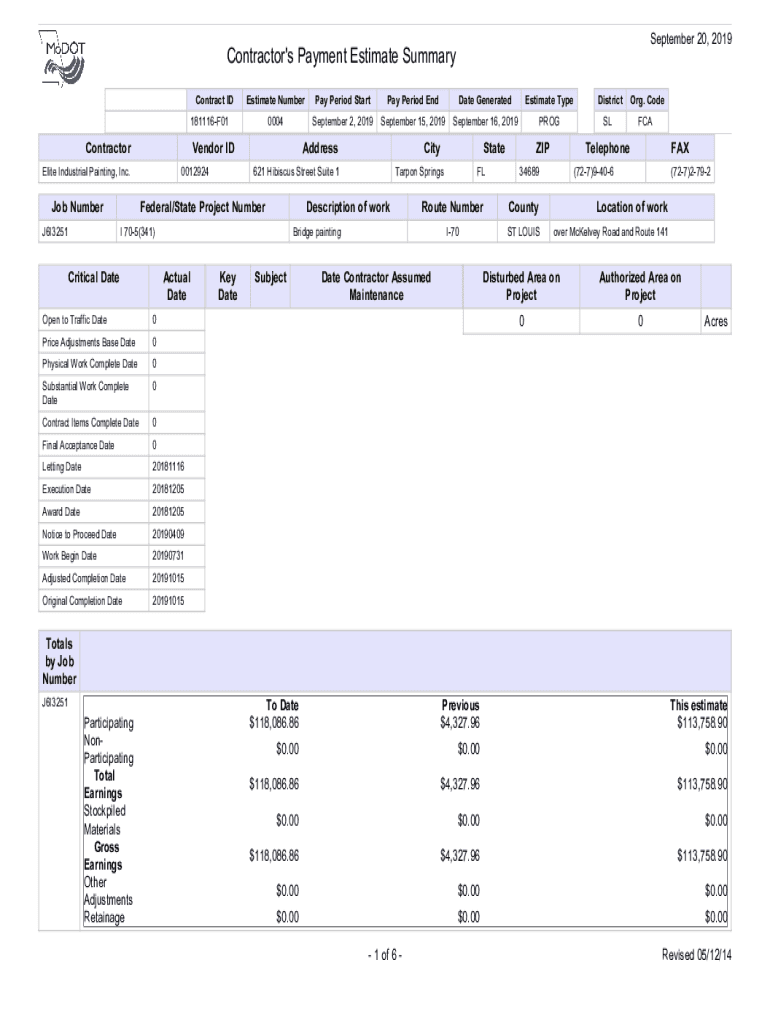

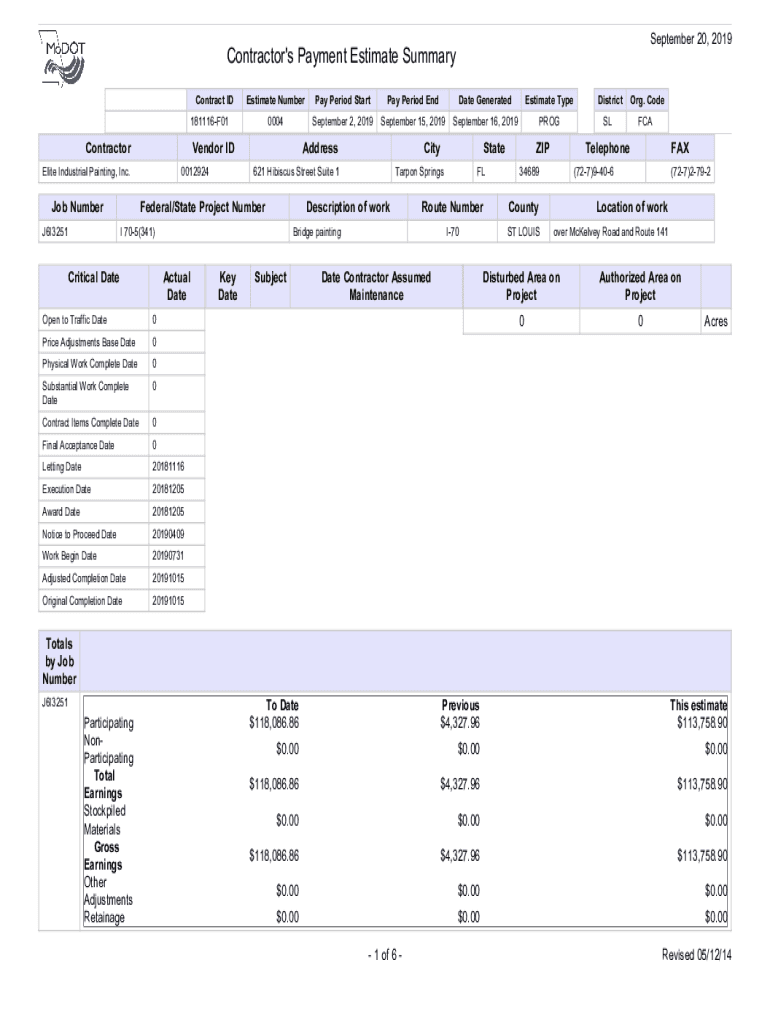

September 20, 2019Contractor\'s Payment Estimate Summary contract and estimate 181116_F01_0004Contract IDContractorJ6I3251Pay Period Started Period Endgame GeneratedEstimate Type0004September 2, 2019September

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign market-based monetary policy uncertainty

Edit your market-based monetary policy uncertainty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your market-based monetary policy uncertainty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit market-based monetary policy uncertainty online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit market-based monetary policy uncertainty. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out market-based monetary policy uncertainty

How to fill out market-based monetary policy uncertainty

01

Start by identifying the market-based indicators that are commonly used to measure monetary policy uncertainty. These indicators can include measures of yield spreads, implied volatility in financial markets, or market-based inflation expectations.

02

Collect the necessary data for these indicators from reliable sources such as financial databases or central bank websites.

03

Determine the time period for which you want to analyze the market-based monetary policy uncertainty. This could be a specific date range or a time series analysis.

04

Calculate the market-based monetary policy uncertainty by applying appropriate statistical techniques to the collected data. This could involve calculating standard deviations, correlations, or other measures of volatility.

05

Interpret the results of the analysis to understand the level and dynamics of market-based monetary policy uncertainty. These insights can help policymakers, economists, and investors make informed decisions.

06

Present the findings in a clear and concise manner, using visualizations or written reports to communicate the results effectively.

07

Continuously monitor and update the analysis to capture any changes or developments in market-based monetary policy uncertainty.

Who needs market-based monetary policy uncertainty?

01

Central Banks: Market-based monetary policy uncertainty can provide valuable insights for central banks in assessing the effectiveness of their policies and understanding market expectations.

02

Economists and Researchers: Market-based monetary policy uncertainty can be used by economists and researchers to analyze the impact of monetary policy decisions on financial markets and economic variables.

03

Investors and Traders: Market-based monetary policy uncertainty can help investors and traders assess the potential risks and opportunities in financial markets, allowing them to make informed investment decisions.

04

Financial Institutions: Market-based monetary policy uncertainty can assist financial institutions in managing their portfolios and assessing the potential impact of monetary policy changes on their investments.

05

Policy Advocates: Market-based monetary policy uncertainty can be used by policy advocates to highlight the potential risks and implications of specific monetary policy decisions on different sectors of the economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit market-based monetary policy uncertainty from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your market-based monetary policy uncertainty into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an eSignature for the market-based monetary policy uncertainty in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your market-based monetary policy uncertainty and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit market-based monetary policy uncertainty straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing market-based monetary policy uncertainty right away.

What is market-based monetary policy uncertainty?

Market-based monetary policy uncertainty refers to the level of uncertainty or unpredictability in the financial markets caused by changes in monetary policy decisions made by central banks.

Who is required to file market-based monetary policy uncertainty?

Financial institutions, economists, policymakers, and researchers are generally required to track and report on market-based monetary policy uncertainty.

How to fill out market-based monetary policy uncertainty?

Market-based monetary policy uncertainty can be filled out by analyzing financial market indicators such as bond yields, stock market volatility, and exchange rate movements to gauge the level of uncertainty.

What is the purpose of market-based monetary policy uncertainty?

The purpose of tracking market-based monetary policy uncertainty is to understand how changes in monetary policy affect market dynamics, investor behavior, and overall economic stability.

What information must be reported on market-based monetary policy uncertainty?

Reports on market-based monetary policy uncertainty should include analysis of market indicators, trends, and correlations with central bank policy decisions.

Fill out your market-based monetary policy uncertainty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Market-Based Monetary Policy Uncertainty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.