Get the free Donor-advised FundsInternal Revenue Service - IRS tax forms

Show details

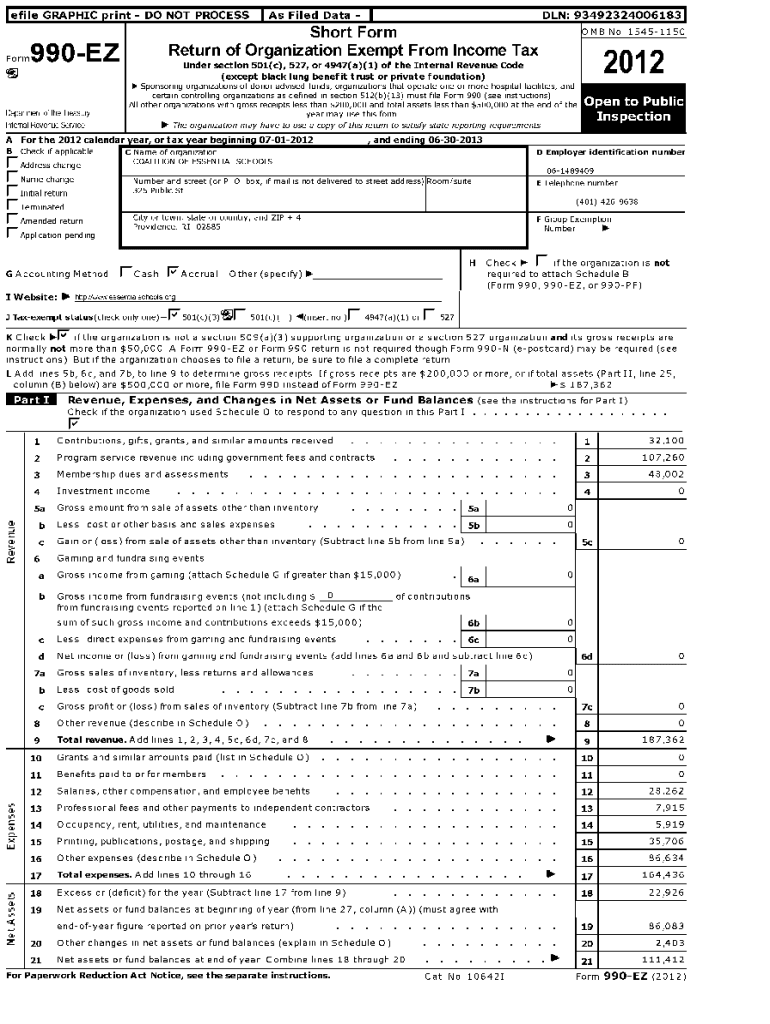

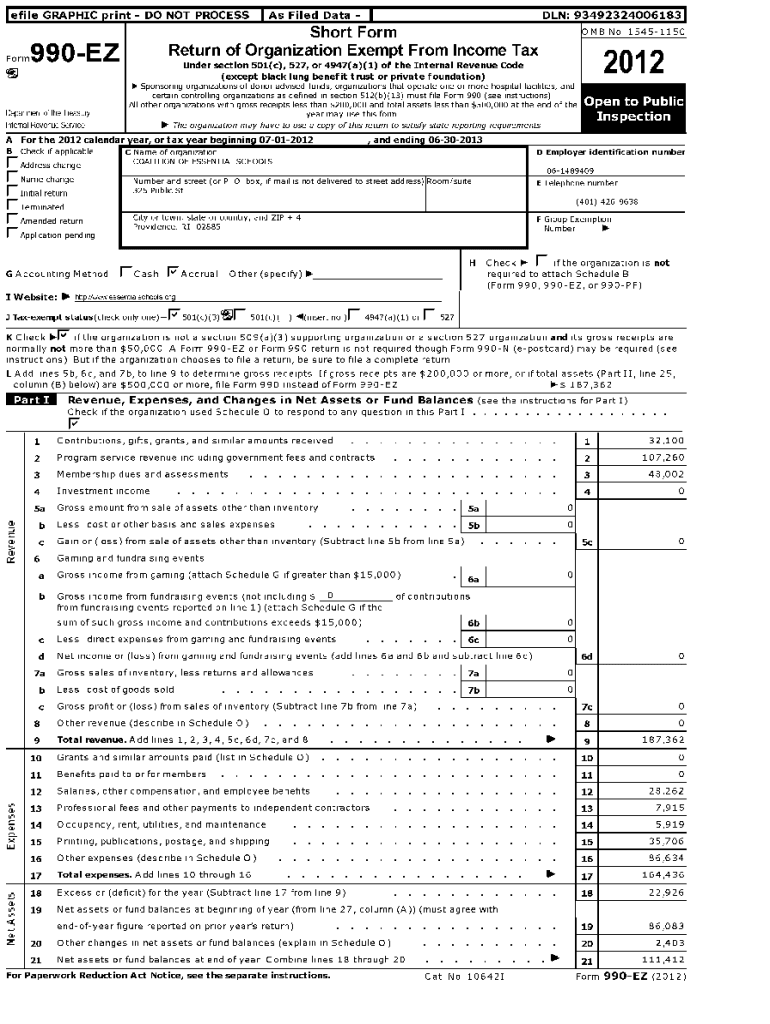

Le file GRAPHIC print DO NOT PROCESSFormCheck if applicableIlAddress change

F20120 Sponsoring organizations of donor advised funds, organizations that operate one or more hospital facilities, and

certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor-advised fundsinternal revenue service

Edit your donor-advised fundsinternal revenue service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor-advised fundsinternal revenue service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donor-advised fundsinternal revenue service online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donor-advised fundsinternal revenue service. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor-advised fundsinternal revenue service

How to fill out donor-advised fundsinternal revenue service

01

Step 1: Gather all the necessary information and documents related to your donor-advised funds.

02

Step 2: Visit the Internal Revenue Service (IRS) website and navigate to the 'Donor-Advised Funds' section.

03

Step 3: Download and complete the appropriate forms provided by the IRS for donor-advised funds.

04

Step 4: Fill out the forms accurately and provide all the required information, including your personal details, donation details, and any additional documentation.

05

Step 5: Double-check all the information and make sure it is error-free.

06

Step 6: Submit the filled-out forms to the IRS by mail or electronically, following the submission instructions mentioned on the IRS website.

07

Step 7: Keep a copy of the filled-out forms and any supporting documents for your records.

08

Step 8: Await confirmation from the IRS regarding the acceptance and processing of your donor-advised funds application.

09

Step 9: If needed, follow up with the IRS for any updates or queries related to your donor-advised funds.

10

Step 10: Once approved, you can start managing your donor-advised funds and making charitable contributions as per the guidelines provided by the IRS.

Who needs donor-advised fundsinternal revenue service?

01

Donor-advised funds are beneficial to individuals, families, and organizations who want to make charitable donations and receive certain tax advantages.

02

Individuals who wish to support specific causes or charities over time can use donor-advised funds as a strategic way to manage their charitable giving.

03

Families who want to involve multiple generations in philanthropy can utilize donor-advised funds to create a long-term giving plan.

04

High-net-worth individuals who desire to maximize their charitable impact while minimizing tax liabilities can benefit from donor-advised funds.

05

Nonprofit organizations and foundations can also establish and manage donor-advised funds to receive donations and effectively distribute funds to eligible charitable causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute donor-advised fundsinternal revenue service online?

pdfFiller has made it simple to fill out and eSign donor-advised fundsinternal revenue service. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in donor-advised fundsinternal revenue service?

With pdfFiller, it's easy to make changes. Open your donor-advised fundsinternal revenue service in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete donor-advised fundsinternal revenue service on an Android device?

Complete donor-advised fundsinternal revenue service and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is donor-advised fundsinternal revenue service?

Donor-advised funds, also known as DAFs, are philanthropic giving accounts that allow donors to make charitable contributions, receive immediate tax benefits, and recommend grants from the fund over time.

Who is required to file donor-advised fundsinternal revenue service?

Organizations that operate donor-advised funds are required to file Form 990 with the Internal Revenue Service each year.

How to fill out donor-advised fundsinternal revenue service?

To fill out Form 990 for donor-advised funds, organizations need to provide information about their financial activities, governance, and programs.

What is the purpose of donor-advised fundsinternal revenue service?

The purpose of donor-advised funds is to facilitate charitable giving by allowing donors to establish a fund, receive tax benefits, and recommend grants to qualified charities.

What information must be reported on donor-advised fundsinternal revenue service?

Information on contributions, grants made, investment income, expenses, and governance practices must be reported on Form 990 for donor-advised funds.

Fill out your donor-advised fundsinternal revenue service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor-Advised Fundsinternal Revenue Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.