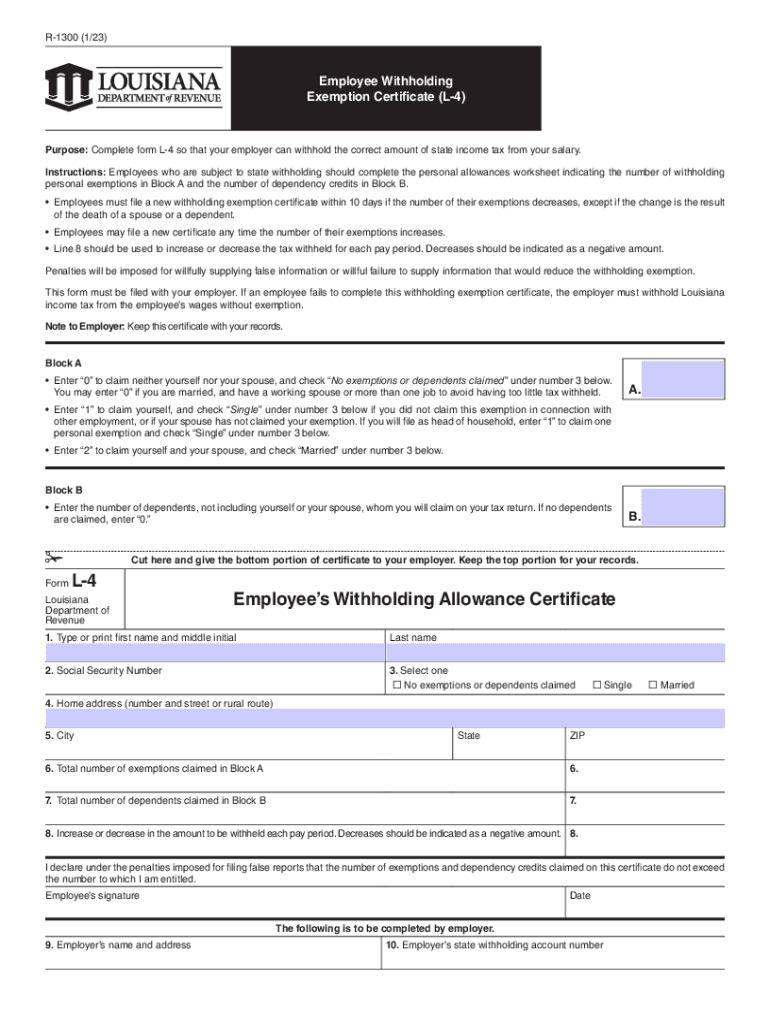

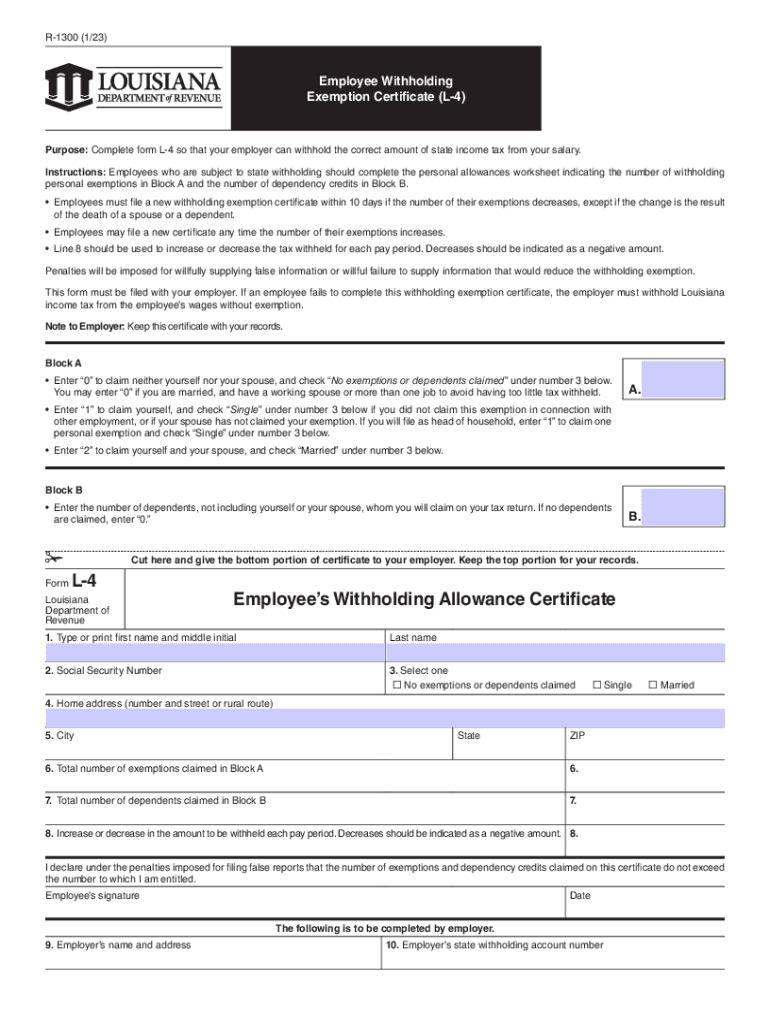

LA R-1300 2023 free printable template

Get, Create, Make and Sign l4 form

Editing louisiana form online

Uncompromising security for your PDF editing and eSignature needs

LA R-1300 Form Versions

How to fill out louisiana r form

How to fill out LA R-1300

Who needs LA R-1300?

Video instructions and help with filling out and completing louisiana form pdf

Instructions and Help about louisiana withholding l4 form

Starting your LLC for this segment we×39;redoing to be back on the go-biz comm site by this point you should have a login create your login information and login go to get started underneath your dashboard once you×39’re logged in you can click the yellow get started button from here we're getting started they want to know what do you want to do and at this point we want to register a Louisiana business just starting up so go ahead and highlight that you could check that bubble and then click Next from here they give you a quick description of starting a new business filing and the options that you do have×39’re going to go ahead and clickbait newer business filing on the next screenplay×39’re going to ask you what typo businesses for this example we×39’re going to be doing in LLC and a domestic LLC and then click Next the first part of the new business registration is typing in the desired name of your limited liability company remember you do need to include LLC or some form of ll at the end of the extension for it to be accepted that is the legal name of your business underneath the doing business as it canes the same name as your limited liability company or if you have reserved a trade name you can type that in at this point for the federal employer identification number please do that portion once you have the name reservation you need to Roget your EIN number from the IRS.gov site you can watch that tutorial reserve your name go visit the IRS.gov site obtain your EIN and then come back to register your new business as you will need that E is to get past this next portion this company is formed for the purpose of engaging in any lawful activity for which limited liability companies may be formed you want to go ahead and check that off next is the duration of the company for the duration you can set a time limit on the duration of the company but for most startups recommend perpetual, and I have included that that means no end tomato×39’s ongoing because if you have is something goes on, and you want to dissolve the business you can always Dothan later, but you don't want to set amend date on the business before it gets started, so you go ahead and fill in perpetual it does accept that as an answer ok once you've typed in everything scroll down put it in your electronic signature which is your name and your title which we×39’ve done to this point a few times the next screen it×39;lobe the location it can't be a pillbox, but it will be the physical location of the LLC now this can be a residential area this can be your apartment or something, but you will be limited in what type of business you can×39’t conducting that area when you go to get your zoning clearance because it can't while it can be you used a house an apartment a commercial area can be used as an office if you×39;resenting a house you're not going to get zoning clearance in most cases cooperate the business out of that house you can use it as an office to file your paperwork...

People Also Ask about louisiana l4 form

Do I claim 0 or 1 on my W4?

What is an l4 in Louisiana?

Should I claim 0 or 1 if I am married?

What does the total number of allowances you are claiming mean?

How much state tax should I withhold Louisiana?

What does claiming 1 mean?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit louisiana l 4 from Google Drive?

How can I send l 4 form to be eSigned by others?

How do I fill out the louisiana l4 form on my smartphone?

What is LA R-1300?

Who is required to file LA R-1300?

How to fill out LA R-1300?

What is the purpose of LA R-1300?

What information must be reported on LA R-1300?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.