Get the free CFMS Individual Disability Income Protection Plan

Show details

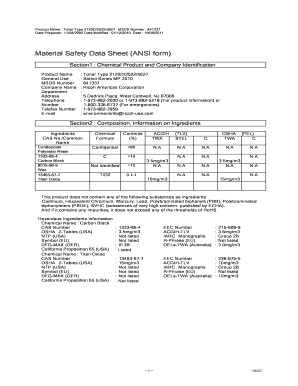

Describes a specialized disability insurance plan tailored for medical students, providing extensive benefits without the need for health evidence and flexibility to adapt as their careers progress.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cfms individual disability income

Edit your cfms individual disability income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cfms individual disability income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cfms individual disability income online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cfms individual disability income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cfms individual disability income

How to fill out CFMS Individual Disability Income Protection Plan

01

Step 1: Gather necessary documents such as identification, proof of income, and medical history.

02

Step 2: Access the CFMS application form online or obtain a physical copy from a CFMS office.

03

Step 3: Carefully read the instructions provided with the application form.

04

Step 4: Fill out personal information including name, contact details, and social security number.

05

Step 5: Provide detailed information about your current employment status and income.

06

Step 6: Report your medical history accurately, including any past disabilities or health issues.

07

Step 7: Review your application for completeness and accuracy.

08

Step 8: Submit the application along with any required documents to CFMS.

Who needs CFMS Individual Disability Income Protection Plan?

01

Individuals who are self-employed and do not have employer-provided disability insurance.

02

Professionals in high-risk jobs who want to ensure income protection during periods of disability.

03

Anyone looking for financial security in case of unexpected illnesses or accidents.

04

Persons with dependents who need to maintain their family's lifestyle during disability.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of individual disability income?

You may be eligible to receive between $50 to $1,681 each week for up to 52 weeks, depending on wages you earned 5-18 months before your claim start date.

What is the primary factor that determines the benefits paid under a disability income?

Explanation. In this scenario, the insured has an individual disability income policy with a 30-day elimination period. The elimination period is the amount of time that must pass before the insurance company begins to pay benefits after a disability occurs.

What are the benefits of an individual disability income policy?

Your most valuable asset isn't your house, car or retirement account. It's the ability to make a living. Disability insurance pays a portion of your income if you can't work for an extended period because of an illness or injury. It's worth looking into if you rely on a paycheck for everyday and recurring expenses.

What is the purpose of a disability income policy?

In most cases, Disability Insurance (DI) benefits are not taxable. But, if you are receiving unemployment, but then become ill or injured and begin receiving DI benefits, the DI benefits are considered to be a substitute for unemployment benefits, which are taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CFMS Individual Disability Income Protection Plan?

The CFMS Individual Disability Income Protection Plan is an insurance policy designed to provide financial support to individuals who become unable to work due to a disabling condition.

Who is required to file CFMS Individual Disability Income Protection Plan?

Individuals who are seeking disability income protection coverage are required to file the CFMS Individual Disability Income Protection Plan.

How to fill out CFMS Individual Disability Income Protection Plan?

To fill out the CFMS Individual Disability Income Protection Plan, applicants must complete all required sections of the application form, including personal information, employment details, and any medical history that may be relevant.

What is the purpose of CFMS Individual Disability Income Protection Plan?

The purpose of the CFMS Individual Disability Income Protection Plan is to provide income replacement for individuals who are unable to work due to illness or injury, ensuring financial stability during their recovery.

What information must be reported on CFMS Individual Disability Income Protection Plan?

Important information that must be reported includes personal identification details, occupation, income information, medical history, and specifics regarding the nature of the disability or condition.

Fill out your cfms individual disability income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cfms Individual Disability Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.