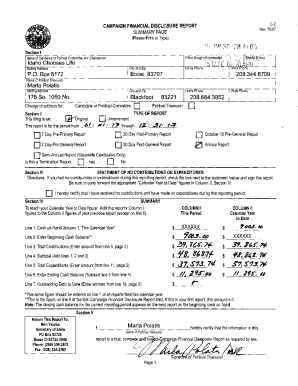

Get the free Non-Resident Alien Scholarship Recipients Procedure - udel

Show details

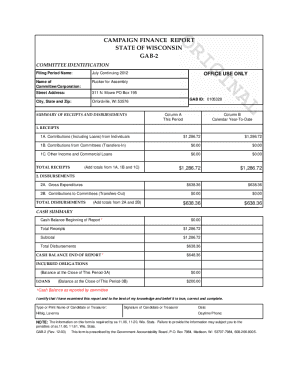

This document outlines the procedures and tax implications for non-resident alien undergraduate students receiving scholarships. It includes information on taxable scholarship amounts, tax exemptions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-resident alien scholarship recipients

Edit your non-resident alien scholarship recipients form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-resident alien scholarship recipients form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-resident alien scholarship recipients online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-resident alien scholarship recipients. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-resident alien scholarship recipients

How to fill out Non-Resident Alien Scholarship Recipients Procedure

01

Obtain the Non-Resident Alien Scholarship Recipients Procedure form from the financial aid office or the institution's website.

02

Carefully read the instructions included with the form to understand the required documents and information.

03

Fill out your personal information in the designated sections, including your name, contact details, and student ID.

04

Provide your immigration status and evidence of your non-resident alien status as required on the form.

05

Indicate the type of scholarship for which you are applying and include any necessary details regarding your eligibility.

06

Attach all required documentation, such as proof of enrollment, international tax forms, and supporting letters if needed.

07

Review the completed form for accuracy and completeness before submission.

08

Submit the form and any accompanying documents to the designated office by the deadline specified.

Who needs Non-Resident Alien Scholarship Recipients Procedure?

01

International students who are attending a school in the U.S. and do not qualify as residents under tax law.

02

Students seeking financial assistance through scholarships that are specifically available for non-resident aliens.

Fill

form

: Try Risk Free

People Also Ask about

Are scholarships taxable for non-residents?

In general, U.S. sourced taxable scholarships, fellowships, and grants that do not represent compensation for services are not subject to withholding when paid to U.S. citizens and resident aliens, but they are subject to withholding when paid to nonresident aliens. The withholding tax rate is 30%.

Do I have to declare scholarship money as income?

Scholarships that pay for qualified educational expenses at qualified educational institutions generally don't count as taxable income. Scholarships are tax-free only if the student is a degree-seeking candidate, attends a qualified educational institution, and the funds are used for qualified education expenses.

What is a nonresident alien required to get an ITIN to claim tax treaty benefit?

Nonresident aliens are required to provide a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on Form 8233 or Form W-8BEN in order to claim the income tax withholding exemption if there is a tax treaty between the foreign national's country of residence and the U.S. If a

Who must file form 8833?

The payee must also file Form 8833 if the payee receives payments or income items totaling more than $100,000 and determines the country of residence under a treaty and not under the rules for determining alien tax status.

Do I send a 1099 to a scholarship recipient?

Payor organizations are not required to report scholarships or fellowship grants on either Form 1099 or Form W-2 unless the payments were made in exchange for services to the payor organization, regardless of whether the payment is a “qualified scholarship.” If the payments do represent compensation for services, then

Are foreign scholarships taxable?

Yes, international students may have to pay taxes on scholarships and grants they receive. The scholarship tax depends on several factors, including how the scholarship is used: Qualified expenses: These are generally tax-free if they cover tuition, fees, books, supplies, and equipment required for courses.

Who qualifies as a nonresident alien?

A non-resident alien for tax purposes is a person who is not a U.S. citizen and who does not meet either the “green card” or the “substantial presence” test as described in IRS Publication 519, U.S. Tax Guide for Aliens.

Does a non-resident have to pay taxes?

As a nonresident, you pay tax on your taxable income from California sources. Sourced income includes, but is not limited to: Services performed in California. Rent from real property located in California.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

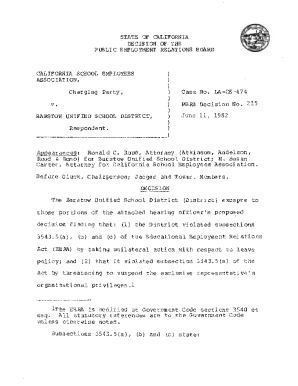

What is Non-Resident Alien Scholarship Recipients Procedure?

The Non-Resident Alien Scholarship Recipients Procedure outlines the steps and requirements for managing scholarships awarded to non-resident aliens, ensuring compliance with tax laws and regulations.

Who is required to file Non-Resident Alien Scholarship Recipients Procedure?

Individuals receiving scholarships who are classified as non-resident aliens for tax purposes are required to file the Non-Resident Alien Scholarship Recipients Procedure.

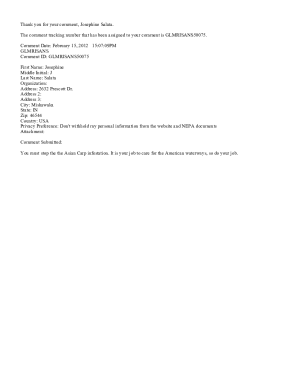

How to fill out Non-Resident Alien Scholarship Recipients Procedure?

To fill out the Non-Resident Alien Scholarship Recipients Procedure, recipients must provide identifiable information, scholarship details, and any required documentation to ensure compliance with IRS requirements.

What is the purpose of Non-Resident Alien Scholarship Recipients Procedure?

The purpose of the Non-Resident Alien Scholarship Recipients Procedure is to ensure proper tax handling and reporting of funds received by non-resident alien scholarship recipients, thereby maintaining compliance with federal regulations.

What information must be reported on Non-Resident Alien Scholarship Recipients Procedure?

The information that must be reported on the Non-Resident Alien Scholarship Recipients Procedure includes the recipient's personal identification details, scholarship amount, source of scholarship funds, and any applicable tax withholding information.

Fill out your non-resident alien scholarship recipients online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Resident Alien Scholarship Recipients is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.