Get the free Schedule J-1 (Form 990) - irs

Show details

Continuation Sheet for Schedule J to list additional information regarding compensation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule j-1 form 990

Edit your schedule j-1 form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule j-1 form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule j-1 form 990 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule j-1 form 990. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule j-1 form 990

How to fill out Schedule J-1 (Form 990)

01

Gather information about your organization's compensation policies and practices.

02

Identify all employees and independent contractors who received reportable compensation.

03

Complete Part I by listing each individual along with their title and reportable compensation details.

04

Provide any required information about your organization's compensation committee and its activities in Part II.

05

Complete Part III to provide the rationale behind compensation decisions for key employees.

06

Review the entire form for accuracy and completeness before submission.

Who needs Schedule J-1 (Form 990)?

01

Nonprofit organizations that are required to file Form 990 and pay compensation to employees or independent contractors.

02

Organizations with high compensation levels that may be subject to increased scrutiny.

03

Tax-exempt organizations that have a compensation committee responsible for setting compensation.

Fill

form

: Try Risk Free

People Also Ask about

Who must file Schedule A?

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

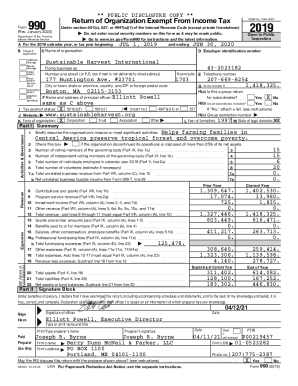

What is the Schedule J on the 990?

Schedule J (Form 990) is used by an organization that files Form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization.

Who must file 990 schedule A?

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Who files Schedule J?

Income averaging for farmers and fishermen provides a way to balance an income tax burden over several years, reducing the effects of both lean and bounty years. Schedule J is the Internal Revenue Service form used when you want to average your fishing or farming income.

Who must file schedule a Form 990?

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

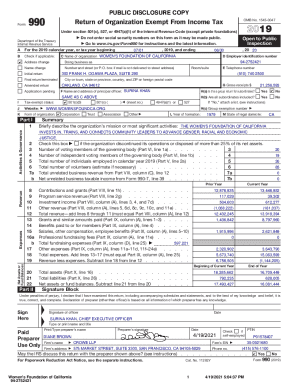

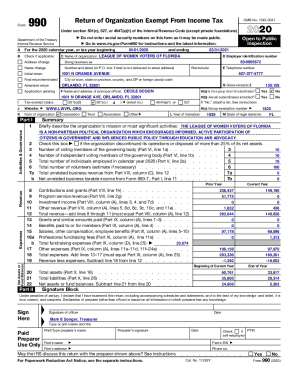

Who needs to file a 990 form?

Most charitable nonprofits that are recognized by the IRS as tax-exempt have an obligation to file IRS Form 990, which is an annual information return to be filed with the IRS by the 15th day of the 5th month after the end of the organization's accounting period.

What 2 types of organizations do not require filing a 990?

More In File Every organization exempt from federal income tax under Internal Revenue Code section 501(a) must file an annual information return except: A church, an interchurch organization of local units of a church, a convention or association of churches. An integrated auxiliary of a church.

Who must file a 990 with the IRS?

Form 990, Return of Organization Exempt From Income Tax An organization must file Form 990, if it is: An organization with either: ► gross receipts of $200,000 or more, or ► total assets of $500,000 or more. A sponsoring organization of one or more donor-advised funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule J-1 (Form 990)?

Schedule J-1 (Form 990) is a supplemental schedule used by certain tax-exempt organizations to provide detailed information about their compensation arrangements with their highest-paid employees, including officers, directors, trustees, and key employees.

Who is required to file Schedule J-1 (Form 990)?

Organizations that are required to file Form 990 and that have compensation arrangements for their highest-paid employees typically need to complete Schedule J-1. This generally includes large tax-exempt organizations or those with significant compensation expenditures.

How to fill out Schedule J-1 (Form 990)?

To fill out Schedule J-1, organizations must provide detailed information about individual compensation packages, including salaries, bonuses, and other benefits for each listed individual, as well as the total compensation paid during the reporting year.

What is the purpose of Schedule J-1 (Form 990)?

The purpose of Schedule J-1 is to promote transparency and accountability by allowing the IRS and the public to see how much organizations are paying their highest-compensated employees, thereby ensuring that these organizations are fulfilling their tax-exempt purposes.

What information must be reported on Schedule J-1 (Form 990)?

Information that must be reported on Schedule J-1 includes the name of each individual, their title or position, total compensation paid, breakdown of various types of compensation (such as bonuses, stock options, etc.), and any other relevant details about their compensation structure.

Fill out your schedule j-1 form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule J-1 Form 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.