Get the free A Level of cover B Your details - Simplyhealth

Show details

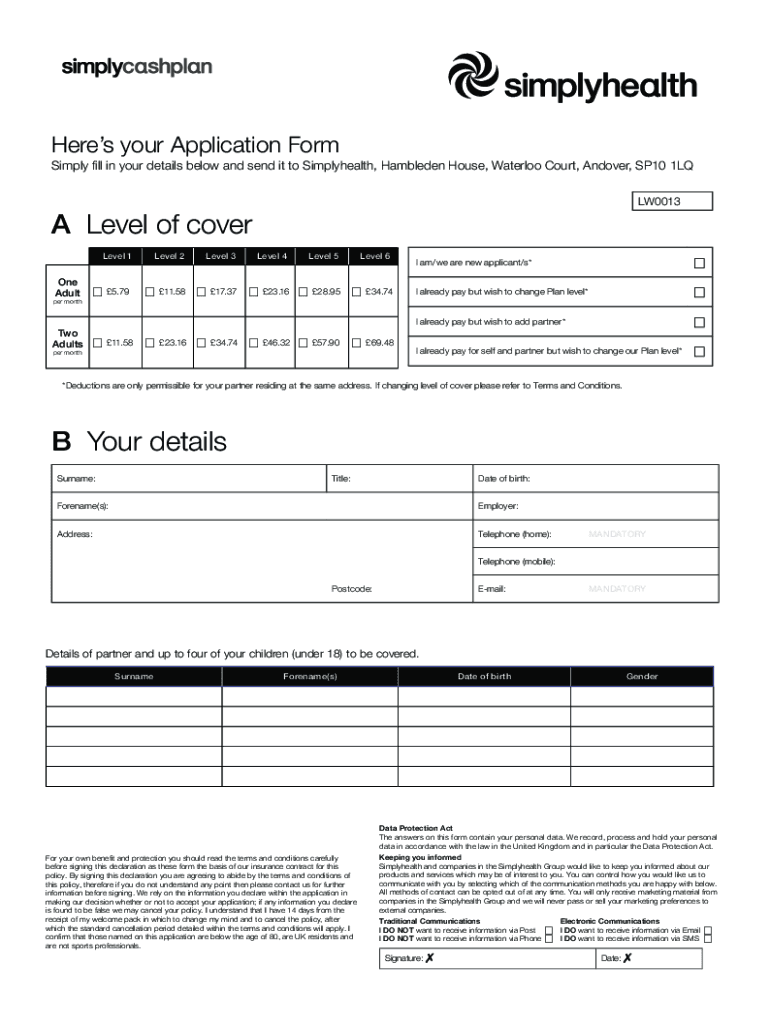

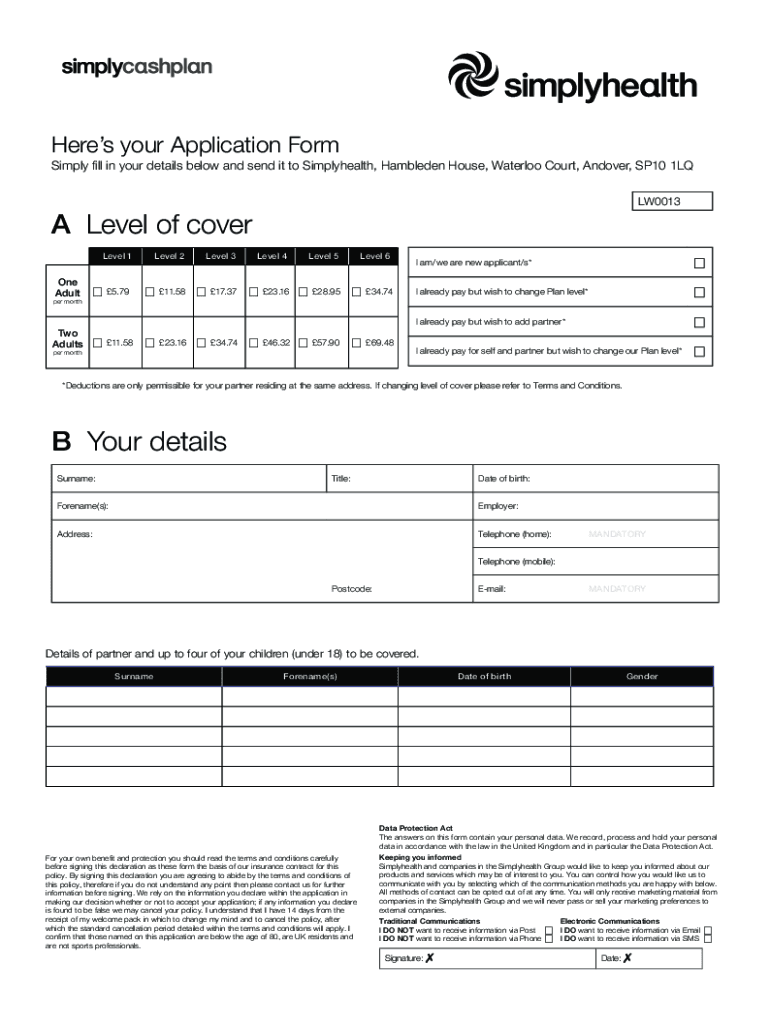

Heresy our Application Form Simply fill in your details below and send it to Simply health, Wimbledon House, Waterloo Court, Andover, SP10 1LQ LW0013A Level of cover Level 1One Adult 5.79Level 2Level

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a level of cover

Edit your a level of cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a level of cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a level of cover online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit a level of cover. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a level of cover

How to fill out a level of cover

01

To fill out a level of cover, follow these steps:

02

Start by assessing your insurance needs and determining the level of coverage you require. Consider factors such as your assets, liabilities, and potential risks.

03

Research and compare different insurance providers and policies to find the one that best suits your needs. Consider factors such as coverage limits, deductibles, and premiums.

04

Contact the chosen insurance provider and request a quote for the desired level of cover. Provide them with all the necessary information accurately to ensure an accurate quote.

05

Review the quote provided by the insurance provider and understand the terms and conditions of the policy. Pay attention to exclusions, limitations, and any additional endorsements or riders.

06

If satisfied with the quote and terms, proceed with completing the application form. Provide all the required personal and policy-specific information accurately.

07

Submit the filled-out application form to the insurance provider either online or through traditional mail. Ensure all supporting documents, if any, are included.

08

Wait for the insurance provider to process your application. They may request additional information or conduct a thorough underwriting process.

09

Once approved, carefully review the policy documents provided by the insurance provider. Make sure all the details are correct and match your desired level of cover.

10

Pay the premium as indicated in the policy documents. Keep a copy of the payment confirmation for future reference.

11

If necessary, regularly review your level of cover to ensure it still meets your changing needs. Consider updating or modifying the policy if required.

Who needs a level of cover?

01

A level of cover is needed by individuals or businesses who want financial protection against potential risks or losses.

02

Specifically, those who may need a level of cover include:

03

- Homeowners who want to protect their property and belongings against damages, theft, or other perils.

04

- Renters who want to safeguard their personal belongings and liabilities against unforeseen events.

05

- Vehicle owners who want insurance coverage for their cars, motorcycles, or other vehicles.

06

- Business owners who want to protect their assets, employees, and operations against various risks and liabilities.

07

- Professionals in specialized fields, such as doctors or lawyers, who want professional indemnity insurance to mitigate potential malpractice claims.

08

- Individuals with high net worth who want to protect their valuable assets, such as jewelry, art, or luxury items.

09

- Families who want life insurance coverage to provide financial security for their loved ones in the event of death.

10

Ultimately, the level of cover is required by anyone who wants peace of mind and financial protection against uncertainties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find a level of cover?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the a level of cover in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit a level of cover online?

The editing procedure is simple with pdfFiller. Open your a level of cover in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out a level of cover on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your a level of cover. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is a level of cover?

A level of cover refers to the amount of insurance protection or coverage that an individual or organization has for a particular risk.

Who is required to file a level of cover?

The requirement to file a level of cover varies depending on the specific insurance policy or regulation. Generally, it is the responsibility of the insured party to ensure that they have the appropriate level of coverage.

How to fill out a level of cover?

To fill out a level of cover, one must provide information about the insured item or risk, the desired level of protection, and any other relevant details requested by the insurance provider or regulatory body.

What is the purpose of a level of cover?

The purpose of a level of cover is to ensure that individuals and organizations have adequate protection against potential risks or liabilities. It helps to minimize financial losses in the event of an unexpected event.

What information must be reported on a level of cover?

The information required on a level of cover typically includes details about the insured item or risk, the chosen coverage limits, any additional coverage options selected, and other relevant policy details.

Fill out your a level of cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Level Of Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.