Get the free Sentinel 403(b) Program Distribution Request Form Instructions (DO NOT SUBMIT THIS D...

Show details

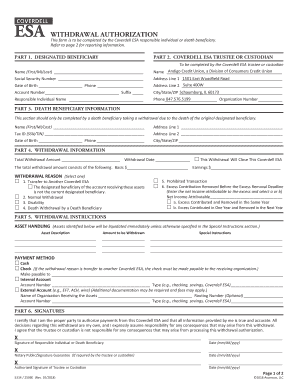

Sentinel 403(b) Program Distribution Request Form Instructions (DO NOT SUBMIT THIS DOCUMENT WITH YOUR DISTRIBUTION REQUEST FORM) 1. PARTICIPANT INFORMATION Participant Name JOHN M. DOE Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sentinel 403b program distribution

Edit your sentinel 403b program distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sentinel 403b program distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sentinel 403b program distribution online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sentinel 403b program distribution. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sentinel 403b program distribution

How to fill out sentinel 403b program distribution?

01

Obtain the necessary forms: Start by contacting the sentinel 403b program provider to request the distribution forms. They may also be available for download on their website. Ensure you have the correct forms for the type of distribution you intend to make.

02

Provide personal information: Fill in all the necessary personal information on the forms, including your name, address, social security number, and contact information. This will help ensure the distribution is correctly processed and allocated.

03

Specify the distribution amount: Indicate the amount of money you wish to distribute from your sentinel 403b program. It's important to consider any tax implications or penalties associated with the distribution, so consult a financial advisor if needed.

04

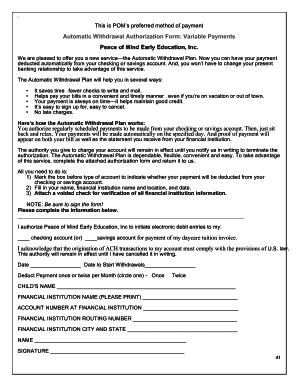

Choose the distribution method: Decide how you want to receive the funds. Options may include a direct deposit to your bank account, a check sent to your mailing address, or any other available method offered by the program provider. Ensure you provide the necessary details or account numbers for the chosen method.

05

Understand the tax implications: Be aware that a distribution from a sentinel 403b program may be subject to taxes or penalties. Consult a tax professional to understand the potential consequences and any available exemptions or deductions.

06

Read and sign the forms: Carefully review the forms, ensuring all information is accurate and complete. Then, sign the forms as required. Some forms may require additional signatures from a spouse or beneficiary.

07

Submit the forms: Once you have filled out and signed the forms, submit them to the sentinel 403b program provider as instructed. Follow any additional instructions they provide, such as providing supporting documentation or completing any additional forms.

Who needs sentinel 403b program distribution?

01

Employees in nonprofit organizations: The sentinel 403b program is designed for employees in nonprofit organizations, such as schools, hospitals, religious institutions, or charitable organizations. These employees can contribute a portion of their salary towards retirement savings, which can then be distributed when eligible.

02

Individuals approaching retirement: Those who are nearing retirement age and have accumulated funds in the sentinel 403b program may need to make distributions to support their post-work life. This can be done through regular distributions or a lump sum payment.

03

Individuals facing financial hardships: In some cases, individuals may require access to their sentinel 403b funds to overcome unexpected financial difficulties. This could include medical expenses, debt repayment, or emergency situations. In such cases, a distribution from the program may be necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sentinel 403b program distribution?

Sentinel 403b program distribution refers to the distribution of funds from a 403b retirement account managed by Sentinel.

Who is required to file sentinel 403b program distribution?

Individuals who have a 403b retirement account managed by Sentinel are required to file the distribution paperwork.

How to fill out sentinel 403b program distribution?

To fill out the sentinel 403b program distribution, individuals need to provide information about the amount of distribution, their personal details, and other necessary information as per the form provided by Sentinel.

What is the purpose of sentinel 403b program distribution?

The purpose of sentinel 403b program distribution is to allow individuals to withdraw funds from their retirement account for various financial needs such as education, medical expenses, or other emergencies.

What information must be reported on sentinel 403b program distribution?

The information that must be reported on sentinel 403b program distribution includes the amount of distribution, account holder's details, reason for distribution, and tax implications.

How do I modify my sentinel 403b program distribution in Gmail?

sentinel 403b program distribution and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send sentinel 403b program distribution for eSignature?

When you're ready to share your sentinel 403b program distribution, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the sentinel 403b program distribution electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your sentinel 403b program distribution in seconds.

Fill out your sentinel 403b program distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sentinel 403b Program Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.