Get the free IRC 403b Tax Sheltered Annuity PlansInternal Revenue4.72.13 IRC 403(b) PlansInternal...

Show details

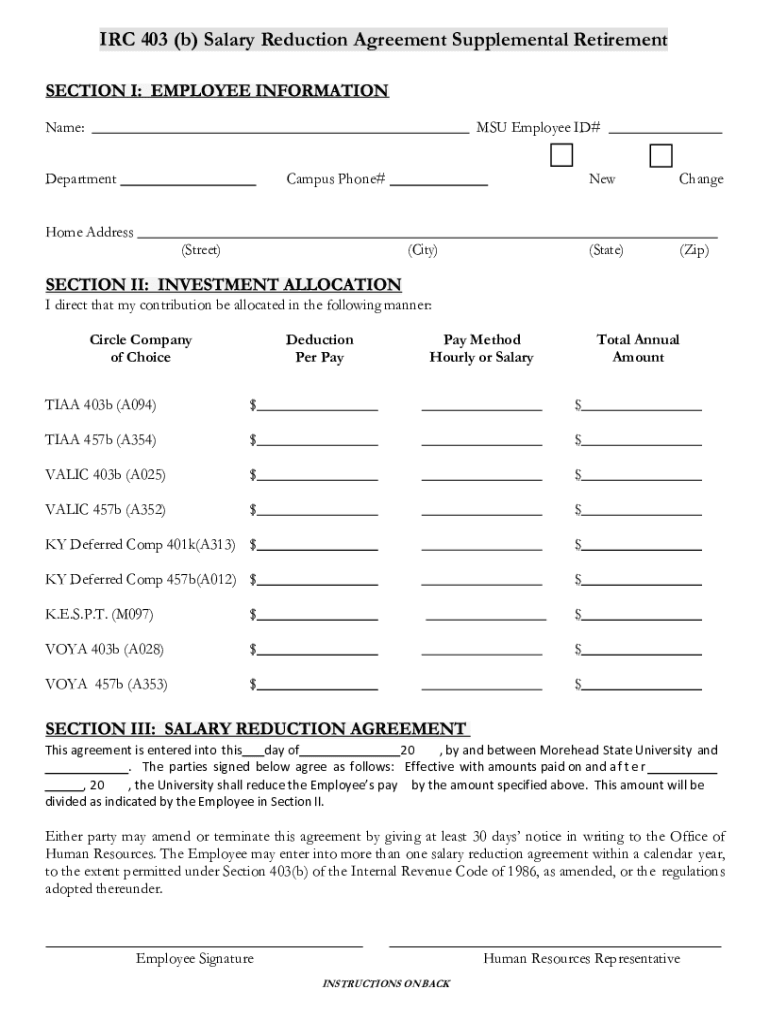

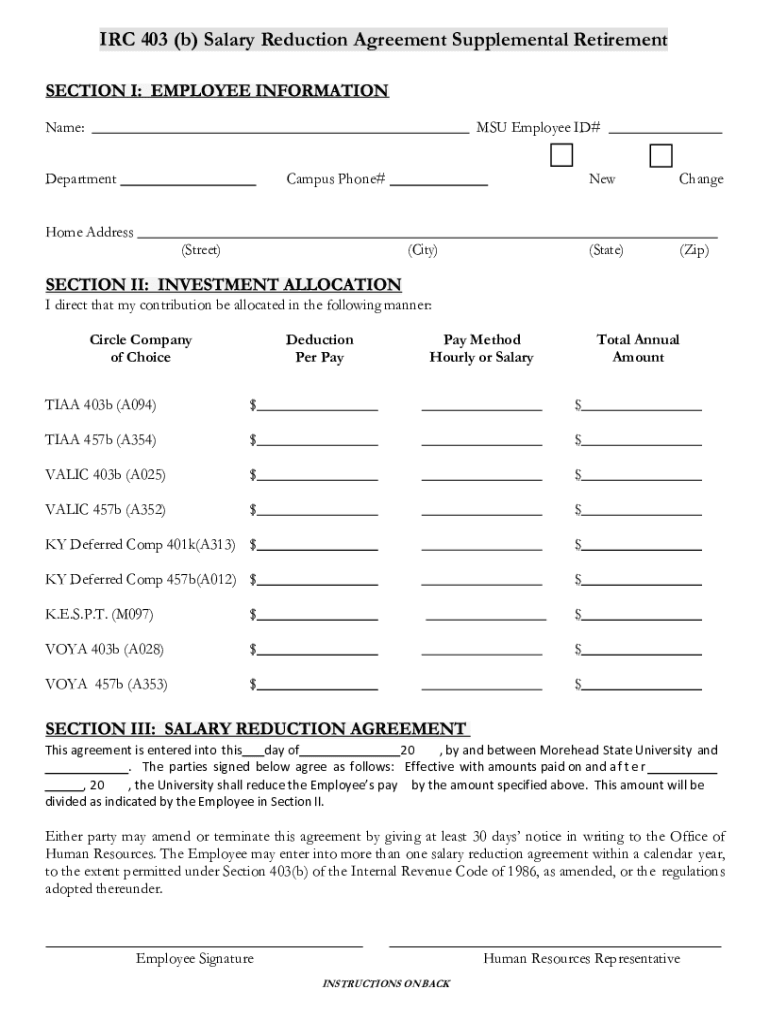

IRC 403 (b) Salary Reduction Agreement Supplemental RetirementName:MSU Employee ID#DepartmentCampus Phone#Exchange(State)(Zip)Home Address (Street)(City)I direct that my contribution be allocated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irc 403b tax sheltered

Edit your irc 403b tax sheltered form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irc 403b tax sheltered form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irc 403b tax sheltered online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irc 403b tax sheltered. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irc 403b tax sheltered

How to fill out irc 403b tax sheltered

01

Determine your eligibility: Make sure you are eligible to contribute to an IRC 403b tax sheltered account. Generally, these accounts are available to employees of public schools, colleges, universities, churches, and certain nonprofit organizations.

02

Gather necessary information: Collect all the required documentation such as your personal identification information, employment details, and income information.

03

Choose a provider: Research and select a suitable provider for your IRC 403b tax sheltered account. Compare their fees, investment options, and customer service.

04

Complete the application: Fill out the application form provided by your chosen provider. Provide accurate and complete information.

05

Decide on contribution amount: Determine how much you want to contribute to your IRC 403b account. Consider your financial goals, budget, and any contribution limits set by the IRS.

06

Set up contributions: Determine the frequency and method of your contributions. You can choose to contribute through salary deferrals or make voluntary contributions.

07

Choose investment options: Select the investment options that align with your risk tolerance and long-term financial goals. Consult with a financial advisor if needed.

08

Review and submit: Carefully review all the provided information before submitting your application. Make sure there are no errors or omissions.

09

Monitor and manage: Regularly monitor your IRC 403b tax sheltered account. Review your investment performance and make any necessary adjustments.

10

Understand withdrawal rules: Familiarize yourself with the withdrawal rules and penalties associated with IRC 403b accounts. Make sure you are aware of any early withdrawal restrictions.

11

Seek professional advice if needed: If you have any doubts or need help with filling out the form, consider consulting a tax professional or financial advisor.

Who needs irc 403b tax sheltered?

01

Employees of public schools

02

Employees of colleges and universities

03

Employees of churches

04

Employees of certain nonprofit organizations

05

Individuals who work in the nonprofit sector and are eligible for retirement plans under section 501(c)(3) of the Internal Revenue Code

06

Anyone interested in saving for retirement on a tax-advantaged basis

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irc 403b tax sheltered in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your irc 403b tax sheltered along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make changes in irc 403b tax sheltered?

The editing procedure is simple with pdfFiller. Open your irc 403b tax sheltered in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete irc 403b tax sheltered on an Android device?

Complete irc 403b tax sheltered and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is irc 403b tax sheltered?

irc 403b tax sheltered is a retirement savings plan for employees of public schools and certain tax-exempt organizations.

Who is required to file irc 403b tax sheltered?

Employees of public schools and certain tax-exempt organizations are required to file irc 403b tax sheltered.

How to fill out irc 403b tax sheltered?

To fill out irc 403b tax sheltered, employees need to provide information about their contributions and investments in the plan.

What is the purpose of irc 403b tax sheltered?

The purpose of irc 403b tax sheltered is to help employees save for retirement while receiving certain tax benefits.

What information must be reported on irc 403b tax sheltered?

Information such as contributions, investments, and earnings must be reported on irc 403b tax sheltered.

Fill out your irc 403b tax sheltered online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irc 403b Tax Sheltered is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.