Get the free MassGIS Data: Property Tax ParcelsMass.gov

Show details

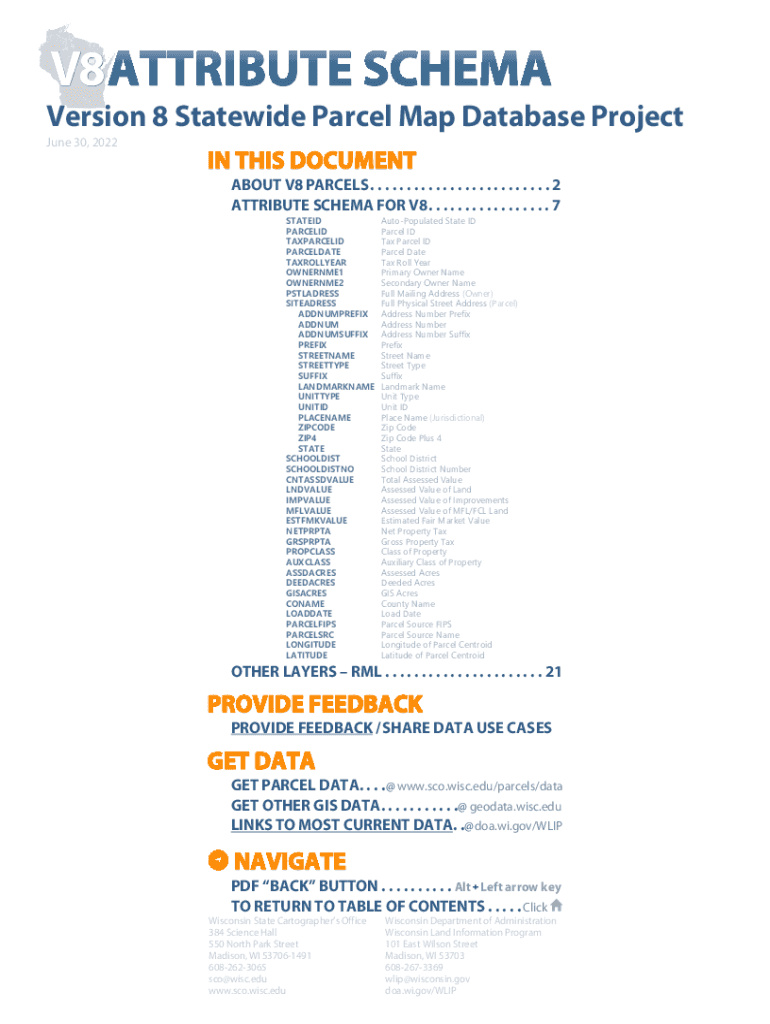

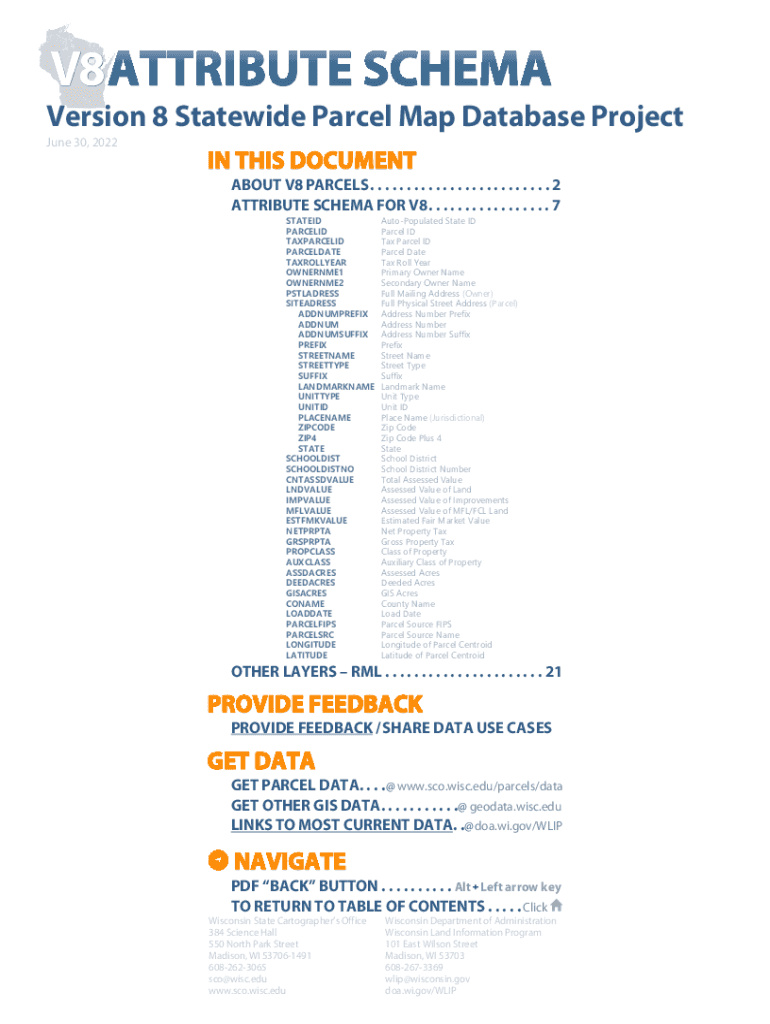

V8Version 8 Statewide Parcel Map Database Project

June 30, 2022,

about V8 PARCELS. . . . . . . . . . . . . . . . . . . . . . . . . 2

ATTRIBUTE Schemas FOR V8. . . . . . . . . . . . . . . . . 7

STATED

PARCELED

TAXPARCELID

PREDATE

TAXROLLYEAR

OWNERNME1

OWNERNME2

PSTLADRESS

STEADINESS

ADDNUMPREFIX

ADDENDUM

ADDNUMSUFFIX

PREFIX

STREETLAMP

STEREOTYPE

SUFFIX

LANDMARKNAME

UNITY

UNITED

PLACE-NAME

OPCODE

ZIP4

STATE

SCHOOLS

SCHOOLDISTNO

CNTASSDVALUE

VALUE

IMPALE

VALUE

ESTFMKVALUE

NETPRPTA

GRAPPA...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massgis data property tax

Edit your massgis data property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massgis data property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massgis data property tax online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit massgis data property tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massgis data property tax

How to fill out massgis data property tax

01

Access the MassGIS website.

02

Navigate to the Data and Maps section.

03

Select the Property Tax option.

04

Review the available data sources.

05

Choose the dataset that fits your needs.

06

Download or access the desired data.

07

Fill out the appropriate fields in the property tax form.

08

Submit the completed form as required.

Who needs massgis data property tax?

01

Various groups and individuals can benefit from MassGIS data on property tax:

02

- Real estate developers and investors may use this information for market analysis, identifying potential investment opportunities, or conducting due diligence on properties.

03

- Government agencies and local municipalities can utilize the data to assess property values, calculate tax rates, and develop housing or land use policies.

04

- Legal professionals, such as lawyers or appraisers, may rely on property tax data for litigation purposes, property valuation, or preparing legal documents.

05

- Researchers or academics studying real estate trends, economic analysis, or urban development may find this data useful for their studies.

06

- Homeowners or prospective homebuyers could access property tax data to evaluate tax burdens, compare property values, or assess the affordability of residential areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send massgis data property tax for eSignature?

massgis data property tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete massgis data property tax online?

Easy online massgis data property tax completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit massgis data property tax on an iOS device?

Create, edit, and share massgis data property tax from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is massgis data property tax?

MassGIS Data Property Tax is a tax on property based on its assessed value.

Who is required to file massgis data property tax?

Property owners are required to file MassGIS Data Property Tax.

How to fill out massgis data property tax?

MassGIS Data Property Tax can be filled out online through the designated website or submitted by mail.

What is the purpose of massgis data property tax?

The purpose of MassGIS Data Property Tax is to generate revenue for the local government based on property values.

What information must be reported on massgis data property tax?

Information such as property address, assessed value, and ownership details must be reported on MassGIS Data Property Tax.

Fill out your massgis data property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massgis Data Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.