NY IT-558-I 2021 free printable template

Show details

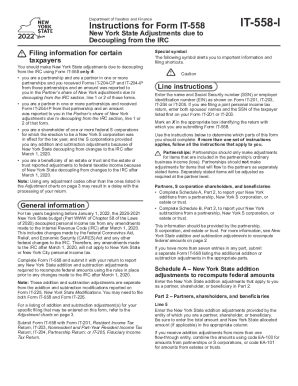

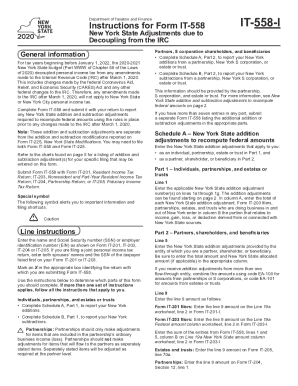

See updated information for this form on our website. Department of Taxation and FinanceInstructions for Form IT558 New York State Adjustments due to Decoupling from the IRC General information For

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-558-I

Edit your NY IT-558-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-558-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY IT-558-I online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY IT-558-I. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-558-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-558-I

How to fill out NY IT-558-I

01

Gather required information: Collect your New York State tax identification number and relevant income documents.

02

Download the form: Obtain the NY IT-558-I from the New York State Department of Taxation and Finance website.

03

Fill in your personal information: Enter your name, address, and tax identification number at the top of the form.

04

Report income details: Provide information regarding your income from New York sources as required in the appropriate sections.

05

Calculate your credits: Follow the instruction to calculate any applicable tax credits.

06

Review the instructions: Ensure you understand all instructions provided in the form and the accompanying guide.

07

Double-check for accuracy: Review all filled-out information for accuracy and completeness.

08

Sign and date the form: Complete the form by signing and dating it at the designated areas.

09

File the form: Submit the completed NY IT-558-I to the New York State Department of Taxation and Finance through the preferred filing method.

Who needs NY IT-558-I?

01

Individuals or businesses who have income sourced from New York State and need to report it to the New York State Department of Taxation and Finance.

02

Taxpayers who are claiming specific credits or adjustments that require the use of NY IT-558-I.

Fill

form

: Try Risk Free

People Also Ask about

Are individual NOLs limited to 80%?

The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example: In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year's income.

What is the IT-558 form?

New York State recently introduced a new form, Form IT-558, New York State Adjustments due to Decoupling from the IRC, which taxpayers will be required to use to make adjustments to their federal adjusted gross income for New York reporting purposes.

Why do I need to fill out form IT-558?

You should make New York State adjustments due to decoupling from the IRC using Form IT-558 only if: • you are a partnership and are a partner in one or more partnerships and you received Forms IT-204-CP and IT-204-IP from those partnerships and an amount was reported to you in the Partner's share of New York

What does decoupling mean in taxes?

Decoupling occurs when there is a deviation of the returns of an asset from the correlated assets. Decoupling refers to the variation between a country's investment performance from its underlying economy.

What is the NOL limitation in New York?

In the case of Net Operating Losses generated in taxable years beginning after December 31, 2017, the total amount of NYC NOLs utilized may not exceed 80% of federal taxable in- come. Only include the NYC Net Operating Loss expiring in the cur- rent tax period.

What is the NOL limitation for individuals in NY?

a federal NOL deduction for losses incurred in tax year 2018 or later is limited to 80% of the current year federal taxable income (computed as if the changes to the IRC after March 1, 2020, did not occur); there is no carryback of losses incurred in tax year 2018 or later (except for certain farming losses); and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the NY IT-558-I in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NY IT-558-I right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out NY IT-558-I on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NY IT-558-I. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit NY IT-558-I on an Android device?

You can make any changes to PDF files, like NY IT-558-I, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY IT-558-I?

NY IT-558-I is the New York State tax form used for claiming a nonrefundable credit for taxes paid to another state.

Who is required to file NY IT-558-I?

Taxpayers who are residents of New York State and have income from another state that has been taxed are required to file NY IT-558-I.

How to fill out NY IT-558-I?

To fill out NY IT-558-I, taxpayers need to provide their personal information, details of the taxes paid to the other state, and calculate the credit according to the instructions provided on the form.

What is the purpose of NY IT-558-I?

The purpose of NY IT-558-I is to allow taxpayers to claim a credit for taxes paid to another state, thereby preventing double taxation on the same income.

What information must be reported on NY IT-558-I?

On NY IT-558-I, taxpayers must report their personal details, the state in which taxes were paid, the amount of income earned in that state, and the tax amount paid to that state.

Fill out your NY IT-558-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-558-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.