Get the free www.irs.gov pub irs-pdfForm 12153 Request for a Collection Due Process or Equivalent...

Show details

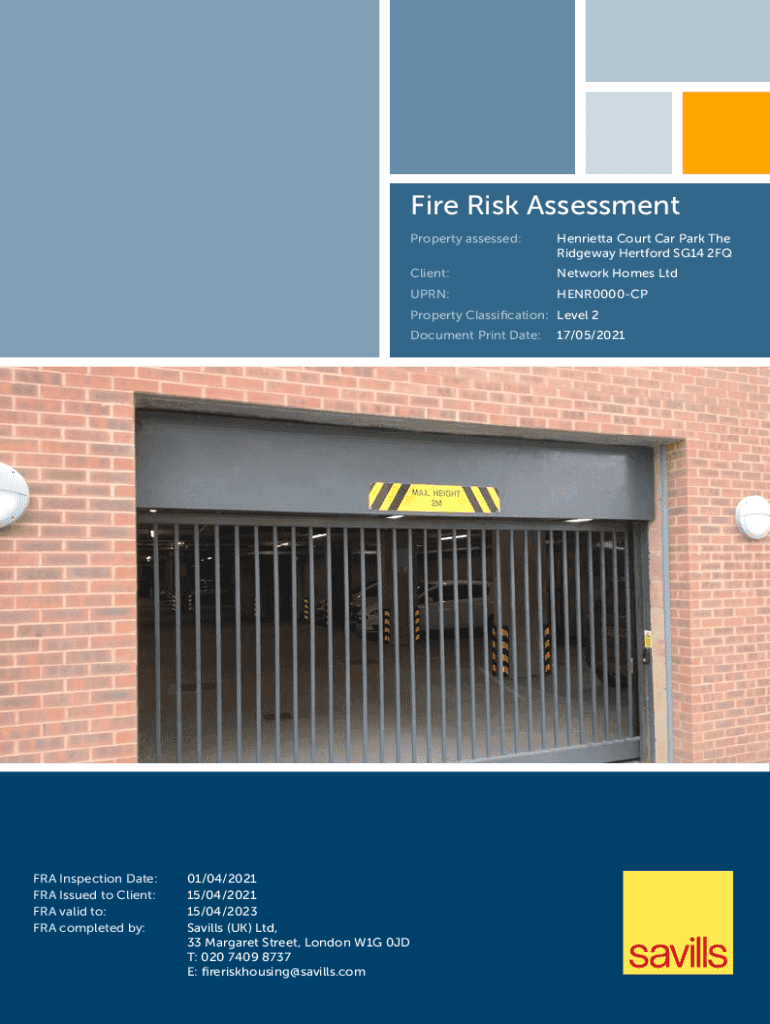

Fire Risk Assessment Property assessed:Henrietta Court Car Park The Ridgeway Hartford SG14 2FQClient:Network Homes Turn:HENR0000CPProperty Classification: Level 2 Document Print Date:FRA Inspection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwirsgov pub irs-pdfform 12153

Edit your wwwirsgov pub irs-pdfform 12153 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwirsgov pub irs-pdfform 12153 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wwwirsgov pub irs-pdfform 12153 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wwwirsgov pub irs-pdfform 12153. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwirsgov pub irs-pdfform 12153

How to fill out wwwirsgov pub irs-pdfform 12153

01

To fill out wwwirsgov pub irs-pdfform 12153, follow these steps:

02

Download the form from the official IRS website (www.irs.gov).

03

Open the downloaded form using a PDF reader like Adobe Acrobat.

04

Start by filling out your personal information, including your name, social security number, and contact details.

05

Proceed to the section titled 'Reason for Requesting Relief' and provide a detailed explanation of why you are seeking relief.

06

If you are represented by a tax professional, provide their contact information and sign the section indicating authorization.

07

Next, include any attachments that support your request for relief. These could include documents like medical records, financial statements, or any other relevant evidence.

08

Review the entire form to ensure all the information provided is accurate and complete.

09

Once you are satisfied, sign the form and date it.

10

Make a copy of the filled-out form and all the attachments for your records.

11

Submit the original form and attachments to the IRS address mentioned in the form's instructions.

12

Please note that this is a general guide, and it is recommended to refer to the specific instructions provided with the form for more detailed guidance.

Who needs wwwirsgov pub irs-pdfform 12153?

01

Individuals who are seeking relief from certain penalties related to the failure to file, pay, or deposit taxes may need to fill out wwwirsgov pub irs-pdfform 12153. This form is specifically designed for requesting relief under the First Time Abate (FTA) policy, Reasonable Cause (RC) criteria, or other administrative waivers. It is suitable for both individual taxpayers and tax professionals who are representing taxpayers. It allows individuals to provide a detailed explanation of the circumstances leading to the penalties and request relief based on applicable provisions. It is essential to review the specific eligibility criteria and guidelines before determining if this form is needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wwwirsgov pub irs-pdfform 12153 to be eSigned by others?

When your wwwirsgov pub irs-pdfform 12153 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute wwwirsgov pub irs-pdfform 12153 online?

Filling out and eSigning wwwirsgov pub irs-pdfform 12153 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit wwwirsgov pub irs-pdfform 12153 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign wwwirsgov pub irs-pdfform 12153 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is wwwirsgov pub irs-pdfform 12153?

wwwirsgov pub irs-pdfform 12153 is the form used by taxpayers to request help from the IRS Taxpayer Advocate Service.

Who is required to file wwwirsgov pub irs-pdfform 12153?

Taxpayers who are experiencing financial difficulties or are facing an IRS collection action can file wwwirsgov pub irs-pdfform 12153.

How to fill out wwwirsgov pub irs-pdfform 12153?

Taxpayers must provide their personal information, details of their tax issue, and describe how the IRS actions are causing financial difficulties.

What is the purpose of wwwirsgov pub irs-pdfform 12153?

The purpose of wwwirsgov pub irs-pdfform 12153 is to request assistance from the IRS Taxpayer Advocate Service in resolving tax issues.

What information must be reported on wwwirsgov pub irs-pdfform 12153?

Taxpayers must report their personal information, details of their tax issue, and provide any supporting documentation.

Fill out your wwwirsgov pub irs-pdfform 12153 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwirsgov Pub Irs-Pdfform 12153 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.