Get the free Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration...

Show details

Este formulario es requerido para que los padres no custodiales certifiquen información fiscal y asuman la responsabilidad de las declaraciones proporcionadas para ayudar a los estudiantes a solicitar

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial aid application

Edit your financial aid application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial aid application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial aid application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial aid application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial aid application

How to fill out Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form

01

Obtain the Financial Aid Application form from the appropriate institution's website.

02

Review the instructions carefully to ensure you understand the requirements.

03

Fill out the personal information section with accurate details such as name, address, and Social Security number.

04

Provide the financial information requested, including income, tax information, and any relevant deductions.

05

Clearly indicate your relationship to the student for whom you are completing the form.

06

Sign and date the form to certify that the information provided is correct.

07

Submit the completed form by the specified deadline, either online or by mailing it to the financial aid office.

Who needs Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

01

Non-custodial parents who are required to provide financial information for a student applying for financial aid.

02

Any parents who do not have custody of the student but contribute to their education costs.

Fill

form

: Try Risk Free

People Also Ask about

What 3 items will you need to complete a FAFSA application?

Your and your contributor's federal income tax return (accessible online) Records of your and your contributor's child support received. Records of your and your contributor's assets. List of schools you're interested in attending.

Do parents who make $120000 still qualify for FAFSA?

There is no income cap for financial aid. It also varies from your school, program, and cola. Just fill it out and most likely you will get some assistance. 122k for a family of 5 is not a lot. If you have any issues filling it out, your school adviser and finance office normally provide assistance with that.

What is the question 23 on the FAFSA?

Question 23 collects information about your drug convictions if any. Although prior drug convictions may make you ineligible for Federal financial aid, there are certain conditions where you could still be eligible for state and other student aid.

What 3 documents are needed for FAFSA?

Gathering Needed Documents Tax returns. Records of child support received. Current balances of cash, savings, and checking accounts. Net worth of investments, businesses, and farms.

What three documents are needed for FAFSA?

Gathering Needed Documents Tax returns. Records of child support received. Current balances of cash, savings, and checking accounts. Net worth of investments, businesses, and farms.

What are the 3 eligibility requirements for FAFSA?

Our general eligibility requirements include that you have financial need for need-based aid, are a U.S. citizen or eligible noncitizen, and are enrolled in an eligible degree or certificate program at an eligible college or career/trade school.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

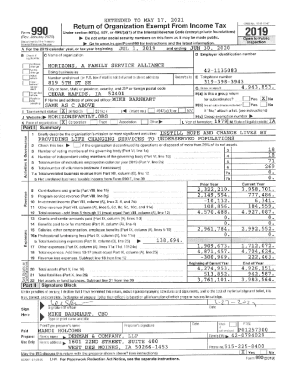

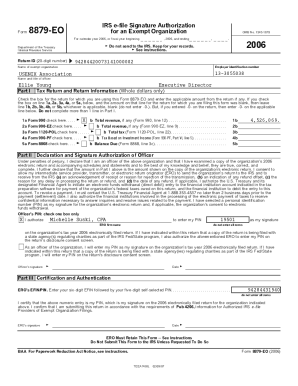

What is Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

The Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form is a document required by some educational institutions to collect financial information from non-custodial parents of students applying for financial aid.

Who is required to file Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

Non-custodial parents of students applying for financial aid, particularly when the custodial parent is filling out the main financial aid application, are typically required to file this form.

How to fill out Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

To fill out the form, the non-custodial parent should provide accurate financial information, including income, tax information, assets, and any other financial resources as requested by the educational institution.

What is the purpose of Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

The purpose of the form is to assess the financial situation of the non-custodial parent in order to determine the overall eligibility for financial aid for the student.

What information must be reported on Financial Aid Application - Non-Custodial Parent's Tax Certification and Declaration of Responsibility Form?

The information that must be reported includes the non-custodial parent's income, tax returns, assets, and any other relevant financial data as specified by the institution.

Fill out your financial aid application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Aid Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.