Get the free VITA Tax Preparation Locations - childcareservices

Show details

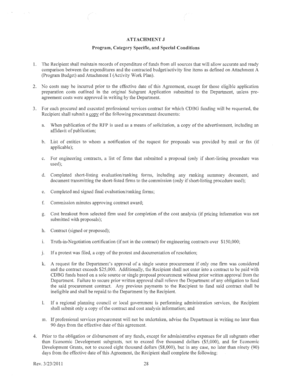

This document provides a list of free Volunteer Income Tax Assistance (VITA) locations in Franklin, Granville, and Vance Counties, including addresses, phone numbers, days and hours of operation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vita tax preparation locations

Edit your vita tax preparation locations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vita tax preparation locations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vita tax preparation locations online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit vita tax preparation locations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vita tax preparation locations

How to fill out VITA Tax Preparation Locations

01

Visit the official VITA program website to find your nearest tax preparation location.

02

Check the operating hours and available services at the selected location.

03

Gather all necessary documents including your tax forms, identification, and any relevant financial information.

04

Go to the VITA location during the operating hours with your documents.

05

Meet with a certified VITA volunteer who will assist you with your tax preparation.

Who needs VITA Tax Preparation Locations?

01

Low to moderate-income individuals and families.

02

Students and educators.

03

Senior citizens and retirees.

04

Individuals with disabilities.

05

Taxpayers who need assistance in filing their taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who is the cheapest to do your taxes?

The IRS Free File program is a fast, safe and free way to do your federal tax return online. The IRS and industry-leading tax software companies deliver the program through the Free File Alliance.

At what age do seniors stop paying federal taxes?

Taxes aren't determined by age, so you will never age out of paying taxes. People who are 65 or older at the end of 2025 have to file a return for that tax year (which is due in 2026) if their gross income is $16,550 or higher. If you're married filing jointly and both 65 or older, that amount is $32,300.

Are federal taxes reduced at age 65?

For single filers and heads of households age 65 and over, the additional standard deduction increases slightly — from $1,950 in 2024 (returns you'll file soon in early 2025) to $2,000 in 2025 (returns you'll file in early 2026). For 2025, married couples over 65 filing jointly will also see a modest benefit.

How much do most tax preparers charge?

Understanding the Average Cost of Tax Preparation by CPA Tax SituationAverage Cost Range (USD) Simple (Single, No Deductions) $100 - $200 Moderate (Homeowners, Deductions) $200 - $400 Complex (Investments, Rentals) $300 - $600 Very Complex (Business Owner, Multi-State) $500+

Do seniors over 70 need to do federal tax returns every year?

In reality, Social Security is taxed at any age if your income exceeds a certain level. Essentially, if your taxable income is greater than the Standard Deduction for your filing status, you'll typically have to file a tax return.

What is the income limit for IRS Vita for seniors?

In-person IRS help for seniors and low-income taxpayers Volunteer Income Tax Assistance – The VITA program is generally for people who make $64,000 or less, people with disabilities and limited English-speaking taxpayers.

At what age does the federal government stop taxing Social Security?

Social Security payments are taxable from the moment you start receiving them until you die. As we explained in the previous section, the key to understanding Social Security taxation is based on your total income and not your age.

At what age do you no longer have to file federal income tax?

When can I stop filing tax returns? Regardless of your age, you'll be required to keep filing a tax return and paying tax as long as you meet the gross income requirements. However, if you are over the age of 65, the gross income limits are a bit higher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VITA Tax Preparation Locations?

VITA (Volunteer Income Tax Assistance) Tax Preparation Locations are designated sites where volunteers assist qualified individuals in preparing their tax returns for free.

Who is required to file VITA Tax Preparation Locations?

Individuals who are low to moderate-income, persons with disabilities, the elderly, and those who speak limited English are encouraged to use VITA services, but there is no strict requirement to file at these locations.

How to fill out VITA Tax Preparation Locations?

To utilize VITA Tax Preparation Locations, individuals should gather all necessary tax documents, locate a nearby VITA site, and bring those documents to the site where volunteers will assist in completing the tax forms.

What is the purpose of VITA Tax Preparation Locations?

The purpose of VITA Tax Preparation Locations is to provide free tax assistance to eligible individuals who may find it difficult to complete their own tax returns, ensuring they receive any credits and refunds they are entitled to.

What information must be reported on VITA Tax Preparation Locations?

VITA sites typically require information such as proof of income, Social Security numbers, filing status, and information about dependents to accurately complete tax returns.

Fill out your vita tax preparation locations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vita Tax Preparation Locations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.