Get the free Information for Contractors About Priority Rated Orders

Show details

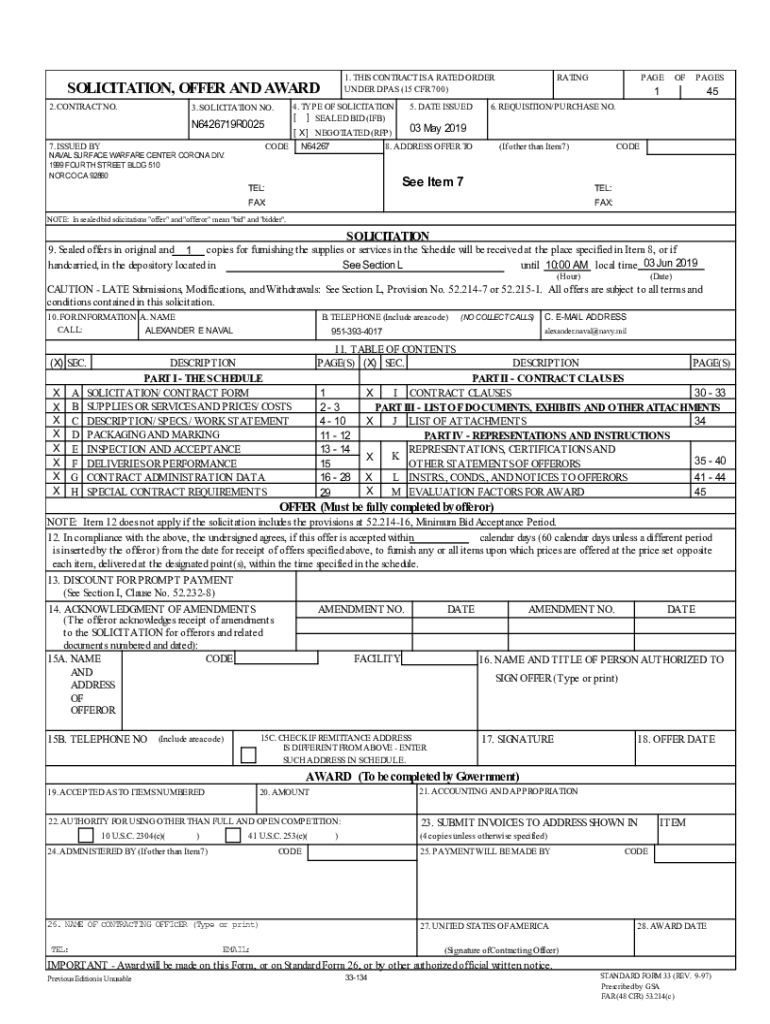

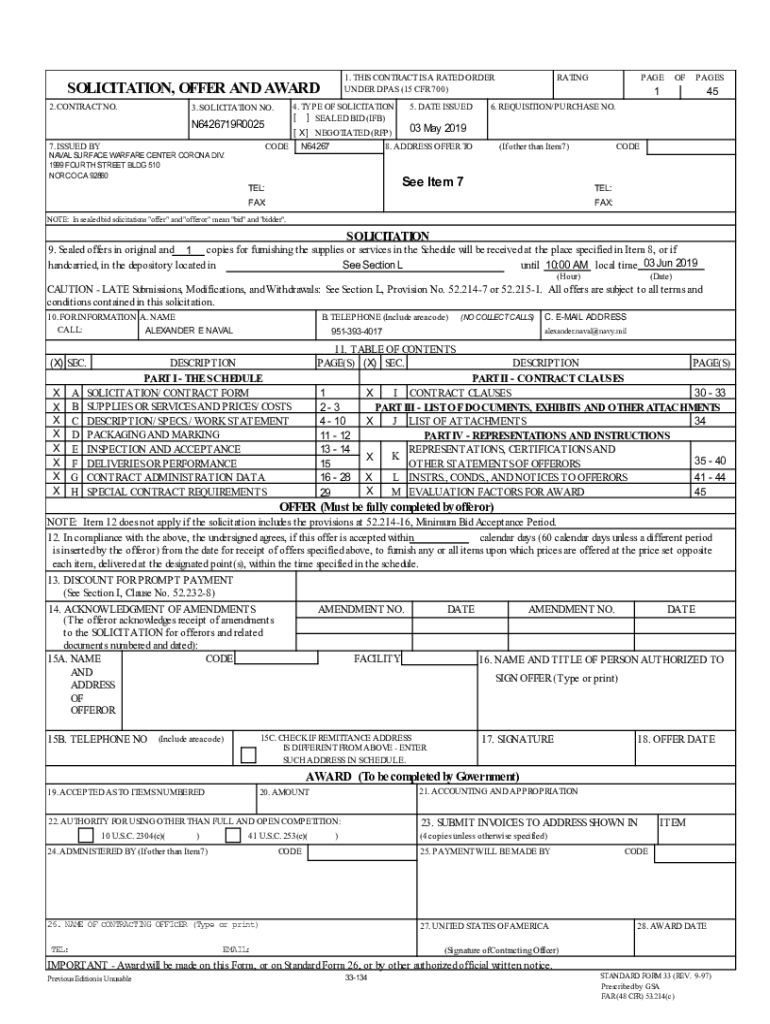

1. THIS CONTRACT IS A RATED ORDER UNDER PAS (15 CFR 700)SOLICITATION, OFFER AND AWARD 2. CONTRACT NO.4. TYPE OF SOLICITATION [ ] SEALED BID (IF)3. SOLICITATION NO. N6426719R0025 7. ISSUED BYN64267OFPAGES1456.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information for contractors about

Edit your information for contractors about form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information for contractors about form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit information for contractors about online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit information for contractors about. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

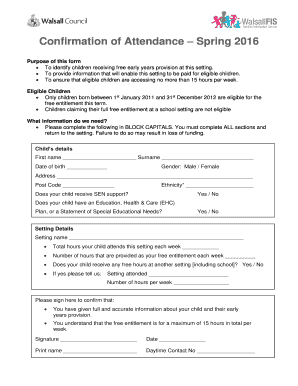

How to fill out information for contractors about

How to fill out information for contractors about

01

Start by gathering all necessary information about the contractor, such as their name, contact details, and business address.

02

Make sure to include the contractor's tax identification number or social security number for proper documentation.

03

Specify the nature of the work performed by the contractor and the duration of the contract.

04

Indicate the payment terms agreed upon with the contractor, including the hourly rate, fixed fee, or any other payment arrangement.

05

Provide a detailed description of the services expected from the contractor and any specific deliverables.

06

Outline any confidentiality or non-disclosure agreements that must be signed by the contractor.

07

Include any insurance requirements or liabilities that the contractor must abide by.

08

Mention any specific conditions for termination or renewal of the contract.

09

Once all the necessary information is gathered, document it in the designated form or contract template.

10

Review the filled-out information for accuracy and completeness before finalizing and sharing it with the contractor.

Who needs information for contractors about?

01

Employers who hire and work with contractors need this information to ensure proper record-keeping, legal compliance, and clear communication of expectations.

02

Human resources departments or personnel responsible for contractor management within an organization require this information to maintain organized contractor records.

03

Legal and compliance teams within a company need this information to ensure contractual agreements are valid and meet all legal obligations.

04

Accounting departments require this information to accurately report contractor expenses, process invoices, and handle tax-related matters.

05

Contractors themselves also benefit from having the information filled out correctly, as it clarifies their rights, responsibilities, and payment terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find information for contractors about?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the information for contractors about in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute information for contractors about online?

pdfFiller has made filling out and eSigning information for contractors about easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out information for contractors about on an Android device?

Use the pdfFiller mobile app to complete your information for contractors about on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is information for contractors about?

Information for contractors is about reporting payments made to independent contractors and freelancers to the IRS.

Who is required to file information for contractors about?

Businesses or entities that have paid independent contractors $600 or more for services rendered during the tax year are required to file information for contractors.

How to fill out information for contractors about?

Information for contractors can be filled out online through the IRS website or through approved software. It requires detailed information about the contractor including their name, address, and social security number, as well as the total amount paid to them during the tax year.

What is the purpose of information for contractors about?

The purpose of information for contractors is to ensure that independent contractors report their income accurately and pay the appropriate taxes on that income.

What information must be reported on information for contractors about?

Information for contractors must include the contractor's name, address, social security number or EIN, and the total amount paid to them during the tax year.

Fill out your information for contractors about online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information For Contractors About is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.