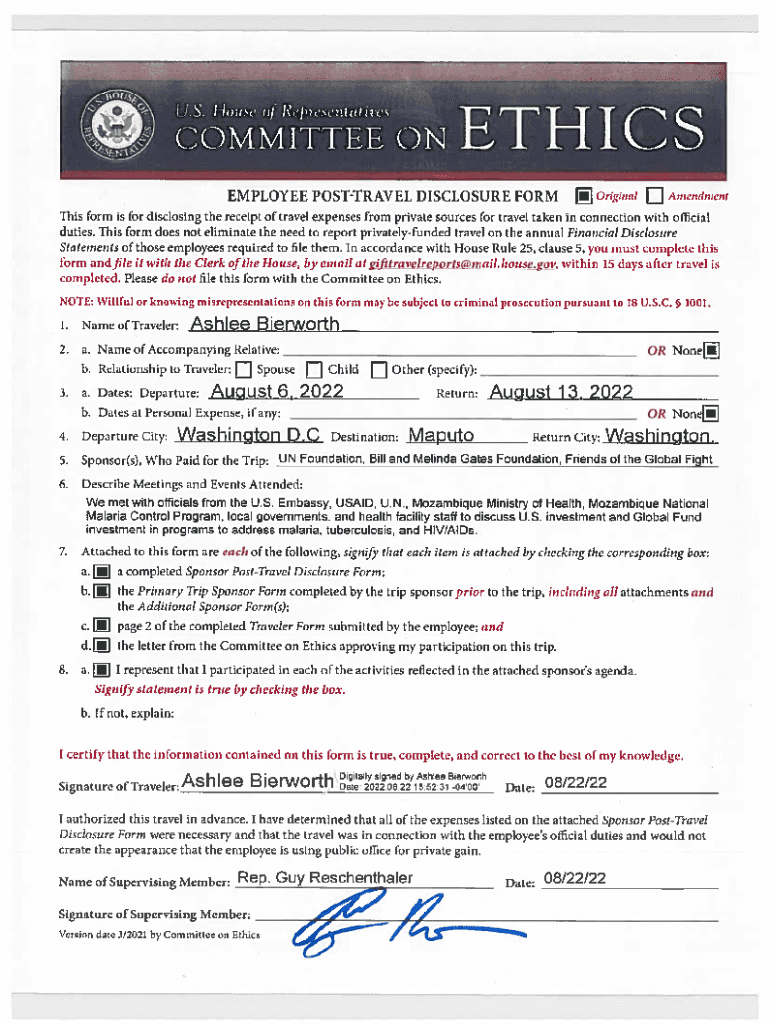

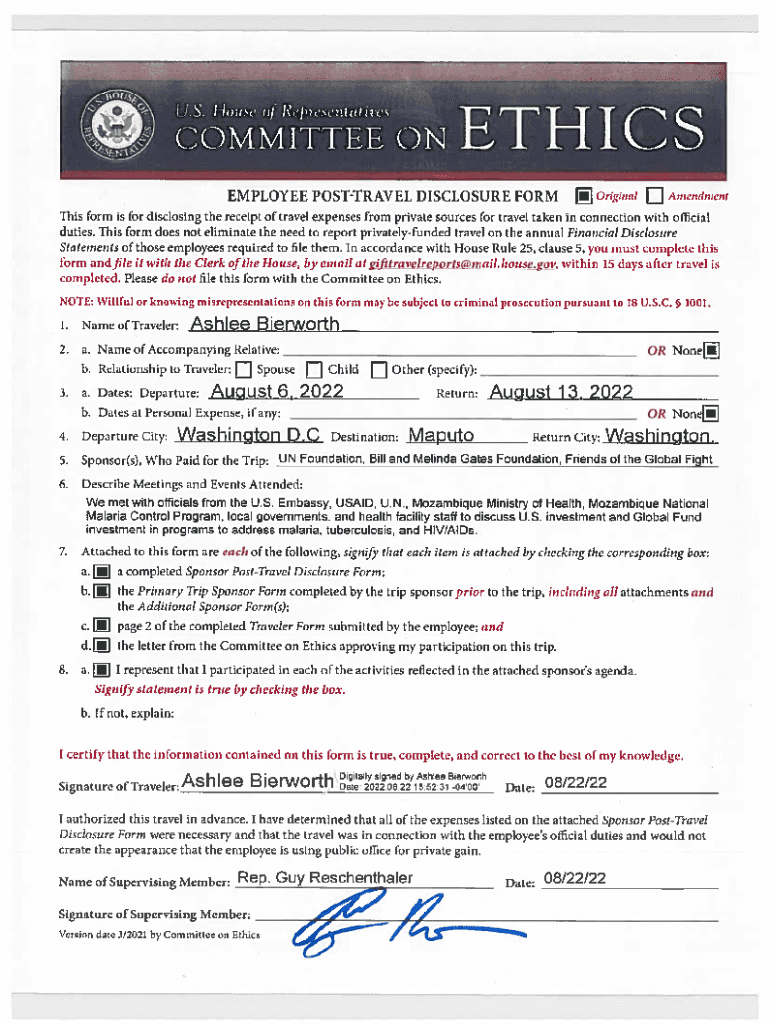

Get the free expenses or reimbursement for travel expenses to House Members, officers, or employe...

Show details

SPONSOR POSTURAL DISCLOSURE FORM OriginalAmendmentThis form must be completed by an officer of any organization that served as the primary trip sponsor in providing travel expenses or reimbursement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expenses or reimbursement for

Edit your expenses or reimbursement for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expenses or reimbursement for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit expenses or reimbursement for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit expenses or reimbursement for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expenses or reimbursement for

How to fill out expenses or reimbursement for

01

To fill out expenses or reimbursement forms, follow these steps:

02

Begin by gathering all necessary receipts and documentation related to your expenses. This may include receipts for meals, transportation, lodging, etc.

03

Review the specific guidelines and policies set forth by your organization regarding expenses and reimbursement. Familiarize yourself with any required forms or procedures.

04

Start by entering your personal information, such as your name, employee ID, and contact details, in the appropriate fields of the form.

05

Next, identify the type of expense you are claiming reimbursement for. This could be categories like meals, transportation, or office supplies.

06

Provide a detailed description of each expense, including the date, location, purpose, and any relevant information or justifications.

07

Enter the total amount spent for each expense. Ensure that you have accurate calculations and include any applicable taxes or fees.

08

Attach the corresponding receipts for each expense, making sure they are organized and easily identifiable. Some forms may require you to write down the receipt number or a brief description of the receipt.

09

If there are any additional supporting documents that need to be submitted, such as proof of attendance for a professional conference, include them along with the form.

10

Double-check all the entered information for accuracy and completeness. Make sure that everything is filled out legibly and without any errors.

11

Once you are satisfied with the information provided, sign and date the form. Depending on the process, you may need to submit the form electronically or physically to the designated department or individual within your organization.

12

Keep a copy of the completed form for your records. It's always a good idea to maintain a record of your expenses and reimbursement requests for future reference or audits.

13

Remember to consult with your organization's financial department or supervisor if you have any specific questions or if there are any additional requirements or procedures that need to be followed.

Who needs expenses or reimbursement for?

01

Expenses or reimbursement forms are typically needed by employees or individuals who have incurred expenses on behalf of their organization or within the scope of their employment.

02

This can include but is not limited to:

03

- Employees who have made business-related purchases or incurred expenses while traveling for work.

04

- Freelancers or contractors who need to be reimbursed for project-related expenses.

05

- Researchers or academics who require reimbursement for conference fees, travel expenses, or research-related costs.

06

- Sales representatives or consultants who have incurred expenses during client visits or meetings.

07

- Students or participants in educational programs who are eligible for expense reimbursements as per program guidelines.

08

Different organizations or institutions may have their own specific policies and criteria for reimbursement, so it's important to consult with the appropriate department or supervisor to confirm eligibility and understand the necessary procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send expenses or reimbursement for for eSignature?

When you're ready to share your expenses or reimbursement for, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find expenses or reimbursement for?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the expenses or reimbursement for. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my expenses or reimbursement for in Gmail?

Create your eSignature using pdfFiller and then eSign your expenses or reimbursement for immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is expenses or reimbursement for?

Expenses or reimbursement is for covering costs incurred by employees while conducting business activities on behalf of the company.

Who is required to file expenses or reimbursement for?

Employees who have incurred expenses while conducting company business are required to file for expenses or reimbursement.

How to fill out expenses or reimbursement for?

To fill out expenses or reimbursement, employees need to gather all receipts and documentation of expenses, complete the expense report form provided by the company, and submit it to the relevant department for processing.

What is the purpose of expenses or reimbursement for?

The purpose of expenses or reimbursement is to ensure that employees are not financially burdened by costs incurred while conducting business activities on behalf of the company.

What information must be reported on expenses or reimbursement for?

The information that must be reported on expenses or reimbursement includes the date of the expense, description of the expense, amount spent, and any receipts or documentation to support the expense.

Fill out your expenses or reimbursement for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expenses Or Reimbursement For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.