Get the free Federal Return and State Return Narrative for Test 2 - 2011

Show details

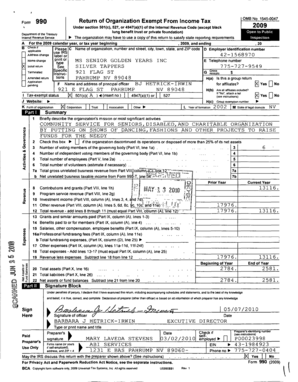

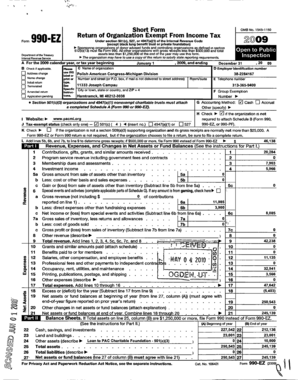

This document contains the federal and state tax return information for the taxpayer Chip N. Dale for the year 2011, detailing income, adjustments, tax credits, payments, and refund information for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal return and state

Edit your federal return and state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal return and state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal return and state online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal return and state. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal return and state

How to fill out Federal Return and State Return Narrative for Test 2 - 2011

01

Gather all necessary financial documents such as W-2s, 1099s, and other income statements.

02

Obtain the Federal Return forms (Form 1040) and the specific State Return forms required for your state.

03

Complete the Federal Return by entering your personal information, income, deductions, and credits as applicable.

04

Fill out the State Return following the instructions provided for that specific state, ensuring to include any state-specific deductions or credits.

05

Review both returns for accuracy, ensuring all calculations are correct and that no information is missing.

06

Sign and date both returns before submission.

07

Submit both returns electronically or via mail as per the specific filing requirements.

Who needs Federal Return and State Return Narrative for Test 2 - 2011?

01

Individuals who are required to file taxes for the year 2011.

02

Taxpayers who have income subject to federal and state taxation.

03

Residents and certain non-residents of the state who have earned income during 2011.

04

Anyone claiming deductions or credits on their income tax returns for 2011.

Fill

form

: Try Risk Free

People Also Ask about

How many years back can you electronically file taxes?

The current year and 2 previous years of returns are available. tax periods.

How do I get a summary of my tax return?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

How many years can you file back taxes in the USA?

Even so, the IRS can go back more than six years in certain instances. Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return's original due date.

Can the IRS go back more than 10 years?

How far back can the IRS go to audit my return? Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years.

What is federal return and state return?

The federal return is filed with the Internal Revenue Service (IRS), and the state return is filed with the Franchise Tax Board (FTB). Both returns are generally due on April 15. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

How many years can you legally not file taxes?

Technically, there is no limit on how many years a taxpayer can go without filing taxes. However, the IRS typically focuses on the most recent six years for enforcement actions.

What was the income tax rate in 2011?

Married Individuals Filing Joint Returns, & Surviving Spouses Taxable Income2011 Tax Not over $17,000 10% of the taxable income Over $17,000 but not over $69,000 $1,700 plus 15% of the excess over $17,000 Over $69,000 but not over $139,350 $9,500 plus 25% of the excess over $69,0003 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Return and State Return Narrative for Test 2 - 2011?

The Federal Return and State Return Narrative for Test 2 - 2011 refers to the specific documents and accompanying narratives required for the federal and state tax returns for the tax year 2011. These documents provide essential information regarding the taxpayer's financial status, income, deductions, and credits applied for that year.

Who is required to file Federal Return and State Return Narrative for Test 2 - 2011?

Individuals and entities that meet certain income thresholds, have specific types of income, or are required to report additional information under federal or state laws are required to file the Federal Return and State Return Narrative for Test 2 - 2011.

How to fill out Federal Return and State Return Narrative for Test 2 - 2011?

To fill out the Federal Return and State Return Narrative for Test 2 - 2011, taxpayers should gather all necessary financial documents, complete the required forms following IRS and state guidelines, and provide detailed narratives as needed to explain their tax situation. It is crucial to ensure accuracy and completeness in all reported information.

What is the purpose of Federal Return and State Return Narrative for Test 2 - 2011?

The purpose of the Federal Return and State Return Narrative for Test 2 - 2011 is to assess the taxpayer's financial obligations for the year, ensure compliance with tax laws, and enable proper evaluation of tax credits and deductions claimed. These narratives help clarify any specific issues or circumstances related to the taxpayer's financial situation.

What information must be reported on Federal Return and State Return Narrative for Test 2 - 2011?

The information that must be reported on the Federal Return and State Return Narrative for Test 2 - 2011 includes income details, deductions, tax credits, any additional taxes, and any pertinent explanations that provide context for the taxpayer's financial situation. This may also include personal information, filing status, and any relevant attachments.

Fill out your federal return and state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Return And State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.