Get the free Home Buyer Application

Show details

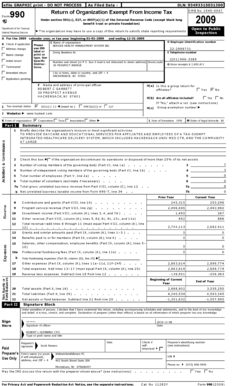

This document is an application form for the Neighborhood Stabilization Program (NSP) managed by the City of Chicago Department of Housing and Economic Development. It collects essential information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home buyer application

Edit your home buyer application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home buyer application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home buyer application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home buyer application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home buyer application

How to fill out Home Buyer Application

01

Gather necessary personal information such as your full name, address, and contact details.

02

Provide details about your employment status, job title, and annual income.

03

List your financial information including existing debts, savings, and assets.

04

Indicate the type of property you are interested in and your desired loan amount.

05

Include any additional information that may assist in your application, such as co-applicants or special circumstances.

06

Review your application for accuracy and completeness.

07

Submit the application to the lender or relevant authority.

Who needs Home Buyer Application?

01

Individuals or families looking to purchase their first home.

02

People who are seeking financing options to buy a property.

03

Anyone intending to apply for a mortgage or loan for real estate purposes.

04

Real estate investors looking to acquire residential properties.

Fill

form

: Try Risk Free

People Also Ask about

Are you considered a first-time home buyer if you inherited a home?

No, generally you cannot qualify as a first- time home buyer if you have inherited a home, as inheriting a property is considered ownership, even if you never lived in it, meaning you are not considered a "first-time" buyer ing to most programs and definitions.

What are the requirements to be a first-time home buyer?

Other first-time homebuyer qualifications At least a 620 credit score. 43 percent or lower debt-to-income (DTI) ratio. A contribution toward a down payment, which varies depending on the loan program. An income and a purchase price within program limits. Buying a home in a specific city, county or state.

Who qualifies as a first-time home buyer in MN?

The Start Up program is for first-time homebuyers, which is someone who "has not had an ownership interest in a principal residence in the last three years." If you've never owned a home, or it's been more than three years since you've been a homeowner, you may be considered a first-time homebuyer.

What qualifies as a first-time home buyer in Minnesota?

The Start Up program is for first-time homebuyers, which is someone who "has not had an ownership interest in a principal residence in the last three years." If you've never owned a home, or it's been more than three years since you've been a homeowner, you may be considered a first-time homebuyer.

What do most first-time home buyers get approved for?

Government-backed mortgage loans The Federal Housing Administration (FHA), Department of Veterans Affairs (VA) and Department of Agriculture (USDA) back mortgage programs that are often an option for first-time homebuyers.

Who is eligible for first-time home buyer in Ohio?

You may qualify for an OHFA first-time homebuyer program if you meet one of the following criteria: You have not had an ownership interest in your primary residence in the last three years. You are an honorably discharged veteran. You are purchasing a home in a target area.

How do I qualify for a first-time home buyer in NY?

Requirements Must purchase in one of the five NYC boroughs. Must be a first-time homebuyer. Must complete a homebuyer education course. Must use their savings for any additional down payment and closing costs. Have a maximum household income of up to 80 percent of the area median income (AMI)

What is the minimum down payment for a house in Minnesota?

The amount of down payment you need to buy a home in Minnesota will vary depending on the home loan or mortgage product you choose. For some mortgage products it's as little as 3% of the purchase price (or total cost of your home.) For others, it may be higher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Home Buyer Application?

The Home Buyer Application is a form used by individuals seeking to purchase a home to apply for financing or a mortgage.

Who is required to file Home Buyer Application?

Individuals or parties who intend to purchase a home and seek financing or mortgage assistance are required to file the Home Buyer Application.

How to fill out Home Buyer Application?

To fill out the Home Buyer Application, applicants should provide personal information, financial details, employment history, and any required documentation such as credit history and identification.

What is the purpose of Home Buyer Application?

The purpose of the Home Buyer Application is to assess the buyer's eligibility for a mortgage or loan, gather financial information, and facilitate the home buying process.

What information must be reported on Home Buyer Application?

The Home Buyer Application must report information such as the buyer's personal details, income, employment history, debts, assets, credit score, and the property details being purchased.

Fill out your home buyer application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Buyer Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.