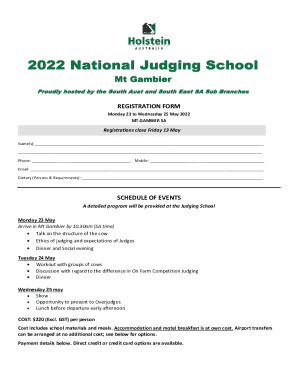

Get the free New Merchant Checklist: Credit Card Processing

Show details

Este documento sirve como una guía para el proceso de solicitud de servicios de procesamiento de tarjetas de crédito, incluyendo una lista de verificación de los documentos y formulaciones necesarias

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new merchant checklist credit

Edit your new merchant checklist credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new merchant checklist credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new merchant checklist credit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new merchant checklist credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new merchant checklist credit

How to fill out New Merchant Checklist: Credit Card Processing

01

Gather necessary business information such as your business name, address, and tax identification number.

02

Determine the type of credit card processing service that suits your business needs (e.g., mobile, online, in-store).

03

Complete the application form provided in the New Merchant Checklist accurately with all required details.

04

Submit supporting documents such as your business license, bank statements, and identification.

05

Review the terms and conditions of the processing agreement thoroughly before signing.

06

Submit the completed checklist and await approval from the credit card processing provider.

Who needs New Merchant Checklist: Credit Card Processing?

01

New merchants looking to accept credit card payments in their business.

02

Existing businesses upgrading or switching credit card processing services.

03

Entrepreneurs launching new ventures that will involve credit card transactions.

04

Retailers and service providers aiming to enhance customer payment options.

Fill

form

: Try Risk Free

People Also Ask about

How do you onboard retailers?

How to onboard a retailer Identify a retailer and pitch local inventory ads. Retailer creates accounts. Retailer identifies you as their data provider.

How do you approach onboarding new merchants?

Here's an overview of the typical merchant onboarding process: Pre-onboarding preparation. Merchant application and review. Compliance and risk assessment. Account setup and integration. Training and support. Ongoing monitoring and optimization.

What are the steps of credit card processing?

Merchant onboarding is a set of processes that payment service providers undertake to gauge the risk posed by a merchant before doing business with them. The process involves Know Your Business (KYB) and Know Your Customer (KYC) checks, as well as risk assessment and ongoing monitoring.

What is the merchant spot onboarding process?

Merchant onboarding is a set of processes that payment service providers undertake to gauge the risk posed by a merchant before doing business with them. The process involves Know Your Business (KYB) and Know Your Customer (KYC) checks, as well as risk assessment and ongoing monitoring.

What are assessments in credit card processing?

“Assessments” are flat-rate fees that card networks charge as a percentage of gross monthly sales, usually between 0.12% and 0.14%. Like dues, assessments are standard across all credit card processors.

How to onboard a merchant?

During the merchant onboarding process, KYC typically involves the following steps: Identification. The business provides necessary information and documentation, such as company registration details, tax identification numbers, and ownership structure. Verification. Risk assessment. Ongoing monitoring.

How to do vendor onboarding?

7 Steps for Successful Vendor Onboarding Collect essential vendor information and documentation. Set up secure systems access and permissions. Define roles, expectations, and communication channels. Deliver comprehensive vendor training. Conduct an initial compliance and quality check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Merchant Checklist: Credit Card Processing?

The New Merchant Checklist: Credit Card Processing is a document that outlines the necessary steps and information needed for merchants to set up credit card processing services. It ensures compliance with industry standards and helps merchants understand their obligations.

Who is required to file New Merchant Checklist: Credit Card Processing?

All new merchants who intend to start accepting credit card payments are required to file the New Merchant Checklist: Credit Card Processing. This includes businesses and individuals who are entering into agreements with credit card processors.

How to fill out New Merchant Checklist: Credit Card Processing?

To fill out the New Merchant Checklist: Credit Card Processing, merchants should provide accurate details about their business, including business name, location, owner information, and banking details. Additionally, they must verify their compliance with required processing standards.

What is the purpose of New Merchant Checklist: Credit Card Processing?

The purpose of the New Merchant Checklist: Credit Card Processing is to ensure that new merchants are informed about the requirements for accepting credit cards and are compliant with regulations. This helps prevent fraud and ensures a smooth processing experience.

What information must be reported on New Merchant Checklist: Credit Card Processing?

The New Merchant Checklist: Credit Card Processing must report information such as the merchant's business name, address, ownership structure, financial information, and details about the type of goods or services sold. Additional compliance-related information may also be required.

Fill out your new merchant checklist credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Merchant Checklist Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.