Get the free Tax Incentives - Alabama Department of Revenue

Show details

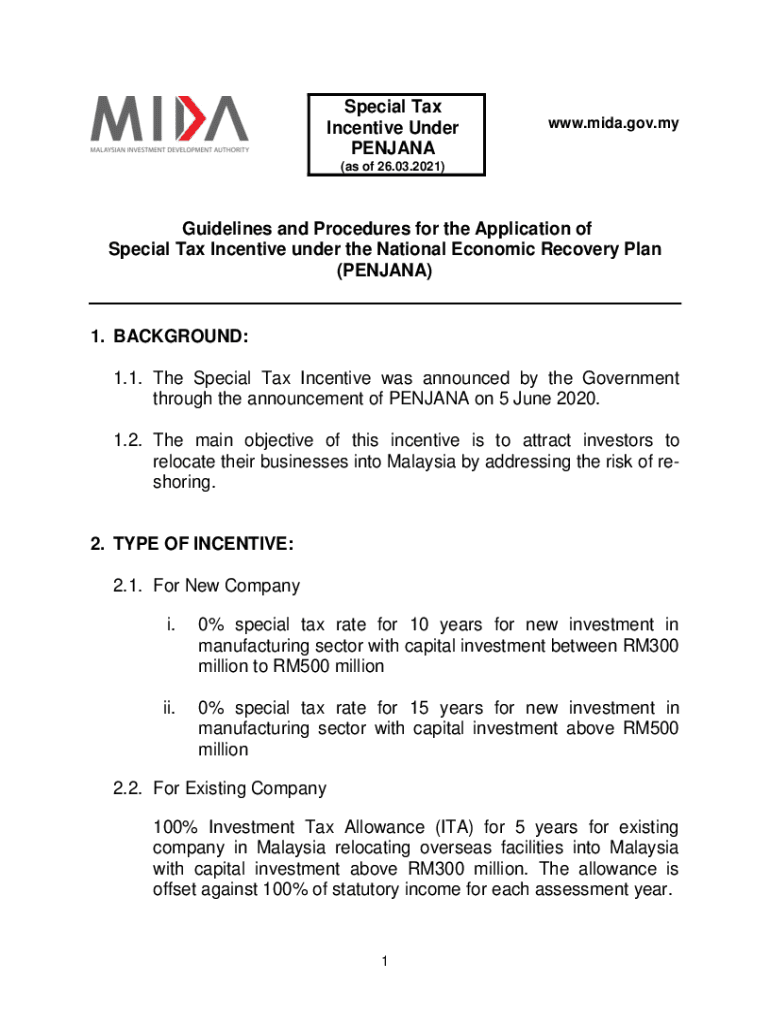

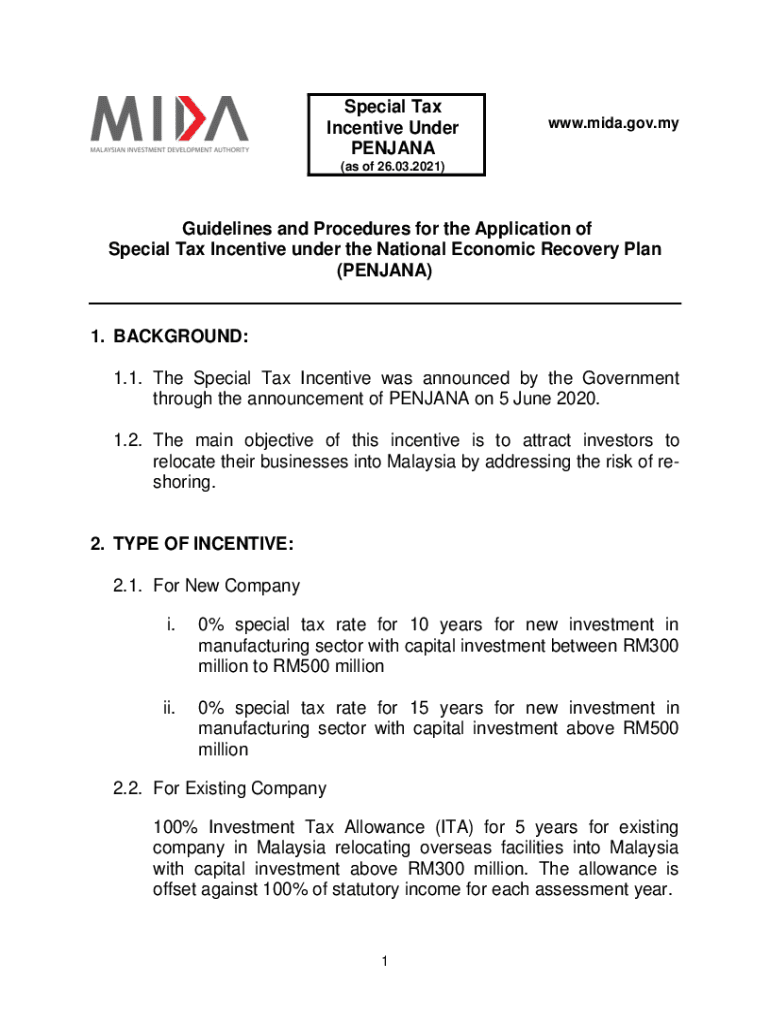

Special Tax

Incentive Under

PENJANAwww.mid.gov.my(as of 26.03.2021)Guidelines and Procedures for the Application of

Special Tax Incentive under the National Economic Recovery Plan

(PENNANT)1. BACKGROUND:

1.1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives - alabama

Edit your tax incentives - alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives - alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentives - alabama online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax incentives - alabama. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentives - alabama

How to fill out tax incentives - alabama

01

Step 1: Gather all necessary documents such as your W-2 forms, 1099 forms, and any other relevant tax documents.

02

Step 2: Determine if you are eligible for any tax incentives by reviewing the Alabama Department of Revenue's website or consulting with a tax professional.

03

Step 3: Complete the appropriate tax forms, such as Form 40 or Form 40NR, based on your residency status.

04

Step 4: Fill out the tax forms accurately and provide all required information, including any information related to tax incentives or deductions you may be eligible for.

05

Step 5: Double-check your completed forms for any errors or missing information.

06

Step 6: Sign and date your tax forms.

07

Step 7: Submit your completed tax forms along with any necessary supporting documents to the Alabama Department of Revenue.

08

Step 8: Keep copies of all your submitted forms and documents for your records.

09

Step 9: Monitor the status of your tax return and any potential tax incentives through the Alabama Department of Revenue's online portal or by contacting their customer service.

Who needs tax incentives - alabama?

01

Tax incentives in Alabama can be beneficial for various individuals and entities, including:

02

- Small business owners looking to expand their operations and create job opportunities in Alabama.

03

- Film and entertainment industry professionals seeking incentives for producing movies, TV shows, or other media projects in the state.

04

- Investors interested in supporting Alabama's economic development by taking advantage of tax credits for investing in certain industries or activities.

05

- Individuals or families looking for tax deductions or exemptions to lessen their overall tax burden.

06

- Startups or growing businesses in key sectors, such as technology or renewable energy, that may be eligible for specialized tax incentives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax incentives - alabama for eSignature?

When you're ready to share your tax incentives - alabama, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute tax incentives - alabama online?

pdfFiller makes it easy to finish and sign tax incentives - alabama online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out tax incentives - alabama on an Android device?

Use the pdfFiller mobile app and complete your tax incentives - alabama and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is tax incentives - alabama?

In Alabama, tax incentives are benefits provided by the government to encourage certain activities, such as business investments or job creation.

Who is required to file tax incentives - alabama?

Certain businesses and individuals may be required to file for tax incentives in Alabama, depending on the specific program or benefit being offered.

How to fill out tax incentives - alabama?

To fill out tax incentives in Alabama, individuals or businesses may need to complete specific forms or applications provided by the state government or relevant agencies.

What is the purpose of tax incentives - alabama?

The purpose of tax incentives in Alabama is to stimulate economic growth, attract businesses, create jobs, and encourage investment in the state.

What information must be reported on tax incentives - alabama?

Tax incentives in Alabama may require reporting information such as income, expenses, investments, job creation numbers, or other relevant data.

Fill out your tax incentives - alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives - Alabama is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.