Get the free How Islamic finance is helping fuel Malaysia's green growth

Show details

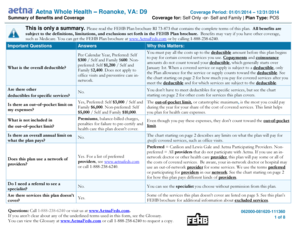

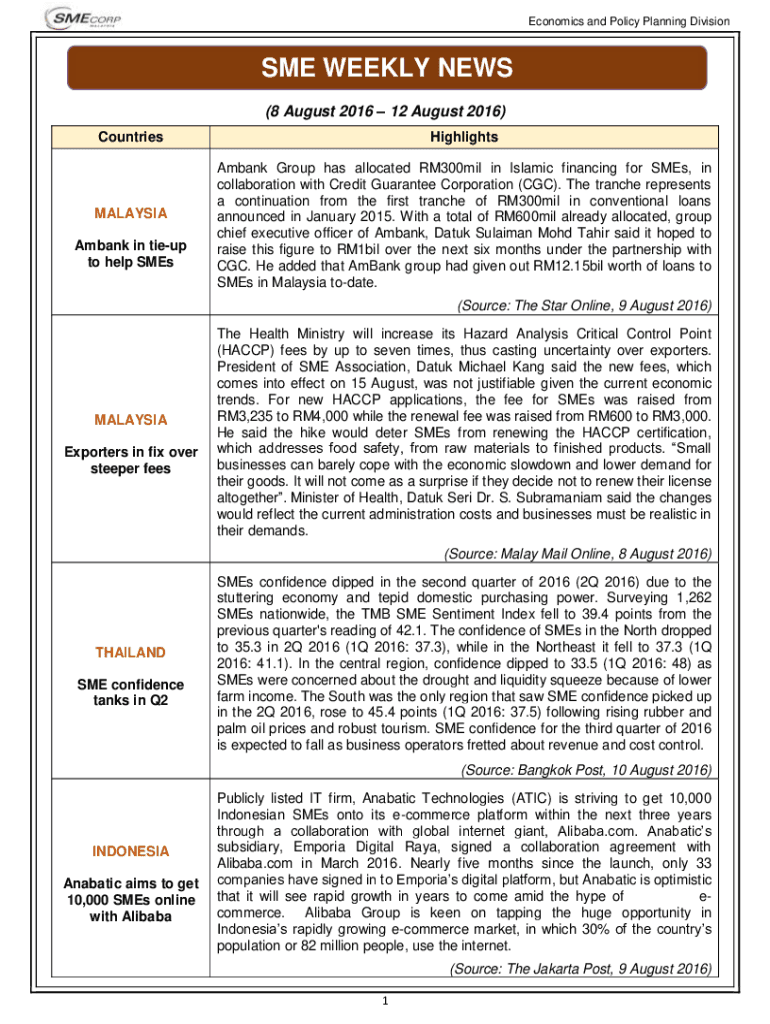

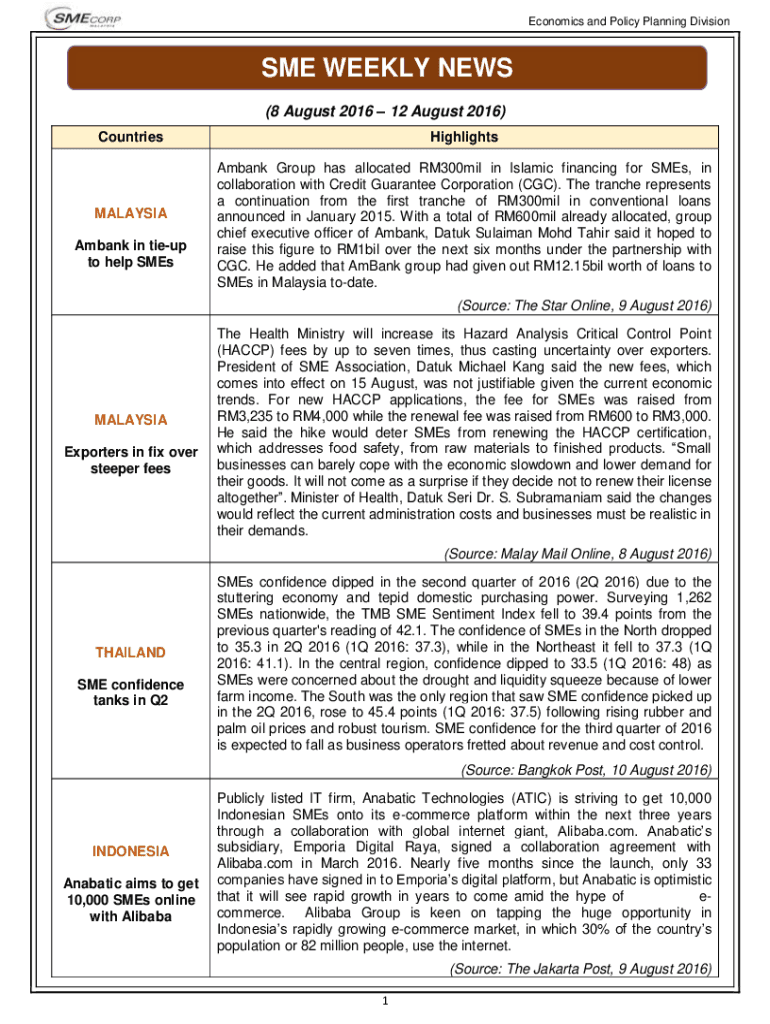

Economics and Policy Planning Division SME WEEKLY NEWS (8 August 2016 12 August 2016) CountriesMALAYSIA Embank in took to help SMEsHighlights Embank Group has allocated RM300mil in Islamic financing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how islamic finance is

Edit your how islamic finance is form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how islamic finance is form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how islamic finance is online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit how islamic finance is. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how islamic finance is

How to fill out how islamic finance is

01

To fill out how islamic finance is, follow these steps:

02

Understand the principles of Islamic finance: Islamic finance is based on principles derived from the Shariah law. It prohibits activities such as charging interest (riba) and investing in businesses that are considered haram (forbidden).

03

Study the different Islamic finance products: Islamic finance offers various products such as Islamic banking, Islamic insurance (takaful), and Islamic investment funds. Explore each product to understand how they operate according to Islamic principles.

04

Learn about the contracts used in Islamic finance: Islamic finance relies on specific contracts such as murabaha (cost-plus financing), musharakah (partnership), and ijara (leasing). Familiarize yourself with these contracts to understand how they are used in different financial transactions.

05

Understand the role of Islamic financial institutions: Islamic finance is offered by specialized institutions that comply with Shariah law. Learn about these institutions and their role in providing Islamic financial services.

06

Consider the ethical aspects of Islamic finance: Islamic finance promotes ethical and socially responsible investing. Understand how Islamic finance encourages investments in businesses that are beneficial to society and the environment.

07

Stay updated with the latest developments in Islamic finance: Like any other financial industry, Islamic finance evolves over time. Stay updated with the latest news and developments to understand the current trends and opportunities in Islamic finance.

Who needs how islamic finance is?

01

Islamic finance is suitable for individuals and businesses who:

02

- Want to adhere to Islamic principles: Islamic finance offers an alternative financial system for individuals and businesses who want to avoid interest-based transactions and comply with Shariah law.

03

- Prefer ethical investments: Islamic finance promotes ethical and socially responsible investments. If someone is interested in investing their money in businesses that are beneficial to society and the environment, Islamic finance can be a suitable option.

04

- Seek risk-sharing partnerships: Islamic finance emphasizes partnerships and risk-sharing. Individuals or businesses looking for financing options that involve sharing risks rather than merely charging interest may find Islamic finance beneficial.

05

- Want to diversify their investment portfolio: Islamic finance provides a range of investment products and opportunities. Investors who want to diversify their portfolio according to Islamic principles can explore Islamic investment funds and other Islamic financial instruments.

06

- Need insurance coverage adhering to Islamic principles: Islamic finance offers Islamic insurance (takaful) that complies with Shariah law. Individuals or businesses who want insurance coverage while avoiding practices deemed haram can consider Islamic insurance.

07

- Prefer an inclusive financial system: Islamic finance aims to provide financial services to a broader segment of the population. It promotes financial inclusion and supports individuals and businesses who may have limited access to conventional banking services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete how islamic finance is online?

Filling out and eSigning how islamic finance is is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the how islamic finance is electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your how islamic finance is in seconds.

Can I edit how islamic finance is on an Android device?

You can make any changes to PDF files, such as how islamic finance is, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is how islamic finance is?

Islamic finance is a financial system that operates according to Islamic law (Sharia) principles, which prohibits earning interest (riba) and investing in businesses that are considered haram (forbidden).

Who is required to file how islamic finance is?

Islamic financial institutions, companies, or individuals involved in Islamic finance transactions are required to file how Islamic finance is.

How to fill out how islamic finance is?

To fill out how Islamic finance is, one must report details of all financial transactions that comply with Islamic law (Sharia) principles.

What is the purpose of how islamic finance is?

The purpose of how Islamic finance is to ensure transparency and compliance with Islamic law (Sharia) principles in financial transactions.

What information must be reported on how islamic finance is?

Information such as types of Islamic finance transactions, amounts involved, parties involved, and compliance with Sharia principles must be reported on how Islamic finance is.

Fill out your how islamic finance is online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Islamic Finance Is is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.