Get the free Tax Incentives For Green Technology Industry - MIDA - mida gov

Show details

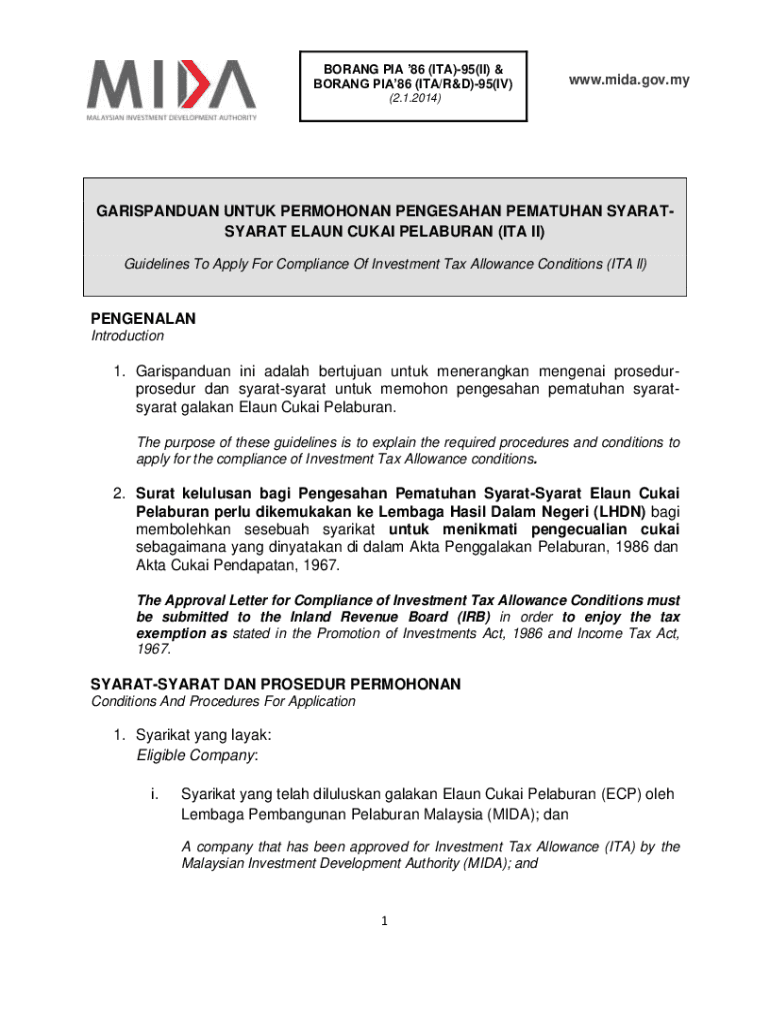

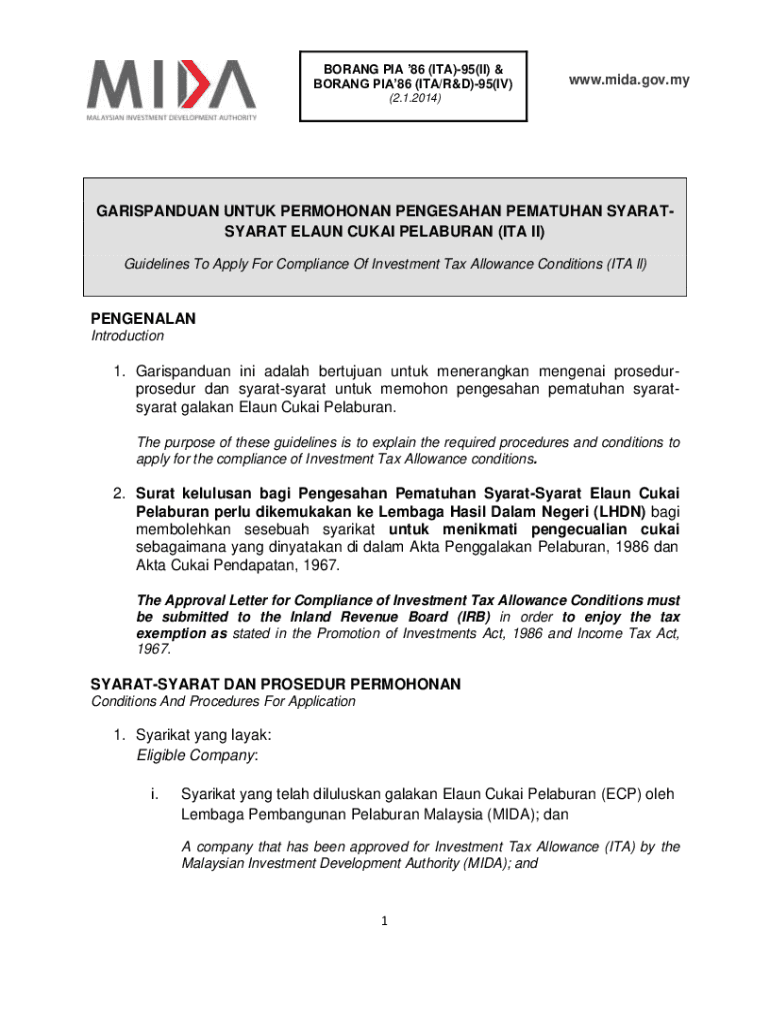

BORING PIA 86 (ITA)95(II) &

BORING PIA86 (ITA/R&D)95(IV)www.mida.gov.my(2.1.2014)GARISPANDUAN UNT UK PERMOHONAN PENGESAHAN PEMATUHAN SYARATSYARAT Élan CUBA ELAURA (ITA II)

Guidelines To Apply For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives for green

Edit your tax incentives for green form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives for green form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentives for green online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax incentives for green. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

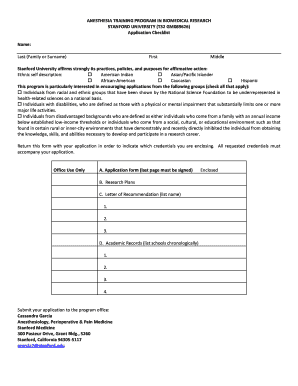

How to fill out tax incentives for green

How to fill out tax incentives for green

01

To fill out tax incentives for green, follow these steps:

02

Gather all the necessary documents and information related to your green activities or projects.

03

Determine the specific tax incentives available for green in your country or region.

04

Understand the eligibility criteria and requirements for each tax incentive.

05

Fill out the appropriate tax forms or applications, providing accurate and detailed information.

06

Attach any supporting documents or evidence required to substantiate your green activities or projects.

07

Review and double-check your filled-out forms for accuracy and completeness.

08

Submit the completed tax forms and supporting documents to the relevant tax authority or department.

09

Keep a copy of the filled-out forms and supporting documents for your records.

10

Monitor the progress of your tax incentive claim and follow up with the tax authority if necessary.

11

Seek professional advice or consult with a tax expert if you have any doubts or questions during the process.

Who needs tax incentives for green?

01

Tax incentives for green are beneficial for various individuals and organizations, including:

02

- Individuals or households investing in renewable energy systems (such as solar panels or wind turbines) for their residences.

03

- Businesses or corporations implementing eco-friendly practices or technologies to reduce their environmental impact.

04

- Startups or entrepreneurs involved in green innovation, research, or development.

05

- Governments or policymakers promoting sustainability and aiming to encourage green initiatives.

06

- Non-profit organizations or foundations supporting environmental conservation projects.

07

- Investors or financiers interested in funding green projects or ventures.

08

- Communities or cities aiming to transition towards a more sustainable and renewable energy future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax incentives for green online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tax incentives for green to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the tax incentives for green in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tax incentives for green and you'll be done in minutes.

How do I complete tax incentives for green on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tax incentives for green by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is tax incentives for green?

Tax incentives for green are financial benefits provided by the government to encourage individuals or businesses to invest in environmentally friendly practices or products.

Who is required to file tax incentives for green?

Businesses or individuals who have undertaken qualifying green initiatives or investments are typically required to file for tax incentives for green.

How to fill out tax incentives for green?

Tax incentives for green can be filled out by providing information about the green initiatives or investments made, along with any supporting documentation.

What is the purpose of tax incentives for green?

The purpose of tax incentives for green is to promote and incentivize environmentally friendly behavior and investments that contribute to a more sustainable future.

What information must be reported on tax incentives for green?

Information such as the details of green initiatives or investments made, the amount spent, and any related expenses or savings must be reported on tax incentives for green.

Fill out your tax incentives for green online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives For Green is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.