Get the free 10 9 A - www10 ava

Show details

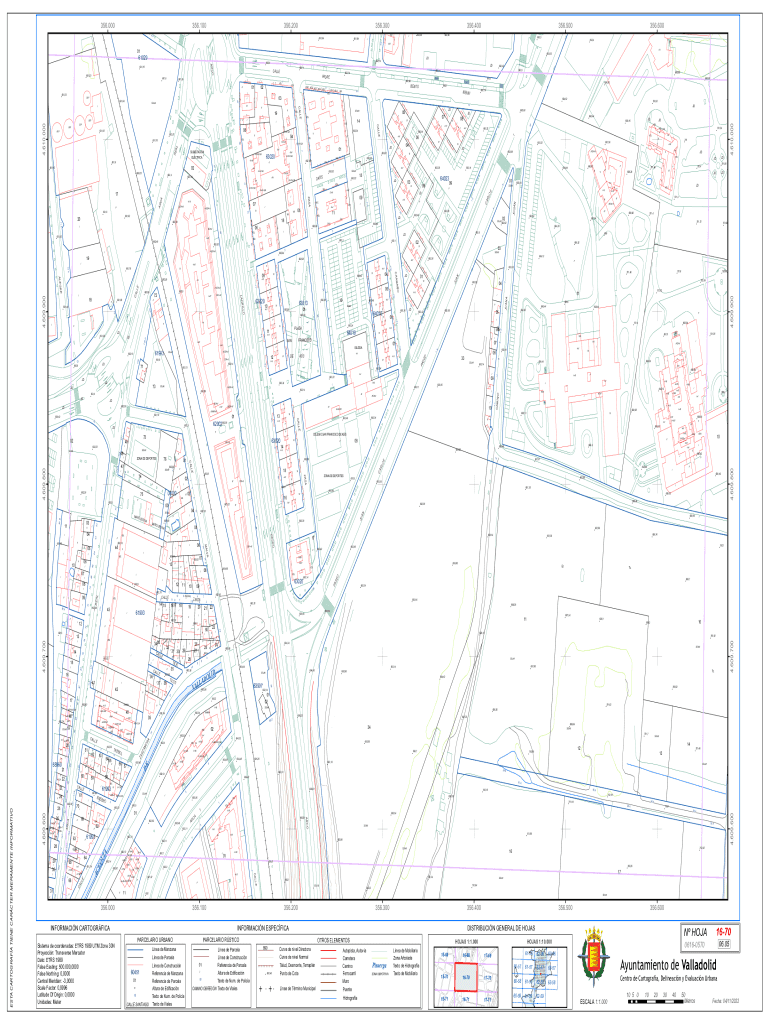

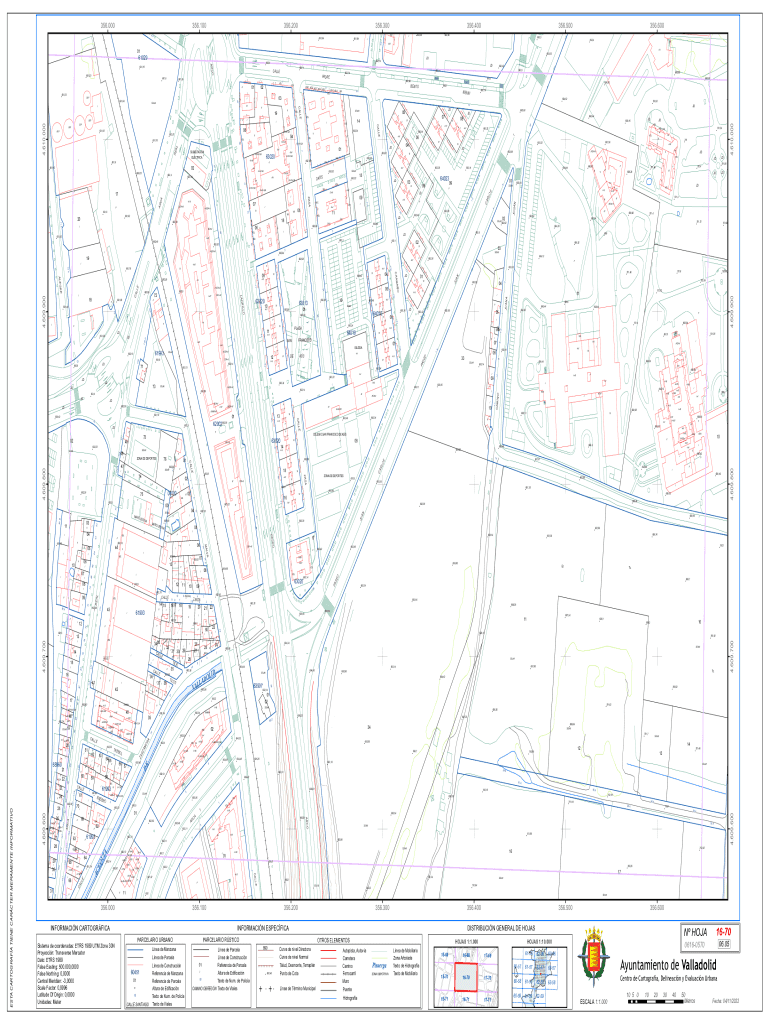

B T T692,78!691,52VOL88SOP+II I+III692,4675693,02ICA LLEP25I10 5 D81JDI+IV10 5JDJD !10 7 10 948SOLARI10 9 A10 9 B111 I12 790 929812 9 13 110 013 5 13 710 2PI65III66III+II I+TZA P I6011362PIIII54 55

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 10 9 a

Edit your 10 9 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10 9 a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 10 9 a online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 10 9 a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10 9 a

How to fill out 10 9 a

01

To fill out 10 9 a, follow these steps:

02

Gather all the necessary information, including your personal details, employment information, and income details.

03

Start by entering your name, address, and social security number in the designated fields.

04

Provide your employer's details, such as their name, address, and employer identification number (EIN).

05

Fill out the income section by reporting your wages, tips, and other compensation.

06

If you have any additional income, such as self-employment income or rental income, include it in the appropriate section.

07

Deduct any adjustments to your income, such as contributions to retirement accounts or health savings accounts.

08

Enter your federal income tax withheld from your paychecks.

09

Specify any refund or amount owed by providing accurate amounts in the appropriate section.

10

Review the information you've entered to ensure its accuracy.

11

Sign and date the form before submitting it.

12

Remember to consult with a tax professional if you have any specific questions or concerns.

Who needs 10 9 a?

01

Various individuals and entities might need to fill out 10 9 a, including:

02

- Employees who need to report their wages, tips, and other compensation for income tax purposes.

03

- Employers who need to provide their employees with accurate information regarding their income and tax withholdings.

04

- Self-employed individuals who need to report their self-employment income.

05

- Individuals who have received certain types of income, such as dividends or interest, that need to be reported on the form.

06

- People who want to claim certain deductions or credits on their tax return may need to fill out 10 9 a.

07

It's important to consult with a tax professional or refer to the official IRS guidelines to determine if you specifically need to fill out this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 10 9 a without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 10 9 a into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit 10 9 a online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 10 9 a to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the 10 9 a in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 10 9 a right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is 10 9 a?

Form 1099-A is a tax form used to report the acquisition or abandonment of secured property by a lender.

Who is required to file 10 9 a?

Lenders who acquire property through foreclosure or who release security interests in property must file Form 1099-A.

How to fill out 10 9 a?

To fill out Form 1099-A, you need to provide details such as the date of lender's acquisition or knowledge of abandonment, the borrower’s information, and the fair market value of the property.

What is the purpose of 10 9 a?

The purpose of Form 1099-A is to provide the IRS with information about the acquisition or abandonment of secured property, which may help in the determination of any potential gains or losses.

What information must be reported on 10 9 a?

Information required includes the lender’s and borrower’s identifying information, the date of acquisition or abandonment, the fair market value of the property, and any outstanding principal balance.

Fill out your 10 9 a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10 9 A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.