Get the free Vested Trust for Margaret Pollard

Show details

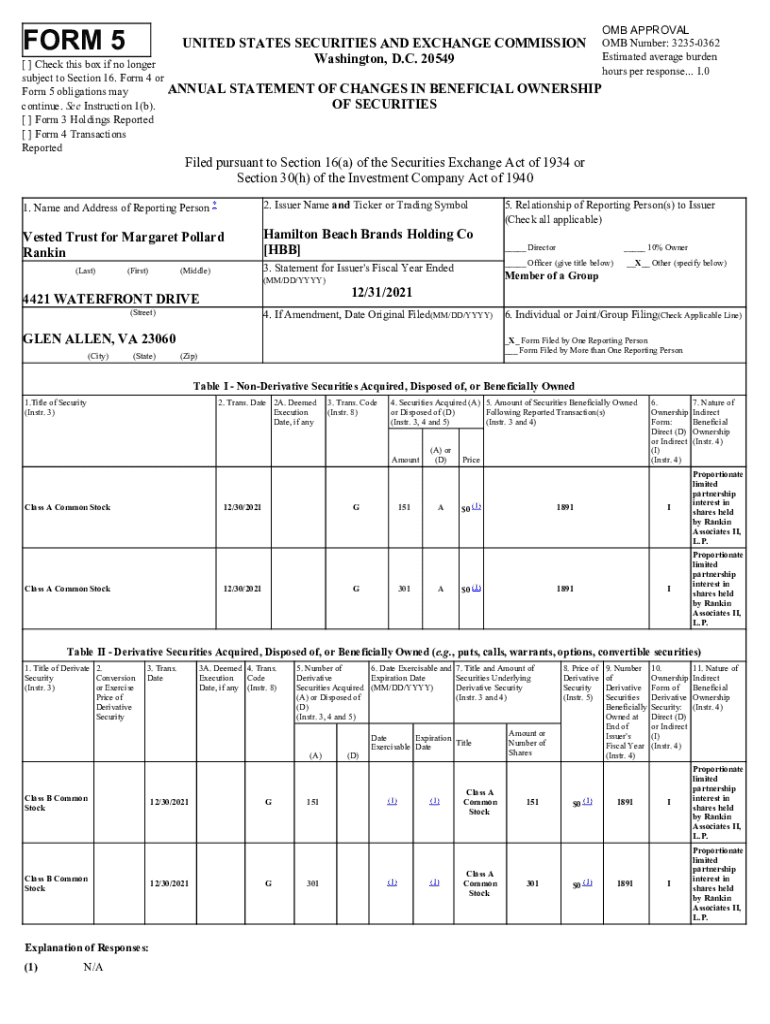

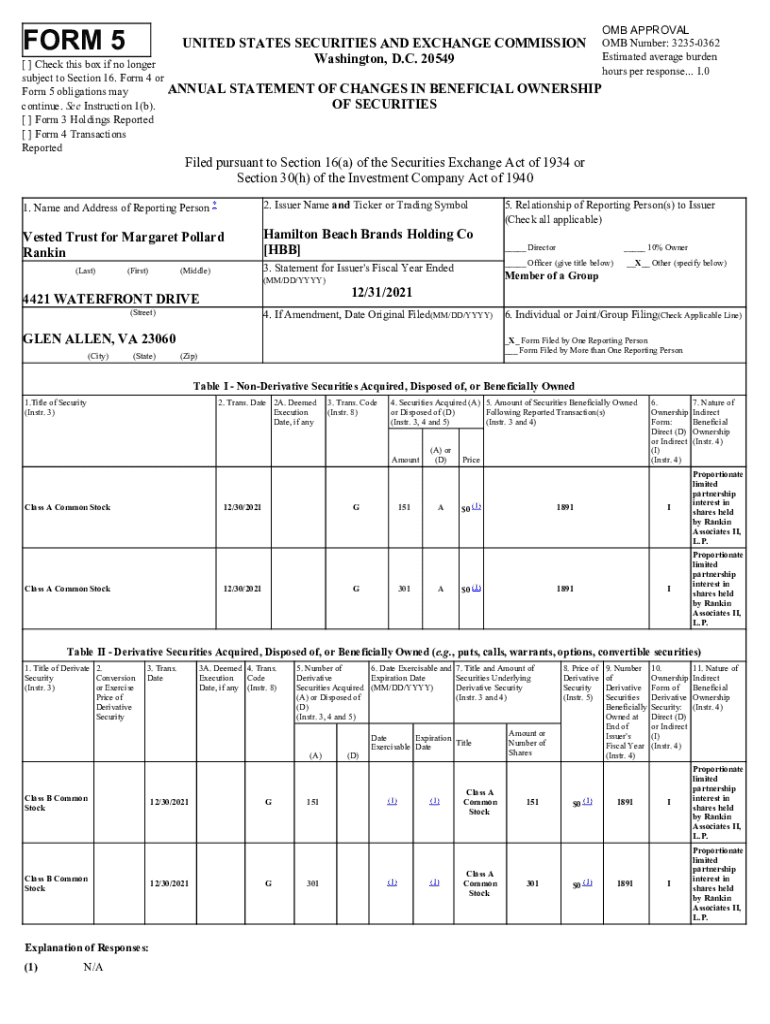

FORM 5 [ ] Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b). [ ] Form 3 Holdings Reported [ ] Form 4 Transactions ReportedUNITED STATES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vested trust for margaret

Edit your vested trust for margaret form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vested trust for margaret form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vested trust for margaret online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vested trust for margaret. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vested trust for margaret

How to fill out vested trust for margaret

01

To fill out a vested trust for Margaret, follow these steps:

02

Gather all relevant information about Margaret, including her full name, date of birth, and contact information.

03

Consult with a lawyer or legal professional to ensure you understand the legal requirements and implications of creating a vested trust.

04

Determine the assets or properties you wish to transfer to the trust on behalf of Margaret.

05

Create a trust agreement that outlines the terms and conditions of the trust, including the trustee's responsibilities and Margaret's beneficiary rights.

06

Name a reliable and trustworthy individual or financial institution as the trustee for Margaret's vested trust.

07

Specify the conditions or circumstances under which Margaret can access or benefit from the assets held in the trust.

08

Sign the trust agreement, ensuring that all parties involved comprehend and agree to its contents.

09

Preserve a copy of the fully executed trust agreement and distribute copies to all relevant parties.

10

Monitor and review the trust periodically to ensure it remains aligned with Margaret's best interests and any changes in applicable laws or regulations.

11

You may also want to consult with an accountant or financial advisor to evaluate the potential tax implications and benefits associated with a vested trust for Margaret.

12

Remember, it's essential to seek proper legal guidance throughout the entire process to ensure the trust is legally valid and adheres to your specific intentions.

Who needs vested trust for margaret?

01

Anyone who wants to secure and protect assets or properties for the benefit of Margaret would need a vested trust.

02

This could include family members, friends, or even organizations that have a vested interest in Margaret's well-being and financial security.

03

A vested trust ensures that the designated assets are held and managed responsibly by a trustee, who will act in Margaret's best interests according to the terms defined in the trust agreement.

04

It provides a legal framework for asset distribution, potential tax benefits, and safeguards against potential risks or challenges that may arise in the future.

05

Ultimately, the decision of who needs a vested trust for Margaret depends on the specific circumstances and intentions of those involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit vested trust for margaret from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your vested trust for margaret into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute vested trust for margaret online?

pdfFiller has made it simple to fill out and eSign vested trust for margaret. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the vested trust for margaret in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your vested trust for margaret and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is vested trust for margaret?

Vested trust for Margaret is a trust established for her benefit, where the assets in the trust become fully hers at a certain point in time or upon meeting certain conditions.

Who is required to file vested trust for margaret?

The trustee or the individual responsible for managing the trust is required to file the vested trust for Margaret.

How to fill out vested trust for margaret?

The vested trust for Margaret can be filled out by providing detailed information about the trust assets, beneficiaries, and any conditions or restrictions placed on the trust.

What is the purpose of vested trust for margaret?

The purpose of the vested trust for Margaret is to ensure that she receives the assets in the trust according to the terms set forth in the trust document.

What information must be reported on vested trust for margaret?

The information that must be reported on the vested trust for Margaret includes details of the trust assets, income, distributions, and any changes in beneficiaries or trustees.

Fill out your vested trust for margaret online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vested Trust For Margaret is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.