Get the free Compensation for Executives and Directors - americanbar

Show details

This document provides information about the 19th Annual National Institute on Compensation for Executives and Directors, including the agenda, faculty, registration details, and tuition information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compensation for executives and

Edit your compensation for executives and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compensation for executives and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing compensation for executives and online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit compensation for executives and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compensation for executives and

How to fill out Compensation for Executives and Directors

01

Gather necessary information on the executives and directors such as roles, responsibilities, and performance metrics.

02

Determine the compensation structure including base salary, bonuses, stock options, and other benefits.

03

Consult industry benchmarks and company policies to ensure competitiveness and fairness.

04

Outline specific objectives and goals for performance-based compensation.

05

Document the rationale for the selected compensation packages.

06

Have the compensation plan reviewed and approved by the board of directors or a compensation committee.

07

Ensure compliance with legal requirements and disclosures related to executive compensation.

Who needs Compensation for Executives and Directors?

01

Organizations looking to attract and retain top talent in executive and director positions.

02

Companies seeking to align executive compensation with company performance and shareholder interests.

03

Firms that need to comply with regulatory requirements regarding executive compensation disclosures.

04

Boards of directors and compensation committees responsible for overseeing and approving compensation plans.

Fill

form

: Try Risk Free

People Also Ask about

How much does a CEO of a $1 billion company make a year?

US CEO compensation By company size, base, bonus, and total cash compensation all rise as revenue does, with total median cash compensation coming in at $1,639,000 at companies with revenue above $1 billion. By industry, CEOs at financial services firms are paid the most: $1,013,000 in median total cash compensation.

How much does a CEO of Fortune 500 company earn?

Average CEO Pay Is Growing, Fueling Economic Inequality In 2023, CEO pay at S&P 500 companies increased 6% over the previous year—to an average of $17.7 million in total compensation. The average CEO-to-worker pay ratio was 268-to-1 for S&P 500 Index companies in 2023.

What is a typical executive compensation package?

By company size, base, bonus, and total cash compensation all rise as revenue does, with total average cash compensation coming in at $1,427,000 at companies with revenue above $500 million.

What is a good executive compensation package?

A well-balanced executive compensation package generally includes base salary, short- and long-term incentive pay, and various benefits and perks (e.g., enhanced retirement benefits, executive wellness programs, company cars, country club memberships, etc.).

What is reasonable executive compensation?

Reasonable compensation is the value that would ordinarily be paid for like services by like enterprises under like circumstances. Reasonableness is determined based on all the facts and circumstances.

What does it take to be a CEO of a Fortune 500 company?

Leadership Qualities of a Fortune 500 CEO These include strategic thinking and vision-setting, decision-making under uncertainty, change management, crisis leadership, public speaking and communication, financial acumen, and innovation and adaptability.

How much does a CEO of a $500 million company make?

The Director of Executive Compensation is responsible for designing, implementing, and managing executive compensation programs that align with the company's strategic goals and objectives.

How much does a CEO of a large company make?

Do you get a good deal as a Ceo ? StateAnnual SalaryHourly Wage California $140,814 $67.70 Minnesota $139,745 $67.19 Rhode Island $139,731 $67.18 New Hampshire $138,760 $66.7161 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Compensation for Executives and Directors?

Compensation for Executives and Directors refers to the total remuneration received by high-level executives and members of the board of directors. This includes salaries, bonuses, stock options, and other financial benefits.

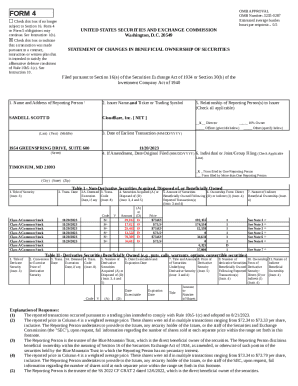

Who is required to file Compensation for Executives and Directors?

Publicly traded companies are required to file compensation information for their top executives and directors. This is typically a requirement under federal securities laws.

How to fill out Compensation for Executives and Directors?

To fill out Compensation for Executives and Directors, companies must compile financial data including base salary, bonuses, stock awards, option awards, and other forms of compensation, then report these figures in the required formats provided by regulatory agencies like the SEC.

What is the purpose of Compensation for Executives and Directors?

The purpose of Compensation for Executives and Directors is to provide transparency about how much executives and directors are paid. This information helps shareholders and the public assess corporate governance and executive performance.

What information must be reported on Compensation for Executives and Directors?

Companies must report various details including the total compensation figures, breakdowns of salary, bonus structures, equity awards, pension values, and any payments made for services in addition to standard compensation.

Fill out your compensation for executives and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compensation For Executives And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.