Get the free LOSS CONTROL POLICY - acmjif

Show details

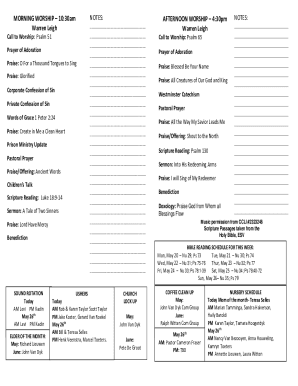

ATLANTIC COUNTY MUNICIPAL JOINT INSURANCE FUND LOSS CONTROL POLICY This policy may not address every situation which might give rise to a loss or injury within your municipality. ORIGINAL PROGRAM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss control policy

Edit your loss control policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loss control policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loss control policy online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loss control policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss control policy

How to fill out a loss control policy:

01

Start by gathering all the necessary information about your organization, including its name, address, and contact information.

02

Identify the key areas of risk in your organization. This could include workplace accidents, property damage, or liability issues. Make a list of these risks and prioritize them based on their potential impact.

03

Determine the appropriate measures to control and mitigate these risks. This may involve implementing safety procedures, conducting regular inspections, or providing employee training programs. Be specific about the actions you will take to address each risk.

04

Create a detailed plan for monitoring and evaluating the effectiveness of your loss control measures. This may include setting up regular reviews, conducting audits, or collecting data on incidents or near misses.

05

Clearly articulate the roles and responsibilities of each individual within your organization when it comes to loss control. This may include assigning specific tasks or responsibilities to different departments or individuals.

06

Include any relevant legal or regulatory requirements that your organization must comply with. This could include industry-specific regulations or any local, state, or federal laws that apply to your business.

07

Consider seeking input or feedback from key stakeholders such as employees, managers, or industry experts to ensure your loss control policy is comprehensive and addresses all relevant risks.

Who needs a loss control policy:

01

Any organization, regardless of its size or industry, can benefit from having a loss control policy. This includes businesses, non-profit organizations, government agencies, and educational institutions.

02

Specifically, organizations that want to proactively manage their risks and prevent accidents, injuries, or property damage should consider implementing a loss control policy.

03

Industries with inherently higher risks, such as construction, manufacturing, or healthcare, often have more complex loss control needs and should prioritize the development of a comprehensive policy.

04

Organizations with multiple locations, remote workers, or a large workforce may need a loss control policy to ensure consistent safety procedures and risk management practices across all operations.

05

Insurance companies or underwriters may require organizations to have a loss control policy as a condition for providing coverage or determining premium rates.

In summary, the process of filling out a loss control policy involves identifying risks, implementing measures to control and mitigate those risks, monitoring and evaluating effectiveness, and clearly defining roles and responsibilities. Any organization can benefit from having a loss control policy, especially those looking to proactively manage risks and prevent accidents or damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loss control policy directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign loss control policy and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete loss control policy online?

pdfFiller has made it simple to fill out and eSign loss control policy. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit loss control policy on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share loss control policy on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is loss control policy?

A loss control policy is a set of procedures and guidelines implemented by an organization to minimize or prevent losses.

Who is required to file loss control policy?

Certain businesses, especially those in high-risk industries, are required to file a loss control policy.

How to fill out loss control policy?

Fill out the loss control policy according to the specific requirements set by the organization or regulatory body.

What is the purpose of loss control policy?

The purpose of a loss control policy is to protect the organization from potential losses and liabilities.

What information must be reported on loss control policy?

Information such as risk assessment, safety procedures, incident reporting protocols, and training programs should be reported on a loss control policy.

Fill out your loss control policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss Control Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.