Get the free CURRENCY EXCHANGE LICENSE APPLICATION - mn

Show details

This application form is used by currency exchange businesses in Minnesota to apply for a license from the Department of Commerce, outlining necessary applicant information, qualifications, and required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign currency exchange license application

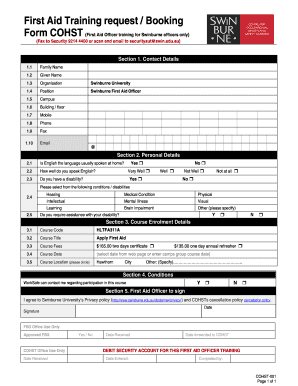

Edit your currency exchange license application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your currency exchange license application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit currency exchange license application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit currency exchange license application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out currency exchange license application

How to fill out CURRENCY EXCHANGE LICENSE APPLICATION

01

Gather necessary documentation, including identification and proof of business address.

02

Complete the currency exchange license application form with accurate information.

03

Provide details about the business structure, ownership, and financial backing.

04

Prepare a business plan outlining the currency exchange operations.

05

Submit fingerprints and undergo a background check as required.

06

Pay the application fee as specified by the licensing authority.

07

Submit the application form along with all supporting documents to the appropriate regulatory body.

08

Await approval from the regulatory body and respond to any additional inquiries.

Who needs CURRENCY EXCHANGE LICENSE APPLICATION?

01

Individuals or businesses looking to operate a currency exchange service.

02

Financial institutions offering currency exchange as part of their services.

03

Travel agencies wanting to provide currency exchange to clients.

04

Online platforms facilitating currency exchange transactions.

05

Any entity involved in buying or selling foreign currencies as a business.

Fill

form

: Try Risk Free

People Also Ask about

How much for money is a transmitter license in the USA?

Money Transmitter License Cost – Generally the number is between US$ 1.0-1.5 Million. The time period to acquire all the licensed can be approximately two years. Here are some cost areas that you will have to pay when it comes to money transmitter license cost: Minimum Net Worth.

Do you need a money transmitter license for crypto?

Yes, many cryptocurrency businesses, such as exchanges and wallet providers, are typically required to obtain a money transmitter license. Since cryptocurrencies are considered a form of value transfer, regulators often treat them similarly to traditional currencies under money transmission laws.

Which states don't require a money transmitter license?

The United States does not have a single money transmitter license. One has to obtain a money transmitter license from each US state. So effectively, there are 49 money transmitter licenses (the exception being the State of Montana, which does not have a money transmitter license).

Does Amazon have a money transmitter license?

Amazon Payments, Inc. is licensed and regulated as a money transmitter in a number of jurisdictions as listed below.

How to get a money transmitter license in the USA?

Steps to Apply for a Money Transmitter License Step 1: Register with FinCEN as an MSB. Step 2: Submit State Money Transmitter License Application(s) Step 3: Provide Background Checks and Compliance Plans. Step 4: Obtain Surety Bonds and Proof of Financial Stability. Step 5: Comply with AML/KYC Regulations.

What is the difference between MTL and MSB?

If you operate a cryptocurrency-related business, most regulators will view your business as a money transmitter. As such, your business is subject to the U.S. Bank Secrecy Act (BSA) and must register for a money transmitter license. This applies in all states, except Montana.

What states do not require a money transmitter license?

Breaking Down the Costs by each state StateLicense Application FeesHigh Level Estimate of Surety Bonds (~1.5% of Bond Amount) California $5,000.00 $3,250.00 Colorado $7,500.00 $3,250.00 Connecticut $1,875.00 $3,900.00 Delaware $230.00 $325.0051 more rows

What is unlicensed money transmitting?

Simply put, 18 U.S.C. 1960, the federal criminal money transmitting statute, makes it a crime to operate a money-transmitting business without complying with state licensing or federal registration requirements.

Is Airbnb a money transmitter?

Airbnb Payments, Inc. is licensed and regulated as a Money Transmitter by the New York Department of Financial Services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CURRENCY EXCHANGE LICENSE APPLICATION?

The Currency Exchange License Application is a formal request submitted to regulatory authorities by individuals or businesses seeking permission to operate a currency exchange service.

Who is required to file CURRENCY EXCHANGE LICENSE APPLICATION?

Individuals or businesses intending to engage in currency exchange activities are required to file a Currency Exchange License Application.

How to fill out CURRENCY EXCHANGE LICENSE APPLICATION?

To fill out the Currency Exchange License Application, applicants typically need to provide relevant information such as personal or business details, financial history, compliance measures, and operational plans, along with any required supporting documentation.

What is the purpose of CURRENCY EXCHANGE LICENSE APPLICATION?

The purpose of the Currency Exchange License Application is to ensure that currency exchange businesses comply with legal regulations, promote financial stability, and prevent illegal activities such as money laundering.

What information must be reported on CURRENCY EXCHANGE LICENSE APPLICATION?

Information that must be reported on the Currency Exchange License Application includes the applicant's identification details, business structure, financial projections, risk management practices, and a description of the services to be offered.

Fill out your currency exchange license application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Currency Exchange License Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.