Get the free Unclaimed Property Tax Refund Claim Form - sdcounty ca

Show details

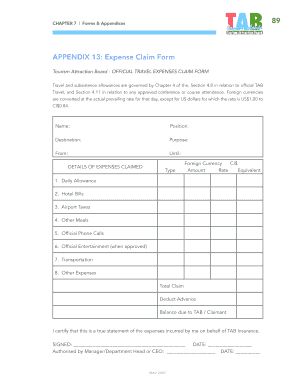

This form is to be used by individuals who have made an overpayment of property taxes and wish to claim a refund. The form requires details about the taxpayer and the parcel/bill number, and necessitates

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unclaimed property tax refund

Edit your unclaimed property tax refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unclaimed property tax refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unclaimed property tax refund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit unclaimed property tax refund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unclaimed property tax refund

How to fill out Unclaimed Property Tax Refund Claim Form

01

Obtain the Unclaimed Property Tax Refund Claim Form from the relevant tax authority's website or office.

02

Fill in your personal information, including your name, address, and contact information.

03

Provide details of the property or funds you are claiming, including account numbers and amounts.

04

Attach any required documentation, such as proof of ownership or previous tax filings.

05

Review the form for any errors or missing information.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form through the designated method (mail, online submission, etc.) as instructed.

Who needs Unclaimed Property Tax Refund Claim Form?

01

Individuals or businesses who believe they are owed unclaimed property or tax refunds from the state.

02

People who have unclaimed funds held by government agencies due to lost or forgotten claims.

03

Taxpayers who have overpaid taxes and are eligible for a refund.

Fill

form

: Try Risk Free

People Also Ask about

How to find out if the government owes you money?

You may search in these databases for unclaimed money that might be owed to you: Treasury Hunt: U.S. securities and undeliverable payments. HUD/FHA mortgage insurance refunds. Credit Union unclaimed shares. U.S. Courts: Unclaimed funds in bankruptcy.

What is a negative report for unclaimed property?

In some years, a holder may not have any unclaimed property to report to a particular state. Unfortunately, some unclaimed property laws or regulations require that the holder file a “negative” report if the holder has no unclaimed property eligible for reporting in a particular report year.

Is unclaimed property a legit site?

The official unclaimed property division has existed for more than 40 years. It's totally legit.

How long does it take to get unclaimed money from Illinois?

Typically, all claims are reviewed in the date order received by our office. Processing time prior to receiving either your first communication or payment may be up to 12 weeks, dependent on the number of claims submitted to our office during the time frame your claim was received.

Is it safe to claim unclaimed property?

Is Unclaimed Property a Trap? An unclaimed property notice can be legitimate, but unclaimed property scams are real too. In an unclaimed property scam, a criminal takes advantage of the unclaimed property process to try to steal your money or data.

What happens when you file a claim for unclaimed property?

Once you have submitted your claim, the unclaimed property department for the state will verify your ownership and process the claim. Some states complete this process in less than 30 days.

Is unclaimed property a trap?

0:05 1:15 And return the property unclaimed property can be searched for free on state government websitesMoreAnd return the property unclaimed property can be searched for free on state government websites beware of scams that charge a fee to search for unclaimed. Property.

How do I claim unclaimed money in CA?

You must file a claim with the State Controller's Office. Click here to locate your property and start a claim. Call us at (800) 992-4647 with any questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Unclaimed Property Tax Refund Claim Form?

The Unclaimed Property Tax Refund Claim Form is a document that individuals or businesses can use to claim refunds for unclaimed property taxes that have been paid but not returned due to various reasons, such as administrative error or failure to claim.

Who is required to file Unclaimed Property Tax Refund Claim Form?

Individuals or businesses that believe they are owed a refund for unclaimed property taxes after having paid them are required to file this form.

How to fill out Unclaimed Property Tax Refund Claim Form?

To fill out the form, one must provide personal or business information, details on the property taxes paid, and any relevant documentation to support the claim. Careful attention should be paid to ensure all required fields are completed accurately.

What is the purpose of Unclaimed Property Tax Refund Claim Form?

The purpose of the Unclaimed Property Tax Refund Claim Form is to facilitate the process for individuals and businesses to reclaim funds that are rightfully theirs but have not been returned due to various administrative issues.

What information must be reported on Unclaimed Property Tax Refund Claim Form?

The form generally requires the claimant's name, contact information, tax identification number (if applicable), details about the unclaimed property taxes, and any supporting documentation such as receipts or past tax filings.

Fill out your unclaimed property tax refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unclaimed Property Tax Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.