Canada CF4106 - British Columbia 2022-2025 free printable template

Show details

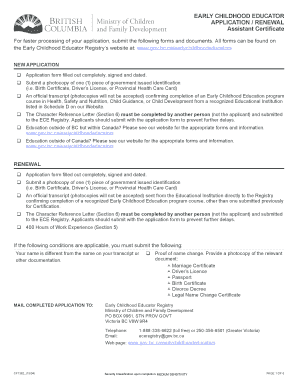

Early Childhood Educator Certificate Renewal Application ECE Assistant Is this application for you? This application is for individuals who: Are applying to renew an Early Childhood Educator (ECE)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada CF4106 - British Columbia

Edit your Canada CF4106 - British Columbia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CF4106 - British Columbia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada CF4106 - British Columbia online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada CF4106 - British Columbia. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CF4106 - British Columbia Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CF4106 - British Columbia

How to fill out Canada CF4106 - British Columbia

01

Obtain the Canada CF4106 form from the official website or local government office.

02

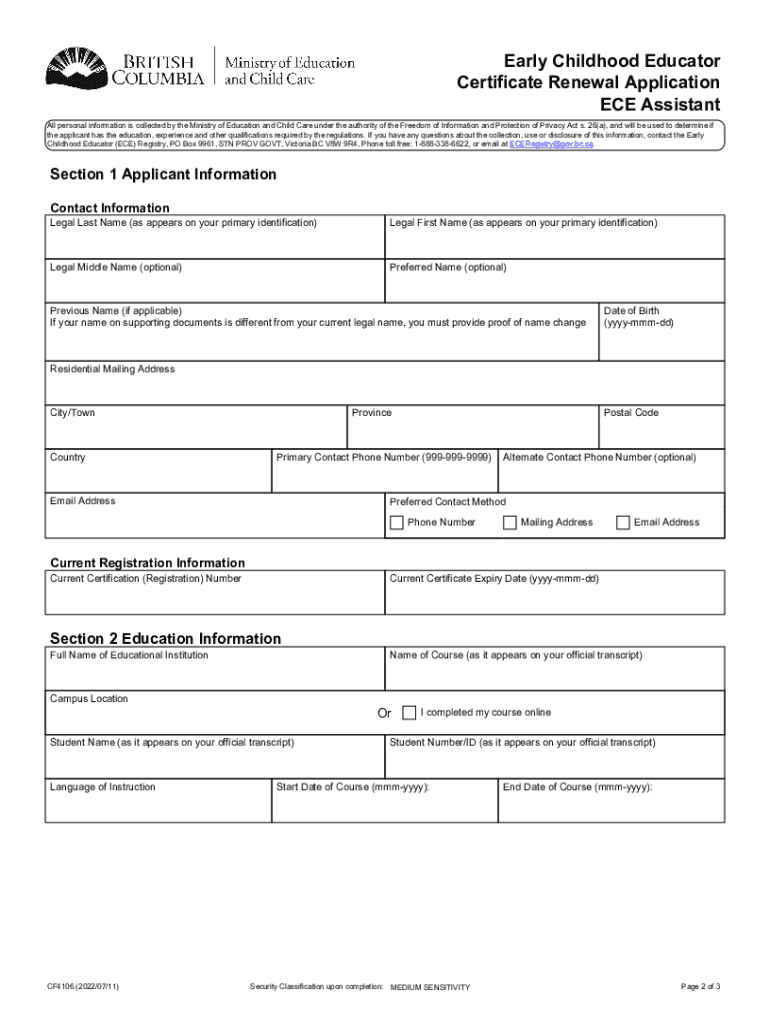

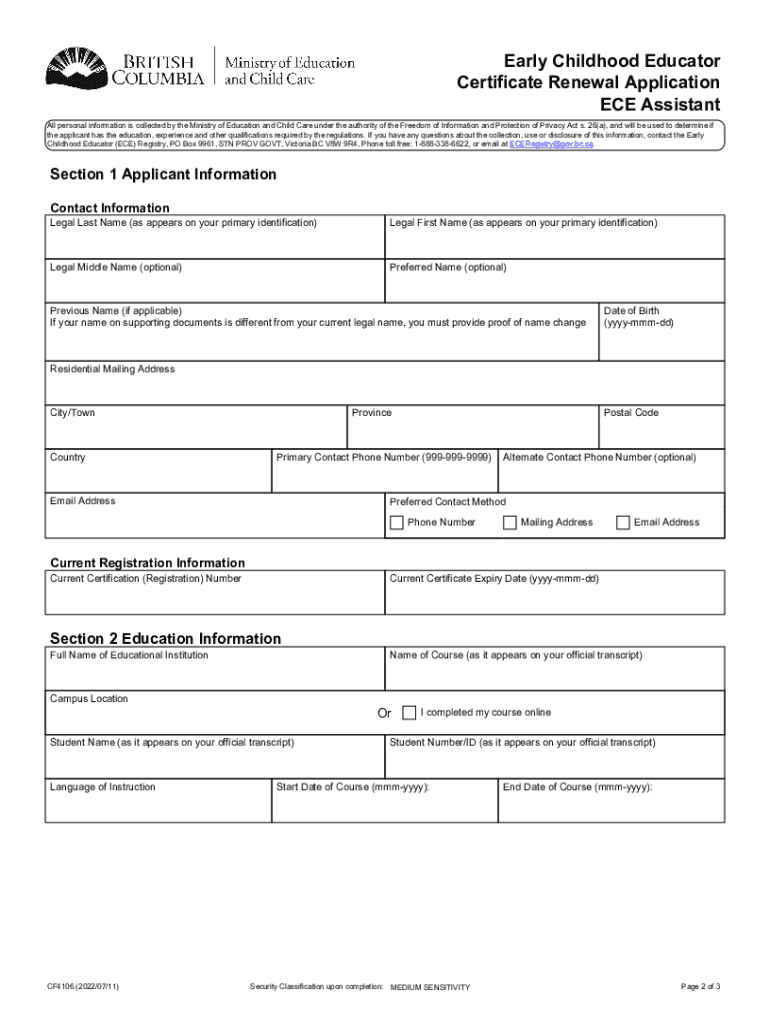

Start by filling out your personal information, including name, address, and contact details.

03

Indicate your social insurance number (SIN) if applicable.

04

Provide details regarding your employment history in British Columbia.

05

Fill in your income information from the last year.

06

Include any deductions you are eligible for.

07

Review the form to ensure all information is accurate and complete.

08

Sign and date the form at the designated section.

09

Submit the form online or via mail to the appropriate government office.

Who needs Canada CF4106 - British Columbia?

01

Individuals residing in British Columbia who are applying for financial assistance or tax benefits.

02

Those who have filed or are planning to file for provincial or federal taxes.

03

Anyone needing to prove residency or income status in British Columbia.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to renew ECE in Ontario?

Annual membership fee is $160. An email reminder will be sent to you two months before your renewal is due.

How much is the renewal fee for College of ECE?

Annual membership fee is $160. If you are paying by credit card or through your bank, you may renew online through the College website and select 'My College Account'.

How do I contact College of ECE?

If you have questions that were not answered in the Membership Renewal Guide, contact the College by telephone or e-mail. Telephone: 416 961-8558 – select the option for “Registration” Toll-free: 1 888 961-8558 – select the option for “Registration” E-mail: registration@college-ece.ca.

What happens if my VA teaching license expires?

A person whose license has expired may renew it within one year after its expiration date by paying the late fee prescribed in 18VAC125-20-30 and the license renewal fee for the year the license was not renewed and by completing the continuing education requirements specified in 18VAC125-20-121 for that year.

How many points do I need to renew my Virginia teaching license?

Individuals renewing a five-year renewable license must complete 180 professional development points as prescribed by the Virginia Board of Education.

How do I renew my teaching license in Virginia?

The main requirement to renew a license is for teachers to show they've earned 180 professional development credits. Candidates may complete coursework to develop their subject knowledge at accredited two- or four-year colleges or universities.

How much does it cost to register with the College of ECE?

How much will it cost to be a member? A one-time application fee of $85 is required for the processing of your application. This is non-refundable, regardless of the outcome of the application process. The registration fee of $160 is the fee for membership with the College and must be paid annually.

What are the requirements for membership into the College of Early Childhood Educators?

An individual with a diploma in early childhood education or equivalent who is employed in licensed child care under the Child Care and Early Years Act.

What is a RECE license?

Early Childhood Educators Qualifications Upgrade Program For individuals working in child care and early years programs can apply for grants to upgrade. their qualifications including becoming a Registered Early childhood education (RECE). They include Education Grants, Travel Grants and a Training Allowance.

How do I renew my College of ECE membership?

How can I renew online? Everyone can renew online through My College Account. Two months prior your renewal due date, you will receive an email from the College. This email will contain a link to set up your password (if you have not already done so) and access your profile.

How often do you need to renew your College of Early Childhood Educators membership?

You must renew your membership and pay the full annual membership fee. If you are paying by credit card or through your bank, you may renew online once you have received an email from the College with a personal link to My College Account. You will receive the link approximately two months before your renewal is due.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada CF4106 - British Columbia?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the Canada CF4106 - British Columbia in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit Canada CF4106 - British Columbia in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Canada CF4106 - British Columbia and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the Canada CF4106 - British Columbia in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Canada CF4106 - British Columbia.

What is Canada CF4106 - British Columbia?

Canada CF4106 - British Columbia is a form used by the Government of Canada for the purpose of reporting taxable income and calculating taxes owed in the province of British Columbia.

Who is required to file Canada CF4106 - British Columbia?

Individuals or businesses that earn income in British Columbia and meet specific taxable income thresholds are required to file Canada CF4106.

How to fill out Canada CF4106 - British Columbia?

To fill out Canada CF4106, individuals must gather their financial information, including income sources and deductions, then accurately complete the form sections pertaining to their income and tax calculations.

What is the purpose of Canada CF4106 - British Columbia?

The purpose of Canada CF4106 is to assess and collect income tax from residents or entities earning income in British Columbia, ensuring compliance with provincial tax laws.

What information must be reported on Canada CF4106 - British Columbia?

Canada CF4106 requires reporting information such as total income, allowable deductions, tax credits, and the calculation of taxes owed for the fiscal year in question.

Fill out your Canada CF4106 - British Columbia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada cf4106 - British Columbia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.