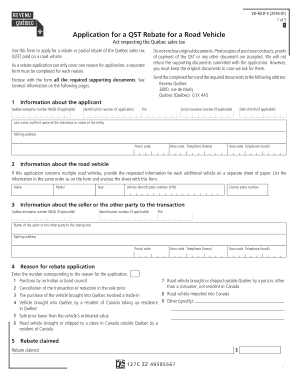

Canada VD-60.R-V - Quebec 2018-2025 free printable template

Get, Create, Make and Sign quebec sales tax qst rebate form

How to edit qst rebate road vehicle form online

Uncompromising security for your PDF editing and eSignature needs

Canada VD-60.R-V - Quebec Form Versions

How to fill out vd60 r v form

How to fill out Canada VD-60.R-V - Quebec

Who needs Canada VD-60.R-V - Quebec?

Video instructions and help with filling out and completing vd 60 r v

Instructions and Help about vd60r v application

Hi skiers I'm Jeff from ski essentials comm nut Bob how are you we're here today to take a look at the 2019 Salomon ST 92 earlier in the year we did a review of the St 106 we also have the 19 q st 99 here, but we've never done a review of the 92 before, so we thought it'd be fun to take a look at it definitely falls into a popular category that kind of low to mid 19 or waist width all-mountain ski starting to emerge as a very popular ski category so lets kind of run through construction it's an inverted 3d wood core there's a lot going on in this ski but we kind of saw that concept a few years ago the first time with blizzard when they kind of flipped the core upside down and essentially is increasing the torsional stiffness of the rocketed portions of the ski and I think it's proven to work this ski also uses a TI power platform, so there's some metal kind of focus underfoot and then Solomon's CF super fiber we've talked about it before we did a review of the Q st-9 a couple of years ago and introduced the concept then pretty cool stuff they wove carbon and flax together so carbon gives it some energy responsiveness torsional stiffness the flax adds some damping properties along the same lines Salomon also includes some rubber there's some rubber in this ski along the edges and the tips and the tails there's also choroid and the tips and the tails which really decrease the swing weight of this ski it is a very light ski in my opinion and there are some changes to it for 2019 this is the 2018 graphic next to it and essentially for the 92 Salomon just increased the amount of carbon and flex in the ski so kind of just boosting its performance a little by adding that carbon and flax in there or adding more of it, but it's overall pretty much the same ski just a little more power out of the new one I would say yeah we still have some 2018 available which will be discounted, so we'll talk a little more about that at the end of this video which one would be best but definitely some options here for the SD 92 whether you go with 18 or 19 so Bob you've skied these quite a bit mm-hmm and from everything you've said it sounds like you're a pretty big fan of them yeah, and I'm a pretty big guy I'm probably weighing about 220 pounds in the winter and these skis feel very stable you know what they've done really with the with this construction is moved the most of the mass kind of in between the tips and the tails and so underfoot it feels very stable the tips and the tails are very lightweight, but that's not to mean that they're soft or can be easily over flexed I mean it's, and it's a flexible ski, but it has a nice predictable feel to it yeah so having that the bulk of that energy underfoot you know carves a great turn but then the lighter tips and Tails do a great job when the snow gets softer very maneuverable you know here in Stowe we got a lot of tight trees and definitely easy to swing around and swivel, and you don't lose that on trail performance...

People Also Ask about ca vd60rv quebec

What form is the Quebec sales tax refund?

Where can I get a Québec tax return form?

Do I charge QST to Québec customers?

Can I claim Canadian sales tax back?

How do I get my Québec tax refund?

How do I get a refund from Quebec sales tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my vd 60 r v directly from Gmail?

How can I modify vd 60 r v without leaving Google Drive?

How do I complete vd 60 r v on an iOS device?

What is Canada VD-60.R-V - Quebec?

Who is required to file Canada VD-60.R-V - Quebec?

How to fill out Canada VD-60.R-V - Quebec?

What is the purpose of Canada VD-60.R-V - Quebec?

What information must be reported on Canada VD-60.R-V - Quebec?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.