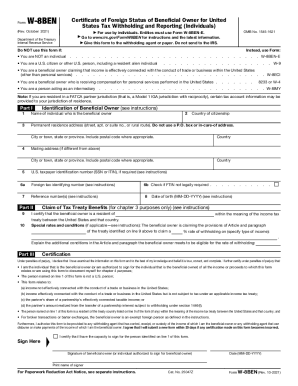

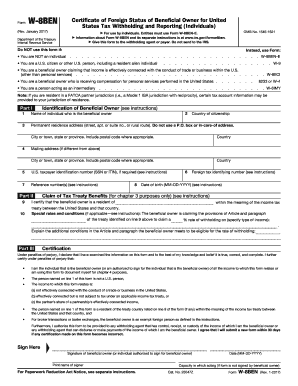

IRS W-8BEN 2014 free printable template

Instructions and Help about IRS W-8BEN

How to edit IRS W-8BEN

How to fill out IRS W-8BEN

About IRS W-8BEN 2014 previous version

What is IRS W-8BEN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-8BEN

What should I do if I realize I made a mistake after submitting the w 8ben 2014 form?

If you discover an error after submitting the w 8ben 2014 form, you can correct it by submitting an amended form. It’s essential to clearly indicate that it is a correction. Additionally, maintain records of your original submission and any communication with the IRS regarding the change.

How can I verify the status of my w 8ben 2014 form after submission?

To check the status of your w 8ben 2014 form after it has been filed, contact the IRS directly through their customer service. It’s advisable to have your submission details handy for quicker assistance, as they can provide information on processing times or any issues encountered.

Are there any common errors I should watch out for when submitting the w 8ben 2014 form?

Common errors include providing incorrect taxpayer identification numbers or failing to sign the form. Carefully reviewing the completed form for accuracy before submission can help avoid these pitfalls, ensuring a smoother processing experience.

What should I do if my w 8ben 2014 form is rejected?

If your w 8ben 2014 form is rejected, review the rejection notice to identify the reason. Depending on the error, you may need to correct the issues and resubmit the form. Keep a copy of both the rejection notice and your corrected submission for your records.

Is e-signature acceptable for the w 8ben 2014 form?

Yes, an e-signature is generally acceptable for the w 8ben 2014 form, provided it complies with IRS standards for electronic submissions. Ensure the method of signing adheres to the required guidelines to maintain the integrity of your submission.

See what our users say