Get the free tax.utah.govsalestransientroomTransient Room Taxes - Utah State Tax Commission - tax...

Show details

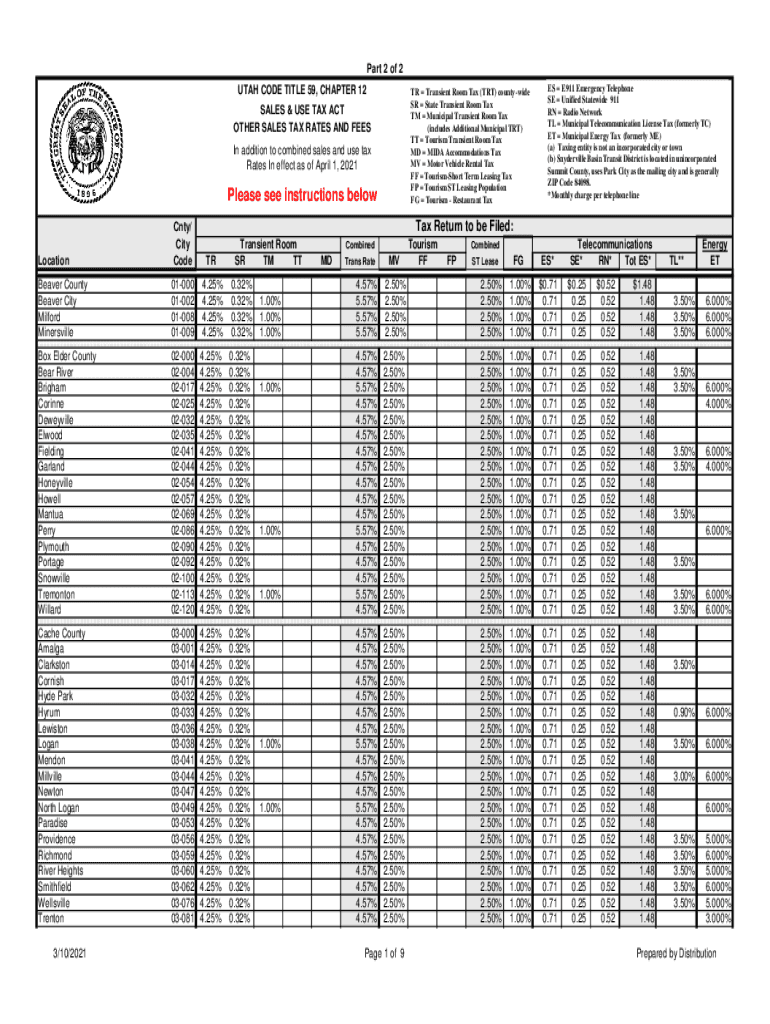

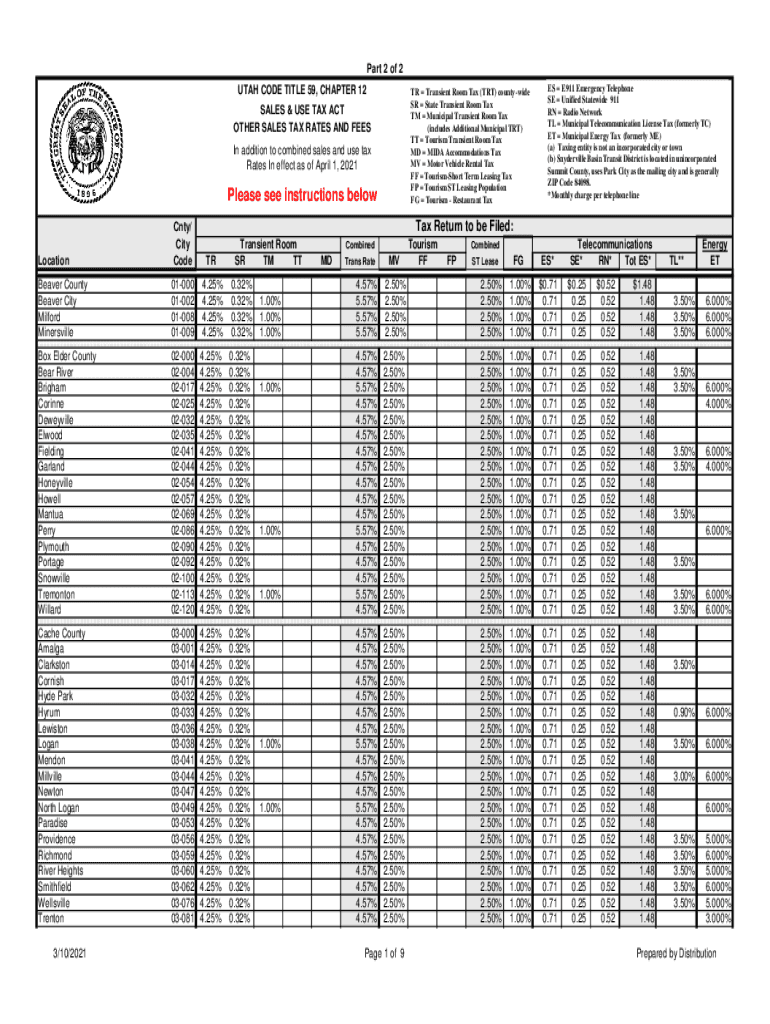

Part 2 of 2 UTAH CODE TITLE 59, CHAPTER 12TR Transient Room Tax (TRT) countywide SR State Transient Room Tax TM Municipal Transient Room Tax (includes Additional Municipal TRT) TT Tourism Transient

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxutahgovsalestransientroomtransient room taxes

Edit your taxutahgovsalestransientroomtransient room taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxutahgovsalestransientroomtransient room taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxutahgovsalestransientroomtransient room taxes online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxutahgovsalestransientroomtransient room taxes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxutahgovsalestransientroomtransient room taxes

How to fill out taxutahgovsalestransientroomtransient room taxes

01

Determine if you are required to collect transient room taxes in Utah.

02

Register with the Utah State Tax Commission by completing Form TC-69, Utah State Business and Tax Registration.

03

Collect transient room taxes from customers at the time of rental.

04

Report and remit the collected taxes to the Utah State Tax Commission on a regular basis.

05

Keep accurate records of transient room taxes collected and remitted for auditing purposes.

Who needs taxutahgovsalestransientroomtransient room taxes?

01

Individuals or businesses that rent out transient rooms, such as hotels, motels, bed and breakfasts, vacation rentals, and Airbnb hosts, in the state of Utah.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit taxutahgovsalestransientroomtransient room taxes on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign taxutahgovsalestransientroomtransient room taxes right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete taxutahgovsalestransientroomtransient room taxes on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your taxutahgovsalestransientroomtransient room taxes from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit taxutahgovsalestransientroomtransient room taxes on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share taxutahgovsalestransientroomtransient room taxes on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is taxutahgovsalestransientroomtransient room taxes?

Transient Room Taxes are taxes collected on short-term accommodations such as hotels, motels, and vacation rentals.

Who is required to file taxutahgovsalestransientroomtransient room taxes?

Owners or operators of lodging establishments are required to file transient room taxes.

How to fill out taxutahgovsalestransientroomtransient room taxes?

To fill out transient room taxes, owners or operators need to report the total amount of room revenue and calculate the tax owed based on the applicable tax rate.

What is the purpose of taxutahgovsalestransientroomtransient room taxes?

The purpose of transient room taxes is to generate revenue for local governments from the hospitality industry.

What information must be reported on taxutahgovsalestransientroomtransient room taxes?

Owners or operators must report total room revenue, number of occupied rooms, and any tax exemptions or deductions.

Fill out your taxutahgovsalestransientroomtransient room taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxutahgovsalestransientroomtransient Room Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.