Get the free Twelve-month cash flow

Show details

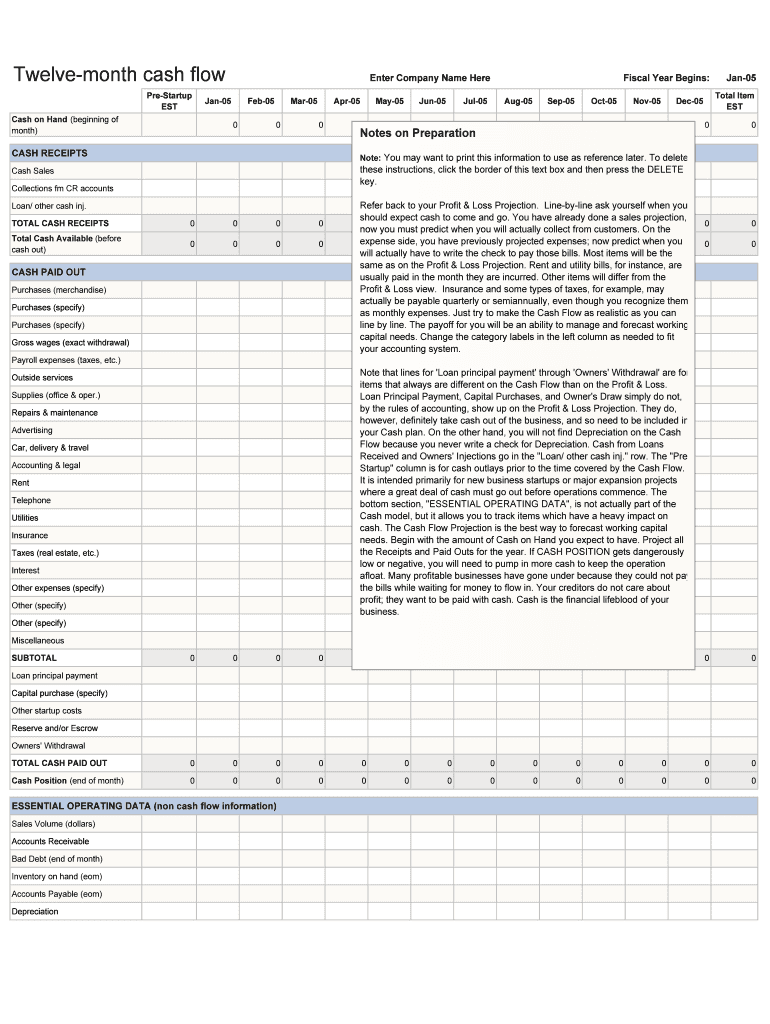

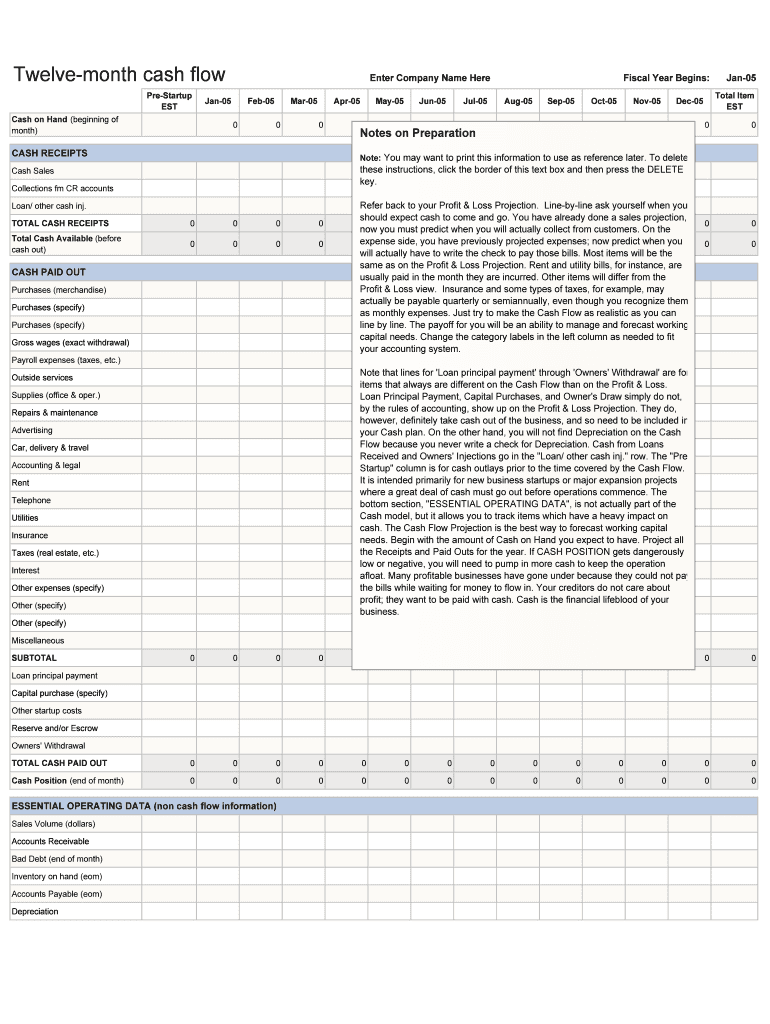

Twelvemonth cash flow

Restart

EST

Cash on Hand (beginning of

month)Enter Company Name HereJan05Feb05

0Mar05

0Apr05

0CASH RECEIPTSMay05

0Jun05

0Jul05

0Notes on PreparationFiscal Year Begins:

Aug050Sep05

0Oct05

0Nov05

0Total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign twelve-month cash flow

Edit your twelve-month cash flow form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your twelve-month cash flow form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit twelve-month cash flow online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit twelve-month cash flow. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out twelve-month cash flow

How to fill out twelve-month cash flow:

01

Start by gathering all necessary financial information, including past income statements, balance sheets, and cash flow statements. This will help you identify trends and make accurate projections for the coming months.

02

Begin by listing your sources of income. This can include sales revenue, interest income, investment earnings, and any other money coming into your business. Be sure to include both recurring and one-time sources of income.

03

Next, list your fixed expenses. These are expenses that do not change month to month, such as rent, utilities, insurance, and employee salaries. Make sure to include any loan or lease payments as well.

04

Identify your variable expenses. These are expenses that fluctuate based on your business activity, such as cost of goods sold, marketing expenses, and travel costs. It's important to estimate these expenses as accurately as possible.

05

Consider any upcoming capital expenditures, such as equipment purchases or facility improvements. These expenses should be included in your cash flow projection for the respective months.

06

Account for any planned loan repayments or dividends that need to be paid out. These are important cash outflows that should be factored into your projection.

07

Review your projected receivables and payables. This includes outstanding customer invoices and bills that need to be paid. Make sure to consider any lag times in payments and adjust your expected cash inflows and outflows accordingly.

08

Once you have gathered all the necessary information, input the data into a spreadsheet or accounting software. This will help you organize the information and calculate your cash flow for each month.

Who needs a twelve-month cash flow:

01

Small business owners: A twelve-month cash flow statement is crucial for small business owners to monitor their financial health and predict their cash position in the coming months. It helps in evaluating the profitability and viability of the business.

02

Startups: Startups often operate with limited cash reserves and need to carefully manage their cash flow. A twelve-month cash flow projection can help startups anticipate cash shortages and plan accordingly.

03

Investors and lenders: Investors and lenders require a comprehensive understanding of a company's financial position before making investment or lending decisions. A well-prepared twelve-month cash flow statement provides them with insights into the company's ability to generate cash and repay debts.

04

Financial advisors and accountants: Financial advisors and accountants need a twelve-month cash flow statement to offer accurate advice and guidance to their clients. It helps them identify potential financial issues and develop strategies to improve cash flow.

05

Individuals: Even individuals can benefit from creating a twelve-month cash flow projection to manage their personal finances. It allows them to plan for major expenses, budget effectively, and ensure they have enough cash to cover their day-to-day expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify twelve-month cash flow without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including twelve-month cash flow, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send twelve-month cash flow to be eSigned by others?

Once you are ready to share your twelve-month cash flow, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete twelve-month cash flow on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your twelve-month cash flow. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is twelve-month cash flow?

Twelve-month cash flow is a financial statement that shows the inflows and outflows of cash over a twelve-month period.

Who is required to file twelve-month cash flow?

Businesses and individuals who want to track their cash flow or are required to report their financial activities.

How to fill out twelve-month cash flow?

To fill out a twelve-month cash flow statement, you need to list all sources of income and expenses for each month over a twelve-month period.

What is the purpose of twelve-month cash flow?

The purpose of twelve-month cash flow is to assess the financial health of a business or individual by tracking cash inflows and outflows over a year.

What information must be reported on twelve-month cash flow?

Information such as income from sales, investments, loans, operating expenses, taxes, and any other cash transactions.

Fill out your twelve-month cash flow online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Twelve-Month Cash Flow is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.