IN IT-20 2021 free printable template

Show details

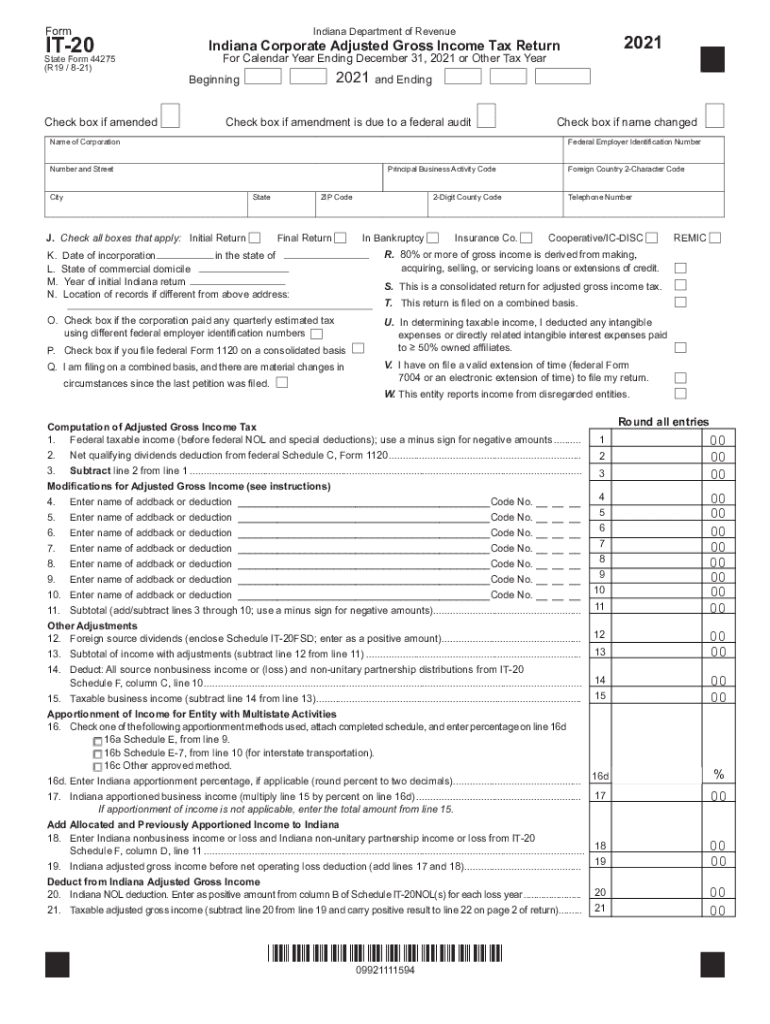

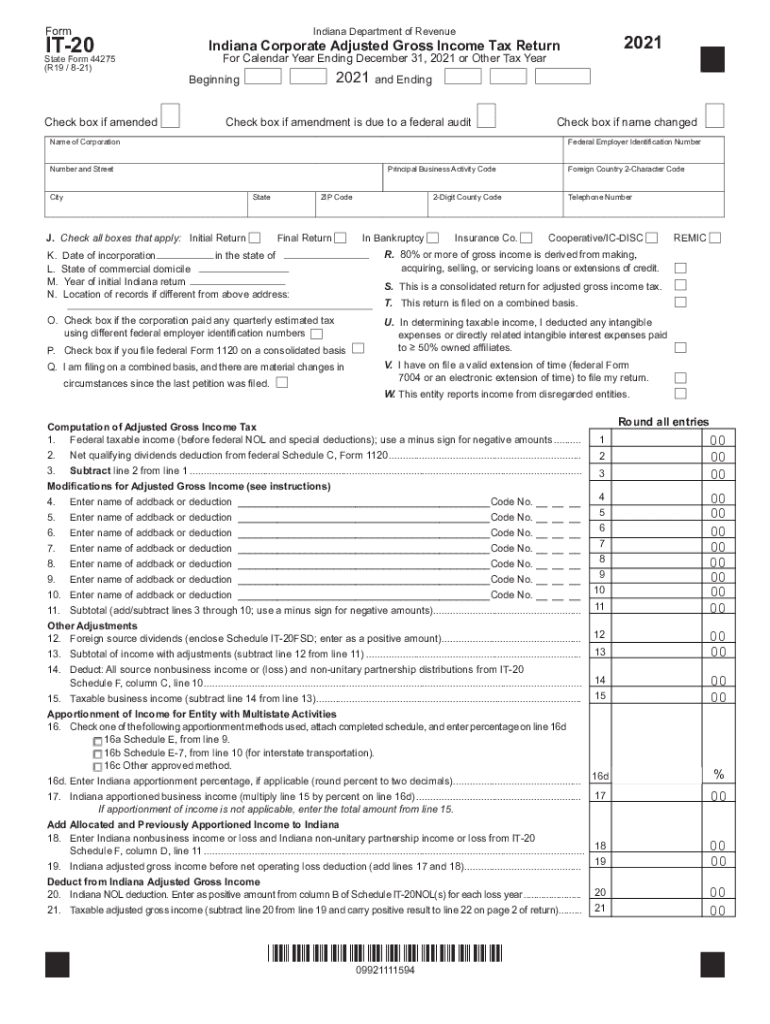

FormIT20State Form 44275 (R19 / 821)Check box if amended Indiana Department of Revenue2021Indiana Corporate Adjusted Gross Income Tax Return For Calendar Year Ending December 31, 2021, or Other Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN IT-20

Edit your IN IT-20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN IT-20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN IT-20 online

To use the professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN IT-20. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN IT-20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN IT-20

How to fill out IN IT-20

01

Gather your tax documents, including W-2s and 1099s.

02

Download the IN IT-20 form from the Indiana Department of Revenue website.

03

Fill in your personal information in the designated sections, including your name and address.

04

Report your income accurately under the income section of the form.

05

Claim any applicable deductions and credits that you qualify for.

06

Review your entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form by the tax deadline to the Indiana Department of Revenue.

Who needs IN IT-20?

01

Individuals and businesses residing in Indiana who are required to file an income tax return.

02

Taxpayers with income sourced from Indiana.

03

Those who owe tax or wish to claim a refund.

Fill

form

: Try Risk Free

People Also Ask about

What are the 3 most common taxes?

There are various lesser-known types of tax, such as tax when you travel, or tax for gambling winnings, but in this post, we'll be focusing on three of the most common types of tax: income tax, consumption tax, and property tax.

Is net income the same as taxable income?

What's the Difference Between Taxable Income and Net Income? Taxable income is the amount of income that is subject to income tax. Net income is the amount of income that is left after subtracting all of the company's expenses, including income tax.

Which of the following are all types of non taxable income?

Here are 10 more types of non-taxable income. Financial Gifts. Educational and Adoption Assistance from Your Employer. Employer-provided Meals and Lodging. Proceeds from a Home Sale. Insurance Provided by Your Employer. Health Savings Accounts (HSAs) Disability Insurance Payouts. Worker's Compensation Benefits.

Is income tax called taxable income?

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income.

How do I make non taxable income?

Here are seven tax-free tax strategies to consider adding to your portfolio or increasing the use of if you already have them. Long-term capital gains. 529 savings plans. Health savings accounts. Qualified opportunity funds. Qualified small business stock. Roth IRAs and 401(k)s. Life insurance.

What are the three types of taxable income?

Types of Taxable Income Employee compensation and benefits. These are the most common types of taxable income and include wages and salaries, as well as fringe benefits. Investment and business income. Miscellaneous taxable income.

What type of income is not taxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Is taxable income the same as gross income?

Gross income includes all income you receive that isn't explicitly exempt from taxation under the Internal Revenue Code (IRC). Taxable income is the portion of your gross income that's actually subject to taxation. Deductions are subtracted from gross income to arrive at your amount of taxable income.

How do I know my taxable income?

Your gross income minus all available deductions is your taxable income. Compare that amount to your tax bracket to estimate the amount you'll owe before applying any available tax credits.

How do you calculate taxable income?

Taxable income is calculated by adding up all sources of income, excluding nontaxable items, and subtracting credits and deductions.

What are 10 types of taxable income?

What is taxable income? wages, salaries, tips, bonuses, vacation pay, severance pay, commissions. interest and dividends. certain types of disability payments. unemployment compensation. jury pay and election worker pay. strike and lockout benefits. bank “gifts” for opening or adding to accounts if more than “nominal” value.

What is taxable income income?

The term taxable income refers to any gross income earned that is used to calculate the amount of tax you owe. Put simply, it is your adjusted gross income less any deductions. This includes any wages, tips, salaries, and bonuses from employers.

How do I find my taxable income?

To calculate your taxable income, first determine your filing status. Next, collect documents for all sources of income. After that, calculate your adjusted gross income. Finally, subtract your deductions from your adjusted gross income to determine your taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IN IT-20 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IN IT-20 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit IN IT-20 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your IN IT-20 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit IN IT-20 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IN IT-20.

What is IN IT-20?

IN IT-20 is an Indiana state tax form used to report income and calculate tax liability for corporate entities doing business in Indiana.

Who is required to file IN IT-20?

Corporations doing business in Indiana or earning income from Indiana sources are required to file the IN IT-20 form.

How to fill out IN IT-20?

To fill out IN IT-20, gather financial records, follow the instructions provided with the form, and accurately report income, deductions, and credits applicable to your corporation.

What is the purpose of IN IT-20?

The purpose of IN IT-20 is to report the income earned by a corporation in Indiana and to calculate and pay the appropriate state income tax.

What information must be reported on IN IT-20?

IN IT-20 requires reporting of the corporation's total income, deductions, credits, and any other pertinent financial information necessary for calculating the state tax liability.

Fill out your IN IT-20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN IT-20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.