AR Form ET-179A 2019 free printable template

Show details

State of Arkansas

Department of Finance and Administration

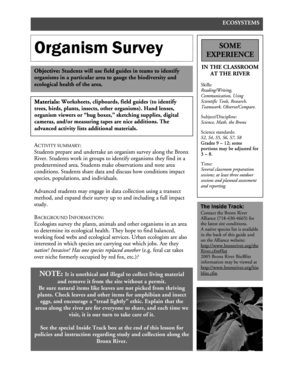

Claim for Additional Local Tax Eligible for Rebate Instructions

Qualifying businesses may be eligible for a rebate of the additional local

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR Form ET-179A

Edit your AR Form ET-179A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR Form ET-179A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR Form ET-179A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AR Form ET-179A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR Form ET-179A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR Form ET-179A

How to fill out AR Form ET-179A

01

Obtain AR Form ET-179A from the New York State Department of Taxation and Finance website or your local tax office.

02

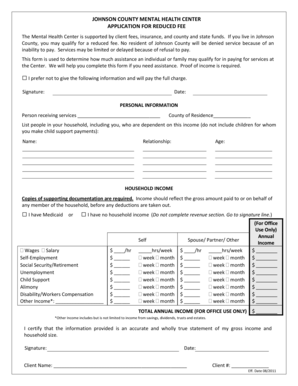

Fill out your personal information at the top of the form, including your name, address, and Social Security Number.

03

Indicate the type of income you are reporting by checking the appropriate boxes.

04

Provide details on your income and deductions in the designated sections, ensuring you have all necessary documentation at hand.

05

Review all entries for accuracy, ensuring that all amounts are correctly entered and that you have included all necessary supporting documents.

06

Sign and date the form in the space provided at the end of the document.

07

Submit the completed form by the specified due date, either online or via mail to the appropriate tax agency address.

Who needs AR Form ET-179A?

01

Anyone who is liable to pay state income tax in New York must fill out AR Form ET-179A.

02

Individuals who have income that requires reporting, such as self-employed individuals or those with investment income, need this form.

03

Tax practitioners or accountants who assist clients with state tax filings will also need to utilize this form for their clients.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get Arkansas state tax forms?

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock) Email: Individual.Income@rev.state.ar.us.

Where can tax forms be obtained?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

How do I get tax exemption in Arkansas?

Steps To Applying For Tax Exemption In Arkansas A copy of the IRS Determination Letter (proof of 501c3 status) Copies of the first and second pages of the IRS Form 1023 (or 1024) A statement declaring Arkansas tax exemption.

Where can I get IRS paper forms?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

Why is Arkansas state Refund taking so long?

What can cause a delay in my Arkansas refund? If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return.

What is the Arkansas sales tax form ET-1?

Form ET-1 is used to report all state and local taxes levied under the Gross Receipts (Sales) Tax and Compensating Use Tax Acts. ALL FIGURES ON THIS REPORT ARE TO BE ROUNDED TO THE NEAREST WHOLE DOLLAR. If the cents amount is 49¢ or less, the cents are dropped. Example, $10.47 would be $10.00.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in AR Form ET-179A?

The editing procedure is simple with pdfFiller. Open your AR Form ET-179A in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out AR Form ET-179A using my mobile device?

Use the pdfFiller mobile app to fill out and sign AR Form ET-179A. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit AR Form ET-179A on an Android device?

You can make any changes to PDF files, such as AR Form ET-179A, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is AR Form ET-179A?

AR Form ET-179A is a tax form used in Arkansas for reporting information related to pass-through entities, such as partnerships and S corporations, specifically for the purposes of determining the tax liabilities of the entity's nonresident partners or shareholders.

Who is required to file AR Form ET-179A?

Pass-through entities that have nonresident partners or shareholders who have income from sources within Arkansas are required to file AR Form ET-179A.

How to fill out AR Form ET-179A?

To fill out AR Form ET-179A, entities must provide information including the names and addresses of the nonresident partners or shareholders, their share of income, and any Arkansas tax withheld. The form must be completed accurately and submitted to the Arkansas Department of Finance and Administration.

What is the purpose of AR Form ET-179A?

The purpose of AR Form ET-179A is to report the income earned by nonresident partners or shareholders of a pass-through entity and to calculate any tax liability they may have in Arkansas, ensuring compliance with state tax laws.

What information must be reported on AR Form ET-179A?

The information that must be reported on AR Form ET-179A includes the names and taxpayer identification numbers of the nonresident partners or shareholders, the amount of income allocated to each from the entity, any tax withheld, and any other required details relevant to their Arkansas income.

Fill out your AR Form ET-179A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR Form ET-179a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.