IRS 990 - Schedule I 2022 free printable template

FAQ about IRS 990 - Schedule I

What should I do if I realize I've made a mistake on IRS 990 - Schedule I after submission?

If you discover a mistake on your submitted IRS 990 - Schedule I, you should file an amended return to correct the error. This involves completing a new version of the Schedule I, indicating that it is an amendment. Ensure that you provide an explanation for the changes made to help the IRS understand the amendments.

How can I track the status of my IRS 990 - Schedule I submission?

To track your IRS 990 - Schedule I submission, you can use the IRS's online tools for status checking if you filed electronically. Alternatively, if filed by mail, allow several weeks for processing and consider contacting the IRS directly for updates if you don't receive confirmation soon.

What should I know about maintaining records related to IRS 990 - Schedule I?

Maintaining accurate records related to IRS 990 - Schedule I is essential. Generally, you should retain records for at least three years from the date of filing. This includes keeping documentation that supports contributions, expenditures, and any amendments you submit, ensuring compliance with privacy and data security practices.

Are there specific issues foreign payees should consider when filing IRS 990 - Schedule I?

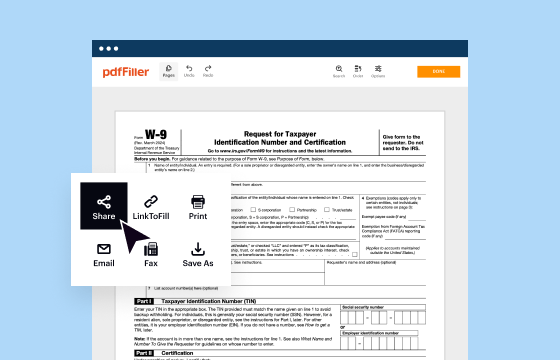

Yes, foreign payees have unique considerations when completing IRS 990 - Schedule I. They must ensure that they comply with U.S. tax regulations regarding reporting income and providing necessary documentation, such as Form W-8BEN, to properly report foreign transactions and avoid unnecessary penalties.